GameStop’s meteoric rise has been the talk of the retail trading investment space. The Direxion Daily Retail Bull 3X ETF (RETL) rose 35% in Wednesday’s trading session alone.

RETL seeks daily investment results of 300% of the daily performance of the S&P Retail Select Industry Index. With its triple leverage, RETL gives investors the ability to:

- Magnify short term perspective with daily 3X leverage;

- Go where there’s opportunity, with bull and bear funds for both sides of the trade; and

- Stay agile, with liquidity to trade through rapidly changing markets

RETL invests in securities found within the index, which is a modified equal-weighted index that measures the performance of the stocks comprising the S&P Total Market Index. The fund has successfully been able to parry the effects of the pandemic since the sell-offs in March, giving bullish retail traders much to cheer about to end 2020.

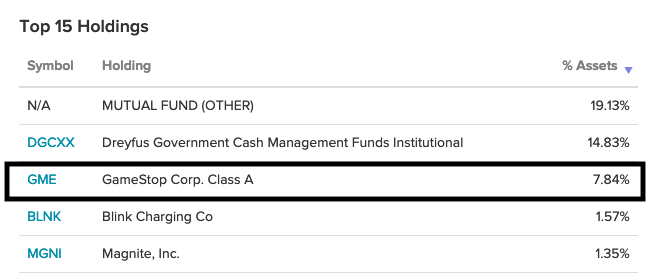

GameStop is one of RETL’s holdings, coming in at third on the list with a 7.84% allocation to its assets. RETL is up over 370%. With GameStop stock up 800% the past five days, RETL is certainly benefitting.

Taking the Other Side of the Short Trade

According to a CNBC article, “Wall Street has been watching GameStop in awe as a band of Reddit-obsessed retail investors managed to push the stock up 1,500% in two weeks, squeezing out short selling hedge funds.” A band of traders have been looking to short squeeze the other side of the trade by piling into GameStop stock.

“A wave of at-home traders found each other on the red-hot ‘wallstreetbets’ Reddit chat room, whose members have ballooned to over 3 million,” the article added. “By motivating each other to keep piling into shares and call options, they coordinated a monstrous short squeeze in the brick-and-mortar video game retailer.”

“Retail investors with the help of technology acting as a union in attacking is a new phenomenon,” said Jim Paulsen, chief investment strategist at the Leuthold Group.

“You combine the power of technology, which allows you through Reddit postings to magnify your individual impact, with some use of leverage and very targeted bets, they can have a significant influence, particularly on areas of vulnerability because of the short positions,” Paulsen said.

For more news and information, visit the Leveraged & Inverse Channel.