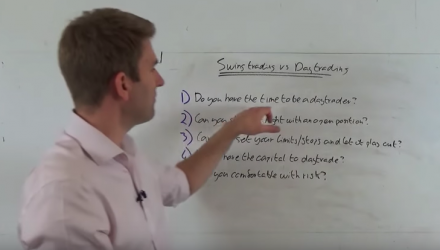

This video discusses the basic differences between day trading and swing trading, as well as which investment style is suitable for which individual.

For more investment strategies, visit the Leveraged Inverse Channel.

This video discusses the basic differences between day trading and swing trading, as well as which investment style is suitable for which individual.

For more investment strategies, visit the Leveraged Inverse Channel.