The World Bank raised real GDP estimates for the U.S. in 2023 while slashing them in 2024 in its latest report. Likewise, global economic growth forecasts reflect weakening next year. It’s an environment of prolonged challenge for advisors and investors as macro forecasts and trends continue to shift.

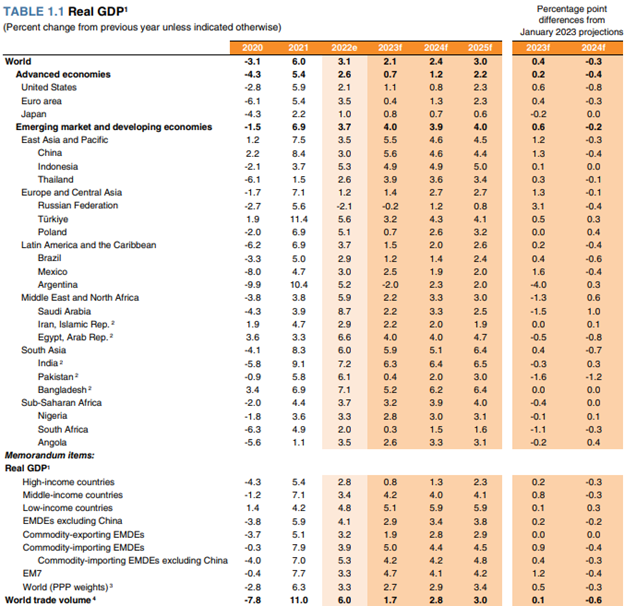

In its Global Economic Prospects report, the World Bank raised both the U.S. and global economic forecasts for 2023. The U.S. is forecast for a real GDP of 1.1% this year, a gain of 0.6% over January’s estimates. Meanwhile, the global economy forecast rose to 2.1%, a 0.4% gain over previous estimates.

Image source: World Bank

The upward revisions were due almost entirely to strong Q1 growth and the bank believes growth will fade for much of the remainder of 2023.

“The World Bank’s latest projections indicate that the world economy will remain frail—and at risk of a deeper downturn — this year and in 2024,” wrote Indermit Gill, senior VP and chief economist of the World Bank Group in the report.

U.S. real GDP estimates for 2024 experienced a downward revision to 0.8%, a 0.8% drop from January’s forecast. Global real GDP also revised downwards to 2.4% next year, a 0.3% decrease. For reference, 2022’s U.S. real GDP global real GDP grew by 3.1%.

“Global growth could be weaker than anticipated in the event of more widespread banking sector stress,” the World Bank wrote. Another potential risk includes if “more persistent inflation pressures prompt tighter-than-expected monetary policy.”

The impacts of tight monetary policies in many developed market economies continue to weigh heavily on the global economy and EM countries. Further bank tightening could exacerbate the debt distress poorer countries are already struggling with and further dampen EM growth.

Advanced economies are projected for just 0.7% growth this year and will remain “feeble” next year. Forecast contributing factors include tightening credit conditions and monetary policy. Labor market softening will also create drag looking ahead, as will persistently high energy prices.

Consider Managed Futures as Economic Weakening Threatens

Managed futures strategies are worth portfolio inclusion for several reasons. They provide strong diversification opportunities as well as capture investing trends as the macro outlook changes. As economic weakening continues this year and next, managed futures are positioned to capture the changing investment trends.

Managed futures funds largely outperformed last year amidst volatile markets and ongoing crises. The abrupt reversal of trends in the wake of regional bank collapses in mid-March created a challenge for many managed futures funds. This means investors can currently gain access to the strategy at discounted prices.

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. The actively managed fund uses long and short positions within the futures market on several asset classes. These include domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. The DBE analyzes the trailing 60-day performance of CTA hedge funds. It then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets anticipated to grow in value. The fund also takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.