The third-quarter earnings-reporting season is winding down, with each sector taking its turn churning out earnings releases. Several key mega-cap companies reported in October and November. Among those are the so-called “Magnificent Seven,” a group that includes Alphabet, Apple, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla.

The Q3 reporting period was a mixed bag for the Magnificent Seven, and although they almost all suffered post-earnings dips, they were generally quick to recover.

Investors Briefly Pull Back Despite Good News

Meta Platforms and Alphabet reported results in late October that were better than their respective consensus numbers. Yet two out of the three saw their stock prices fall post-announcement.

Meta reported earnings of $4.39 per share on $34.15 billion in revenue, versus the consensus numbers of $3.70 per share and $33.45 billion. However, the social networking giant’s stock tumbled as investors worried about management commentary suggesting caution on the ad market due to the heightened tensions in the Middle East.

Alphabet also beat overall expectations for its third-quarter earnings. That said, its shares briefly sold off on concerns about weaker-than-expected Google Cloud revenue in the days after its earnings announcement before resuming a generally upward trajectory.

Meanwhile, Microsoft reported a nearly perfect quarter based on analyst expectations, and initially, its stock rose. However, it later tumbled, likely due to the pullbacks seen by other companies in the Magnificent Seven. Apple smashed expectations for its third-quarter earnings in early November, and its stock still fell briefly post-announcement before recovering after a few days.

Amazon’s stock price declined sharply in the leadup to its earnings announcement before rebounding quickly after its after-hours announcement. The company reported earnings of 94 cents per share on $143.1 billion in revenue, smashing the analyst estimates of 59 cents per share and $141.7 billion in sales.

Not all of the news for Amazon was good, though it saw the quickest recovery. The midpoint of the company’s fourth-quarter guidance was below expectations. Additionally, Amazon seems to be giving up some market share in the cloud. Amazon Web Services recorded a 12% increase in cloud revenue, versus Microsoft Azure’s 29% jump and Google Cloud’s 22% rise.

Positive Results Except for Tesla

Tesla was the first of the Magnificent Seven to report its earnings. Additionally, it was the one member of the group that missed expectations widely, although most electric vehicle makers also posted somewhat weak numbers. Tesla reported earnings of 66 cents per share on $23.35 billion in sales, versus the expectations of 73 cents per share on $24.14 billion in revenue. Its shares still have not recovered to pre-earnings announcement levels.

Nvidia was the last of the member of the Magnificent Seven to report earnings, with its results announced the Tuesday before Thanksgiving. The company’s stock price fell after it announced earnings, but ticked up the following Monday. The declines came in spite of impressive earnings and strong revenue increases as well as above-consensus expectations for the future.

ETFs for Magnificent 7 Exposure

Although shares of all of the Magnificent Seven tumbled initially after their earnings releases, the stocks of the first six to report all rebounded a week or so later, including Tesla, despite its wide miss on both the top and bottom lines. Nvidia was still down nearly 3% in midday trading the day after it reported.

Investors looking to capture the performance of the Magnificent Seven in a single fund rather than individually investing in all seven stocks have multiple ETFs to choose from.

