“Red October” and “Volatile October” are just a couple of monikers the past month can be aptly named after the capital markets were fueled by sell-offs. However, one ETF, the Direxion Daily 20+ Year Treasury Bear 3X ETF (NYSEArca: TMV), got a healthy dose of rocket fuel, which made it soar past its 200-day moving averages in the year-to-date chart, one-month chart and 5-day chart.

October wasn’t kind to U.S. stocks as the technology sector, in particular,got trounced with the S&P 500 following the Nasdaq Composite into correction territory before pulling itself out this week. The bond market saw its fair share of doldrums as a result of the whipsawing volatility as Treasury yields reached its own highs–a boon for TMV.

As bond prices were getting depressed, a movement into short duration by dogpiling into certain bond ETFs for the purposes of hedging benefitted TMV.

“TMV has a duration of -51–as rates get hiked and bond prices fall, it’s a great way for traders to generate alpha on the bear side, or hedge duration,” said Sylvia Jablonski, Managing Director, Co-Head of the Capital Markets & Institutional Strategy Team at Direxion.

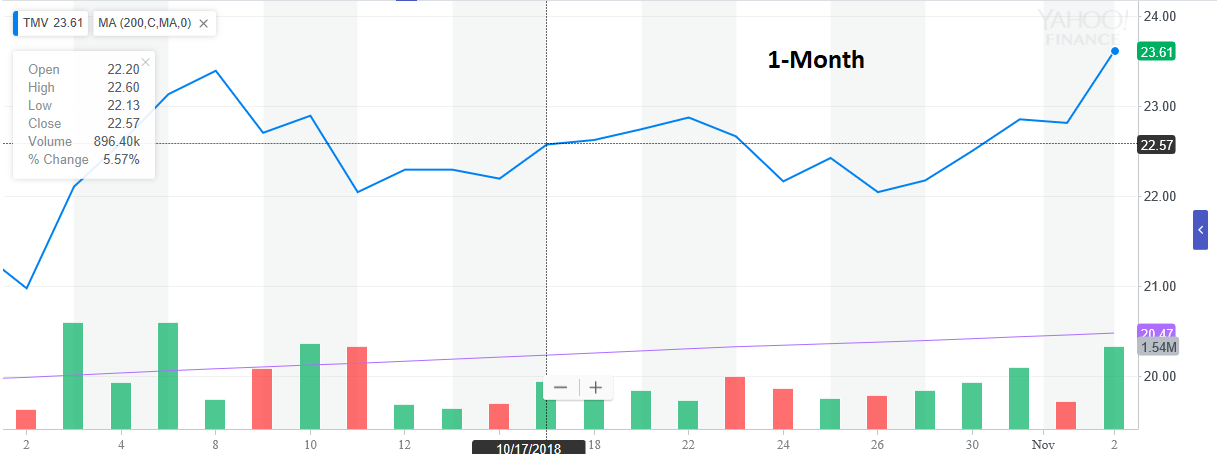

TMV Crosses 200-Day MA in YTD, 1-Month and 5-Day Charts

The benefits of October’s volatility were evident in TMV’s year-to-date, one-month and five-day charts below as the ETF traded above its 200-day moving average. TMV has provide investors with an 18.99% return thus far this year and 9.66% the last 12 months, according to Yahoo Finance performance numbers.

TMV seeks daily investment results before fees and expenses of 300% of the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. TMV invests in swap agreements, futures contracts, short positions or other financial instruments that provide inverse or short leveraged exposure to the index, which is a market value weighted index that includes publicly issued U.S. Treasury debt securities that have a remaining maturity of greater than 20 years.