Worsening deflation is putting the Direxion Daily FTSE China Bull 3X ETF (YINN) in bear mode. With YINN down 25%, traders can take the other side with the Daily FTSE China Bear 3X Shares (YANG).

As opposed to YINN, YANG has risen almost 27% the past month amid China’s struggles. Extend the time frame to its year-to-date performance and the fund is up 35%.

In the meantime, China is dealing with deflationary pressures that could extend into 2024. As such, YANG could be on traders’ watch lists for further gains.

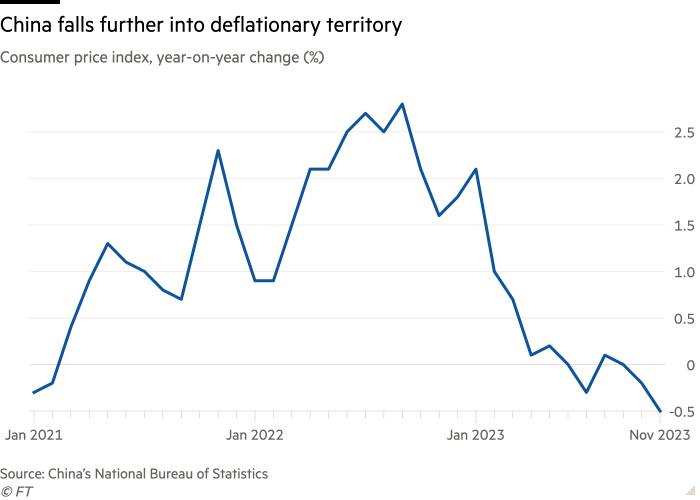

“China’s consumer prices fell 0.5 per cent year on year in November, the sharpest decline in three years as the world’s second-largest economy grapples with worsening deflation,” reported the Financial Times. It further noted that consumer prices have fallen “more than the 0.2 per cent decline forecast by a Bloomberg survey of economists and exceeded October’s fall of 0.2 per cent.”

“Producer prices, which are measured at factory gates and heavily driven by the cost of commodities and raw materials, dropped by 3 per cent and have remained in negative territory for the past year,” the report added. “Consumer prices entered deflationary territory in July and briefly rose in August before falling again in October.”

Policymakers Under Pressure

China’s government was already feeling the pangs of a real estate development crisis. And while deflation was percolating in the background, now the issue is coming closer to the forefront. Stimulus measures have already been implemented to try and stymie the real estate issues. But now the government is faced with additional pressures to formulate policy and right the economy.

“The deflationary trend adds to an array of economic pressures facing the country’s policymakers, including a liquidity crunch in the property sector, weak trade data and a slowing recovery from three years of zero-Covid lockdowns and border closures,” the Financial Times report added further. “Consumer demand has struggled to fully rebound in 2023, while policymakers have set an economic growth target of just 5 per cent, the lowest rate in decades.”

YANG seeks daily investment results equal to 300% of the inverse (or opposite) of the daily performance of the FTSE China 50 Index. Traders can use the added leverage to maximize profits. Or they could use it as a tactical tool to hedge other positions. China’s government may be able to right the proverbial economic ship. Having the ability to flip to YINN in times of upside highlights the flexibility of Direxion ETFs.

For more news, information, and analysis, visit the Leveraged & Inverse Channel.