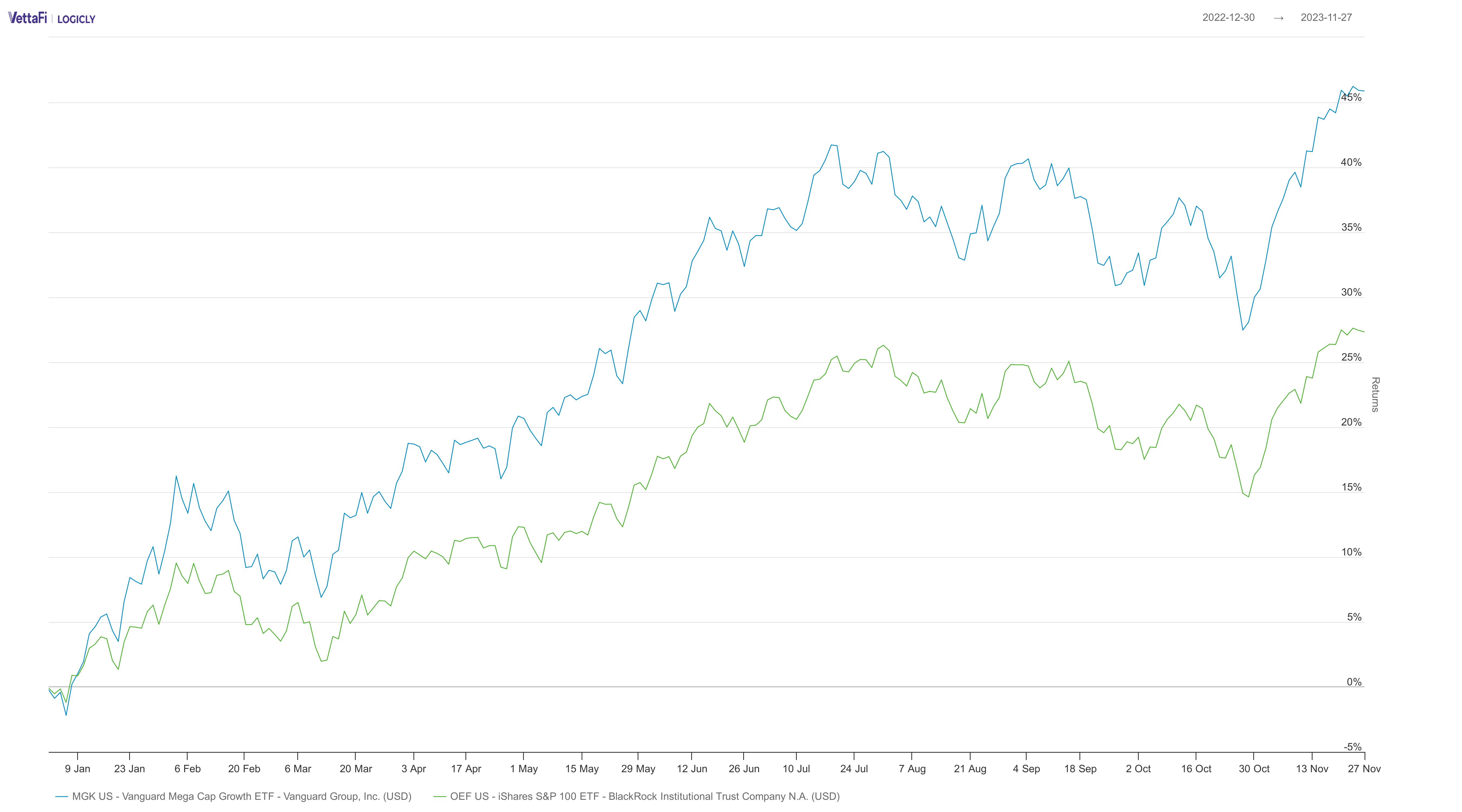

For example, the Vanguard Mega-Cap Growth ETF (MGK), which has $15.4 billion in net assets and is up 46% year to date, actually has the Magnificent Seven as its top seven holdings. Apple and Microsoft each account for 15% of its portfolio, while Amazon is at 7%, followed by Nvidia at 5%, two different share classes of Alphabet at 4% each, Meta Platforms at 4%, and Tesla at 3%

Meanwhile, the iShares S&P 100 ETF (OEF) includes all of the Magnificent Seven in its top 10 holdings, with Apple and Microsoft at 11% each, Amazon at 7%, Nvidia at 5%, and two share classes of Google and Meta at roughly 4% each.

The recently renovated Roundhill Magnificent Seven ETF (MAGS) offers concentrated exposure only to the seven companies in the group, but does so through exposure to both the targeted stocks and total return swaps, rather than purely via equities.

For more news, information, and analysis, visit VettaFi | ETF Trends. .