2020 wasn’t kind to brick and mortar retailers with a record number of store closings and more could be ahead in 2021. While ETFs like the Direxion Daily Retail Bull 3X ETF (NYSEArca: RETL) managed to finish 2020 up over 60%, can it maintain its level of performance last year?

RETL seeks daily investment results of 300% of the daily performance of the S&P Retail Select Industry Index. With its triple leverage, RETL gives investors the ability to:

- Magnify short-term perspective with daily 3X leverage;

- Go where there’s opportunity, with bull and bear funds for both sides of the trade; and

- Stay agile with liquidity to trade through rapidly changing markets

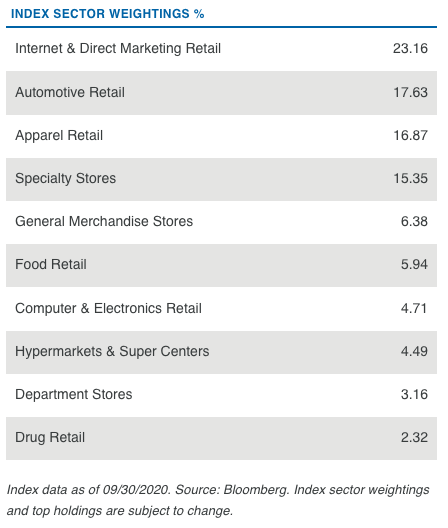

RETL invests in securities found within the index, which is a modified equal-weighted index that measures the performance of the stocks comprising the S&P Total Market Index. The fund has successfully been able to parry the effects of the pandemic since the sell-offs in March, giving bullish retail traders much to cheer about to end 2020.

Fortunately for RETL, its holdings represent companies that have been able to push through the pandemic with an online retail presence. With companies like Carvana as part of its top holdings, RETL has businesses that do a number of its retail sales online.

More Store Closings in 2021?

RETL’s holdings is a positive sign for bulls as 2021 could be another year marked with brick and mortar store closings. At least that’s what analysts in the retail industry are predicting for the new year.

“We’re not done yet,” Terry Lundgren, Macy’s former long-time CEO, told CNBC in mid-December. “We’re going to learn even more when we get through the holiday season. Retailers who have a weak balance sheet today aren’t going to get relief in January. It’s going to get tougher. When the volume of purchases drops dramatically after Christmas, the expenses remain.”

“They’re actually going to have an opportunity to grow again. That’s the upside, the green shoots, from that perspective of store closures,” Mr. Lundgren added, predicting it’s “probably not too much more than six months from now.”

Per a Retail Wire article, “before the pandemic, the expansion of online shopping had dragged down in-store traffic. Government-mandated restrictions, along with consumer caution, during the pandemic accelerated the online shift and decimated in-store selling for many retailers. A report from real estate firm CoStar Group found that 40 major retailers filed for bankruptcy and more than 11,000 store closures were announced in 2020 — both records.”

For more news and information, visit the Leveraged & Inverse Channel