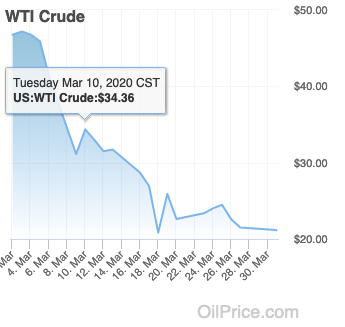

Oil prices touched down to their lowest level since 2002 as the price of U.S. crude fell as much as under $20 per barrel. A combination of a Saudi Arabia-Russia price war and the coronavirus pandemic put demand forecasts on the gloomier side.

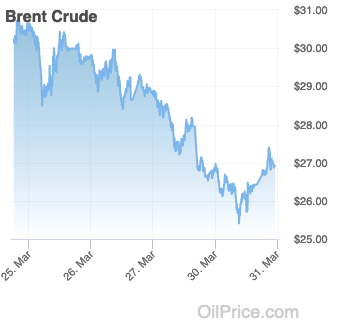

In Monday’s trading session, West Texas Intermediate futures fell to 6.5% at $20.11 a barrel, while Brent crude fell 6.4% to $26.18 a barrel. Additionally, it didn’t help oil prices after Goldman Sachs “estimated that oil demand this week will have fallen by 26 million barrels a day, or 25%, during the crisis,” per a Wall Street Journal report.

“Given the market’s expectations for oil demand to continue to decline until the return of normal economic activity, oil prices are still too high, according to Edward Marshall, a commodities trader at Global Risk Management,” the report added further.

“I think there’s too much hope in other financial markets—people are posturing for the bottom and as the tail of Covid-19 gets fatter more analysts are going to have to bring down their oil demand numbers for May and June,” Marshall said. “At that point we could see sub-$20-a-barrel Brent.”

Here are a pair of ETFs to play the weakness in oil:

- DB Crude Oil Double Short ETN (NYSEArca: DTO): offers 2x daily short leverage to the broad-based Deutsche Bank Liquid Commodity Index-Oil, making it a powerful tool for investors with a bearish short-term outlook for crude oil futures and Treasury bills. Investors should note that DTO’s leverage resets daily, which results in a compounding of returns when held for multiple periods. DTO can be a powerful tool for sophisticated investors but should be avoided by those with a low-risk tolerance or a buy-and-hold strategy.

- ProShares UltraShort Bloomberg Crude Oil (NYSEArca: SCO): offers 2x daily short leverage to the broad-based Dow Jones-UBS Crude Oil Sub-Index, making it a powerful tool for investors with a bearish short-term outlook for crude oil. Investors should note that SCO’s leverage resets on a daily basis, which results in a compounding of returns when held for multiple periods. SCO can be a powerful tool for sophisticated investors but should be avoided by those with a low-risk tolerance or a buy-and-hold strategy.

For more market trends, visit ETF Trends.