It’s a challenging market out there, with a confluence of complex and often conflicting factors. Andrew Beer, co-founder and managing member of DBi, discussed investing bias and why managed futures make sense for the next decade on a recent podcast.

Beer recently appeared on the “Top Traders Unplugged” podcast hosted by Niels Kaastrup-Larsen, managing director of DUNN Capital (Europe). The pair discussed current markets, the managed futures strategy, replication, and more. They opened with a discussion on the impact of higher rates for longer and what that means for investors.

Building Success in a “Very Strange, Artificial Situation”

Investors spent much of this year hoping that Fed rate hikes would conclude at each consecutive meeting. Now, at the end of September, investors face the high likelihood of another rate hike by year’s end. What’s more, markets are grappling with the Fed’s forecast of fewer rate cuts next year than anticipated. It’s a reality markets weren’t positioned for, and remain consistently on the wrong side of.

“As a rules-based investor, you know how bad it is to hope that a trade that is going against you is not going to continue to go against you,” Beer said. “It’s the worst heuristic bias that people have when it comes to investing.”

Beer went on to discuss the grim reality that the entire wealth management industry in the last two decades is almost entirely dependent upon stocks and bonds remaining inversely correlated. Though it’s been a truth of markets for 20 years, it’s a reality that is changing and reverting to a more normal reality of positive real rates. It’s a reality most investors remain unprepared for.

“It’s returning to normal and they’re having a really hard time making sense of it,” Beer explained. “A lot of people’s businesses and livelihoods and success was built on a very, very, very, very strange, artificial situation.”

It’s an environment that trend strategies and managed futures, with their non-correlated exposures, are ripe for. Managed futures invest across a variety of asset classes through the futures market. They can take both long and short positions on the direction an asset is moving. These strategies can capture not just upward momentum but downward trends as well and capitalize on them. Because they invest in futures, they hold low to negative correlations to both stocks and bonds.

“I think medium and long-term trend is the single best diversifier you can put next to a portfolio of stocks and bonds, bar none,” said Beer.

Eliminating Single Manager Investing Bias and Risk

In an environment of increased stock and bond correlations, Beer sees those correlations proving disastrous to the structure of most portfolios.

“This is an existential threat,” Beer explained. “If stocks and bonds start moving in tandem, or continue to move in tandem, [clients]… are stuck on a scary rollercoaster. We can try to get them something better.”

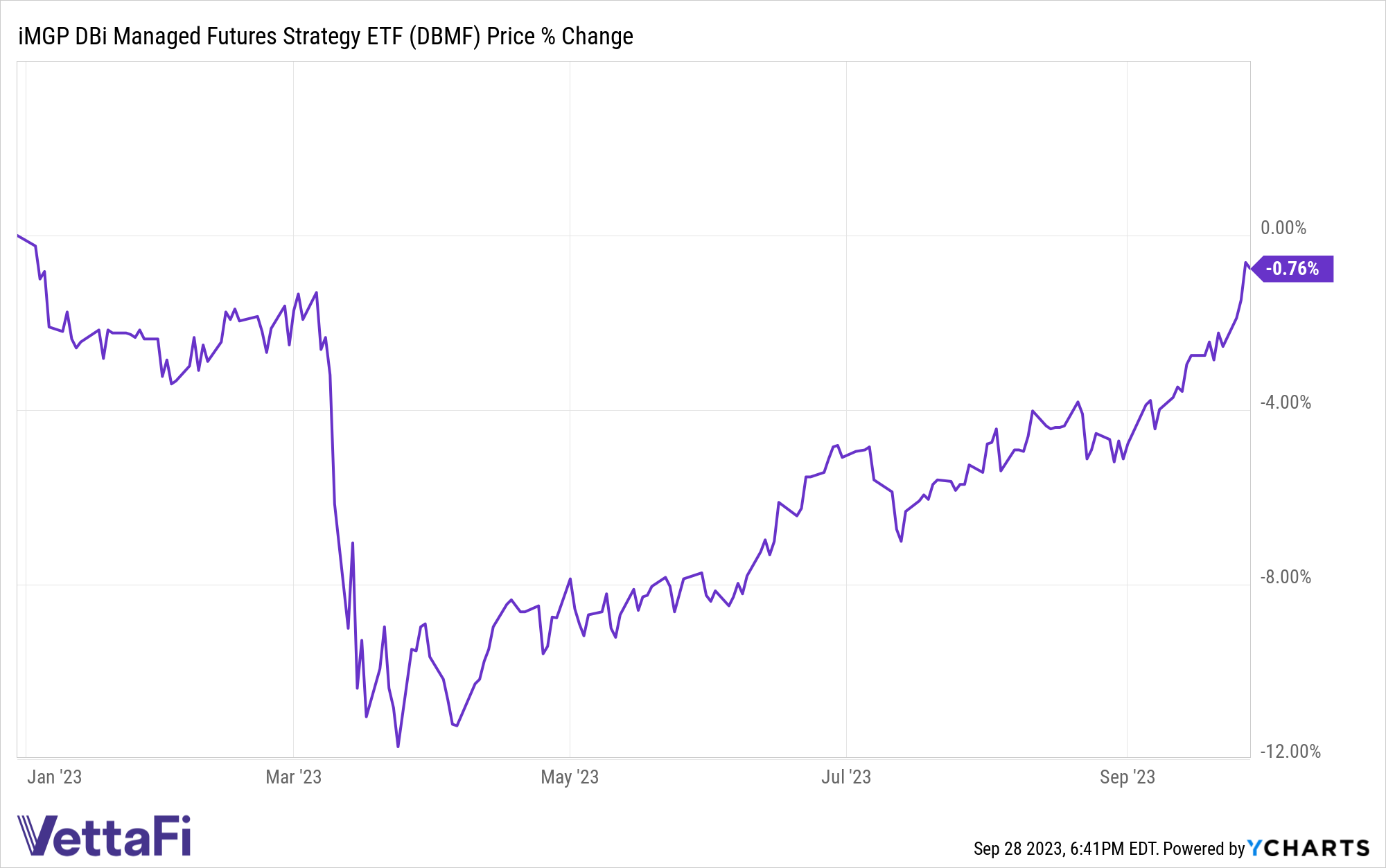

The strong diversification and outstanding performance of a handful of managed futures ETFs last year like the iMGP DBi Managed Futures Strategy ETF (DBMF) continue to catch investors’ eyes. That alongside the increasing probability of stock and bond correlations for periods makes managed futures a strong addition to portfolios looking ahead.

DBMF seeks to replicate the averaged performance of the 20 largest managed futures hedge funds via the SocGen CTA Index. By offering the replication strategy in an ETF, DBMF creates significant fee savings. These savings in turn contribute to the alpha potential of the fund. Replication and performance are some things the industry is paying attention to.

“For the asset allocators that I’ve talked to… They don’t want to have to worry who’s the best, they like the space,” Beer explained. “They look at this SocGen CTA Index and… want an easy way to get exposure today.”

That means eliminating the need to try and pick a singular manager in the space. DBMF does so by looking not just at the performance of the 20 largest hedge funds but at their averaged performance. In doing so, the fund eliminates single-manager risk.

Invest in Managed Futures With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund. The contracts the fund invests in include equities, fixed income, currencies, and commodities. The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts.

This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds. The model then determines a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.