The fourth quarter is typically the most important time of year for retailers. While shoppers are looking forward to a parade of sales, investors in retail stocks eagerly anticipate projections and announcements of which companies showed the strongest year-over-year growth.

Though this seasonal trend is well-known by investors, it’s not unusual to see retailers outperform in November as the holiday season approaches. And that looks to be the case again in November.

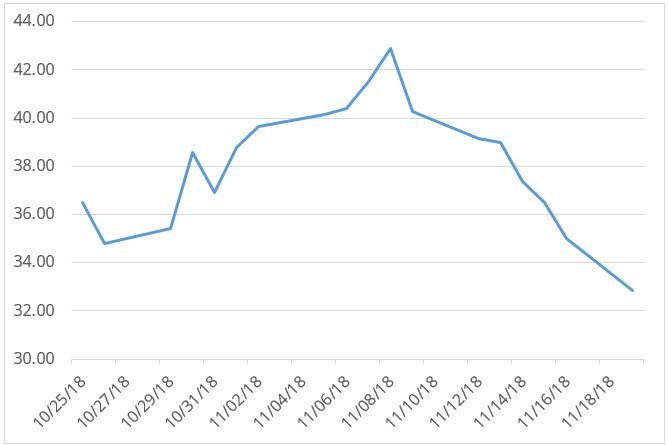

After succumbing to the same pressure as most other equities in October, the sector made a comeback at the end of the month. From Oct. 26-Nov. 8 the Direxion Daily Retail Bull 3X Shares ETF (RETL) rallied 30 percent to regain about half its losses.

But that trend has since completely reversed, as the fund has given back all those gains.

Data Range: 10/25/2018 – 11/20/2018. Source: Bloomberg. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For standardized performance and the most recent month-end performance, click here.

To figure out what happened let’s go back to the summer, when many retail stocks surged on the back of stellar quarterly financial results. Looking at some of RETL’s top holdings, DSW, Ollie’s Bargain Outlet, Tractor Supply Company, and Express each posted top-line surprises of 2 percent or more (15 percent in the case of DSW). What’s more, the latest per-share earnings from Kroger, Ollie’s Bargain Outlet, NutriSystem, and Foot Locker beat estimates by anywhere from 7 to 11 percent.