Advisors face a number of challenges in current markets, given risks and stock and bond correlations. They must grapple with how to invest smartly as well as keeping their clients invested in the traditional 60/40 portfolio. Jan van Eck, CEO of VanEck, and Andrew Beer, co-founder and managing member of DBi, joined Michael Batnick, managing partner of Ritholtz Management, to discuss today’s investing environment on The Compound & Friends podcast.

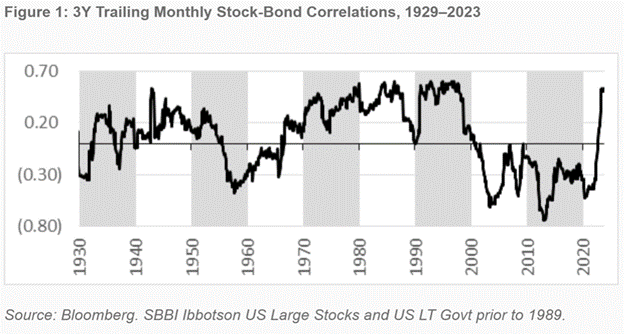

In an environment of aggressive Fed rate hikes and persistent inflation, bonds ceased acting as a hedge for equities for much of the last 18 months. It creates significant challenge as advisors find themselves faced with a changing market regime. It’s a regime of a reversion to mean for stock and bond correlations.

Challenges to the Model

Modern portfolios were constructed at a time when stocks and bonds demonstrated consistent, negative correlations to each other. It’s a phenomenon that is most common in low inflationary environments, according to Beer.

“That’s not normal,” he said. “What’s normal is that in most periods of time, you actually do have a positive correlation between stocks and bonds.”

Image source: The Compound and Friends podcast

Stocks and bonds moving in positive correlation to each other is deeply problematic for the modern 60/40 portfolio.

“One of the great innovations in the wealth management space was trying to get clients to invest in model portfolios,” explained Beer. By investing in a model portfolio, clients are much more likely to ride out drawdowns and challenging periods. This is particularly true when compared to investing in asset classes individually.

Those same model portfolios now face challenges. Should interest rates increase further, bond yields would rise while prices fell. Should inflation fail to unwind, bonds and equities both would be impacted. Though there is income back now in bonds, a 60/40 portfolio is a bet largely on the same kind of risk profile, according to Beer.

“A 60/40 portfolio today has double the risk it did seven years ago,” he noted. “A 60/40 portfolio today has roughly the risk that it had at the height of the GFC.”

Keeping Clients Invested During Market Turbulence

“The first job of every financial investment advisor is get your client into the market,” van Eck explained. In the current market, given cash yields, it’s a difficult sell right now.

By adding noncorrelated diversifiers — like managed futures — to a portfolio, investors might prove more willing to take that step, or to remain in positions even during drawdowns.

“You have, I would argue, the biggest risk in the market — and I think we agree — which is the Federal budget deficit,” van Eck added. “It’s just unsustainable if you do the math.”

With that risk looming over markets, adding genuine diversifiers could enhance portfolio stability. To be most efficient, these diversifiers need to carry low correlations to both stocks and bonds. The addition of noncorrelated diversifies like managed futures could be beneficial both in the near term as well as in the future during market dislocations.

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.