I hear about the Magnificent Seven several times a day — seven companies and eight stocks that have dominated headlines for the past few months.

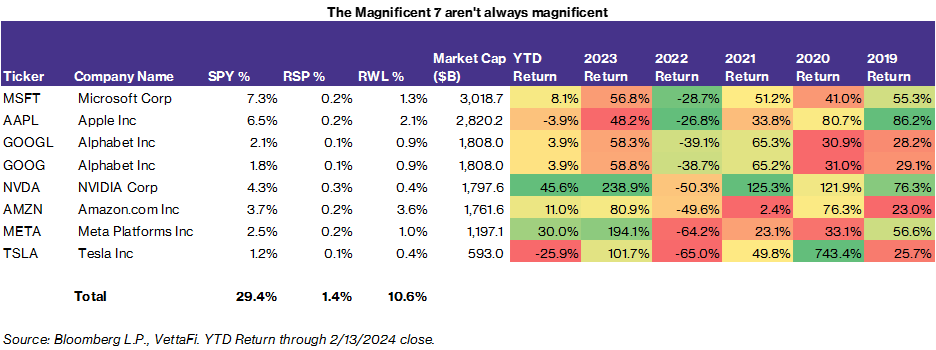

The Magnificent Seven comprises Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), Tesla (TSLA), and Alphabet (GOOG/GOOGL). These names aren’t new and have all been in the S&P 500 for at least the past five years (most even longer).

But now investors are paying more attention to the Magnificent Seven. And it’s not just because of the catchy name. It makes sense that investors like big tech. They can get exposure to innovation and technological advances while staying relatively safe due to these companies’ scale.

With added excitement surrounding artificial intelligence, the Magnificent Seven may be one of the easiest ways to play this trend without investing in obscure small-cap stocks. But many investors may be unintentionally overallocating to these stocks in their ETFs. These are ways investors can avoid (or embrace) the Magnificent Seven in their ETFs.

Over-Concentration in the Magnificent Seven May Be Too Much of a Good Thing

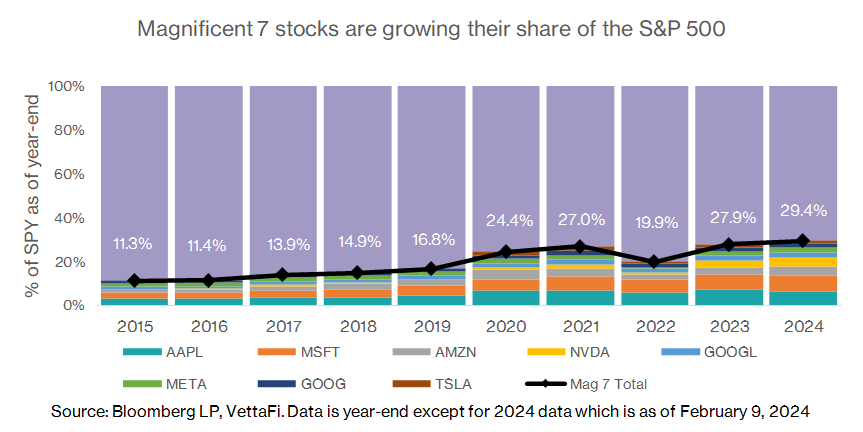

Since 2020, these seven companies (and eight stocks) have made up close to a quarter of the S&P 500 index . They’ve grown to almost one-third of the SPDR S&P 500 ETF Trust (SPY) currently. While large weights and high returns have boosted the S&P 500 (i.e., Nvidia is up 46% YTD), these stocks can also weigh on the market when they are down (i.e., Tesla is down 26% YTD). And since investors usually own multiple ETFs, exposure in an investor portfolio isn’t usually limited to what we see in the S&P 500.

Another popular ETF, for example, is the Invesco QQQ Trust (QQQ), which tracks the tech-heavy Nasdaq-100 Index. QQQ has about 40% of its weight in the Magnificent Seven stocks. Many other industry and thematic ETFs based on disruptive technology and innovation also have a heavy exposure to these stocks.

