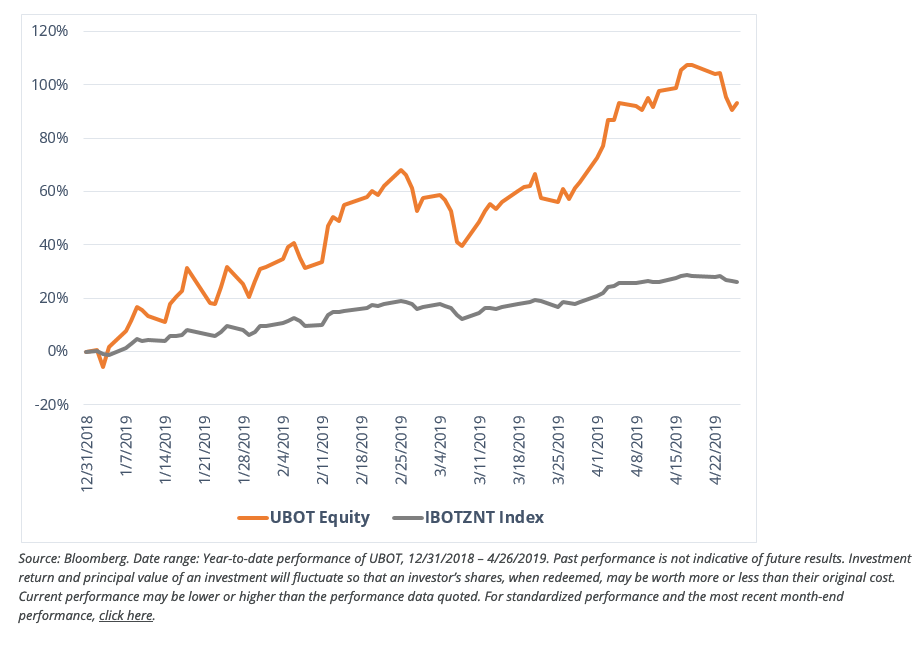

While the majority of the capital markets are fixated on trade wars, the Robotics & AI Bull 3X ETF (NYSEArca: UBOT) is up 98.25 percent year-to-date–gains that would even make a robot exhibit emotion.

UBOT seeks daily investment results equal to 300 percent of the daily performance of the Indxx Global Robotics and Artificial Intelligence Thematic Index, which is designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence.

The robotics space is certainly in a push-pull dichotomy of investors capitalizing on the latest in disruptive technology, while at the same time, getting push back from those threatened by the wider adoption of robots. The fears are warranted given that robotics technology has the capacity to supplant human jobs.

It’s a contentious topic given that in the business world, it’s either adapt or die.

“As the world marches toward unprecedented levels of mechanization, no one truly understands the scale and impact of new technology and the tectonic shifts in the way the workforce will be have to adapt,” a Direxion Investments blog noted. “A well-known PEW Research Center study showed that, while two-thirds of Americans believe automation will replace most of the work done by humans, 80 percent don’t believe that their jobs will be affected.

“As the robot uprising gains pace, the Indxx Global Robotics & Artificial Intelligence Thematic Index, which is composed of companies producing the less consumer-facing technology that is quickly altering the workforce, is gaining popularity. Traders looking to go all in, and leverage exposure to this index, have been rewarded handsomely year-to-date.”

Key characteristics of UBOT:

- The Indxx Global Robotics and Artificial Intelligence Thematic Index (IBOTZNT) is designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence, including companies involved in developing industrial robots and production systems, automated inventory management, unmanned vehicles, voice/image/text recognition, and medical robots or robotic instruments, as determined by the index provider, Indxx.

- Companies must have a minimum market capitalization of $100million and a minimum average daily turnover for the last 6 months greater than, or equal to, $2 million in order to be eligible for inclusion in the Index.

“‘What’s the next tech story?’–that’s what people ask us,” Sylvia Jablonski, Managing Director, Capital Markets – Institutional ETF Strategist, told ETF Trends at Inside ETFs..

“You have robotics, you have medical robots that do surgeries, you have AI in factories, you have an aging population being replaced by robots–I just think that space is going to be huge,” Jablonski added.

For more market trends, visit ETF Trends.