For instance, a future mobility ETF like the iShares Self-Driving EV and Tech ETF (IDRV) has about 15% exposure to these stocks. An artificial intelligence ETF like the Roundhill Generative AI & Technology ETF (CHAT) has about 30% exposure to these stocks. This is because many newer industries have few public companies. And those that do exist may have low market cap or trading volume and aren’t eligible for index inclusion.

But these indexes and ETFs often include Magnificent Seven companies since these companies play a role in infrastructure and development for emerging technologies. But that could also lead investors to having the same exposure to the Magnificent Seven multiple times, which defeats the purpose of an ETF: diversification.

Alternate Weighting Methods Can Help Investors Avoid Over-Concentration

In a market-cap-weighted ETF like the SPY, it might seem counterintuitive to invest in a group of 500 stocks where only eight stocks (and seven companies) make up one-third of the holdings. Stocks like Ralph Lauren (RL) — which is up 23% YTD — have only 0.02% weight. Why have holdings that amount to close to zero?

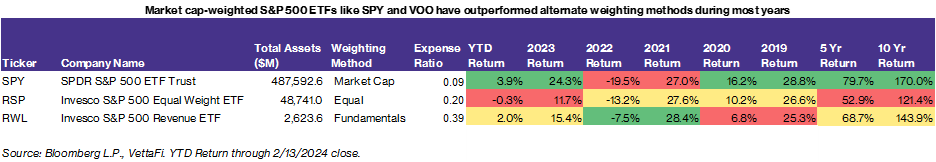

Equal-weight ETFs like the Invesco S&P 500 Equal Weight ETF (RSP) solve that issue. These ETFs level the playing field among stocks (allows holdings like Ralph Lauren, mentioned above, to contribute to performance). Some ETFs also use alternative weighting methods like the Invesco S&P 500 Revenue ETF (RWL). RWL weighs constituents of the S&P 500 by revenue earned, and caps company weights at 5%. Since weights are based on fundamentals — similar to the way an analyst would look at stocks — these weights can seem more “rational” when compared to equal weighting.

While these alternate weighting methods have outperformed in volatile years like 2021 and 2022, SPY has outperformed in other years and over longer periods of time. Because it is difficult to time the market, many investors may prefer to maintain the status quo and invest in a market-cap-weighted ETF like SPY or VOO. Ultimately, the over-concentration in the S&P 500 may not be a huge issue if your portfolio is diversified beyond large-cap equities — including fixed income, alternatives, international equities, and small-cap domestic equities.

How to Embrace the Magnificent Seven With ETFs

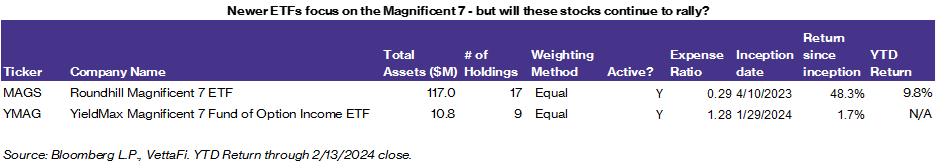

For investors who don’t think they’re getting enough Magnificent Seven, there’s an ETF for everything. Two ETFs, the Roundhill Magnificent 7 ETF (MAGS) and the YieldMax Magnificent 7 Fund of Option Income ETF (YMAG) allow greater exposure to the Magnificent Seven. MAGS was formerly known as the Roundhill Big Tech ETF but changed its name in November 2023 and added exposure to Tesla and Nvidia. The fund gives equal exposure to the seven companies. Roundhill is planning on launching three additional Magnificent Seven funds in early 2024, including leveraged and inverse versions. YMAG similarly allocates an equal weight to the seven companies; however, the fund uses exposure to option income ETFs instead of stocks. The fund focuses primarily on income as its objective.

MAGS has so far performed better than the S&P 500, but like many trends and themes, ETFs are often launched past the peak of the trend. With investors already questioning Tesla’s current “magnificence,” it may be easier to invest in the Magnificent Seven through individual stocks, where you can buy more or less of certain stocks rather than buying an ETF with a fixed allocation.

For more news, information, and analysis, visit VettaFi | ETF Trends.