With the anticipation of rate cuts, the expectation that the U.S. dollar will fall is also an appended byproduct. That should fuel bullish opportunities in emerging markets (EM), including Brazil, whose equites are experiencing year-over-year growth.

The largest economy in Latin America witnessed strong growth in 2023, beating expectations from economists. It was a welcome metric, especially given that the country also came under new leadership last year.

“Brazil’s economy grew 2.9% in 2023, beating expectations in the first year of the administration of President Luiz Inácio Lula da Silva, according to the government statistics,” a Fox News report confirmed.

“The number announced by IBGE impressed many economists, whose overall forecast early last year was for only 0.8% growth in 2023,” the report added.

According to the report, much of the growth had to do with record production in agricultural commodities like corn and soybeans. That also came amid harsh weather conditions in certain parts of the country from the El Nino climate patterns that negatively affected crops.

Despite the economic headwinds, Brazil’s growth trajectory has leadership optimistic in 2024. According to Fox News, the government expects 2.2% growth this year and a retreating dollar amid U.S. Federal Reserve interest rate cuts could also help the purchasing power of the local currency.

Given the recent growth spurt, certain credit ratings agencies gave credence to Brazil’s rise among GDP rankings.

“The credit rating agency Austin Ratings said Brazil’s economy is now the ninth biggest in the world, based on the preliminary gross domestic product numbers,” the report added further, noting that the GDP “reaching $2.17 trillion in GDP last year moved the South American nation ahead of Canada and Russia.”

Double Leveraging Brazil

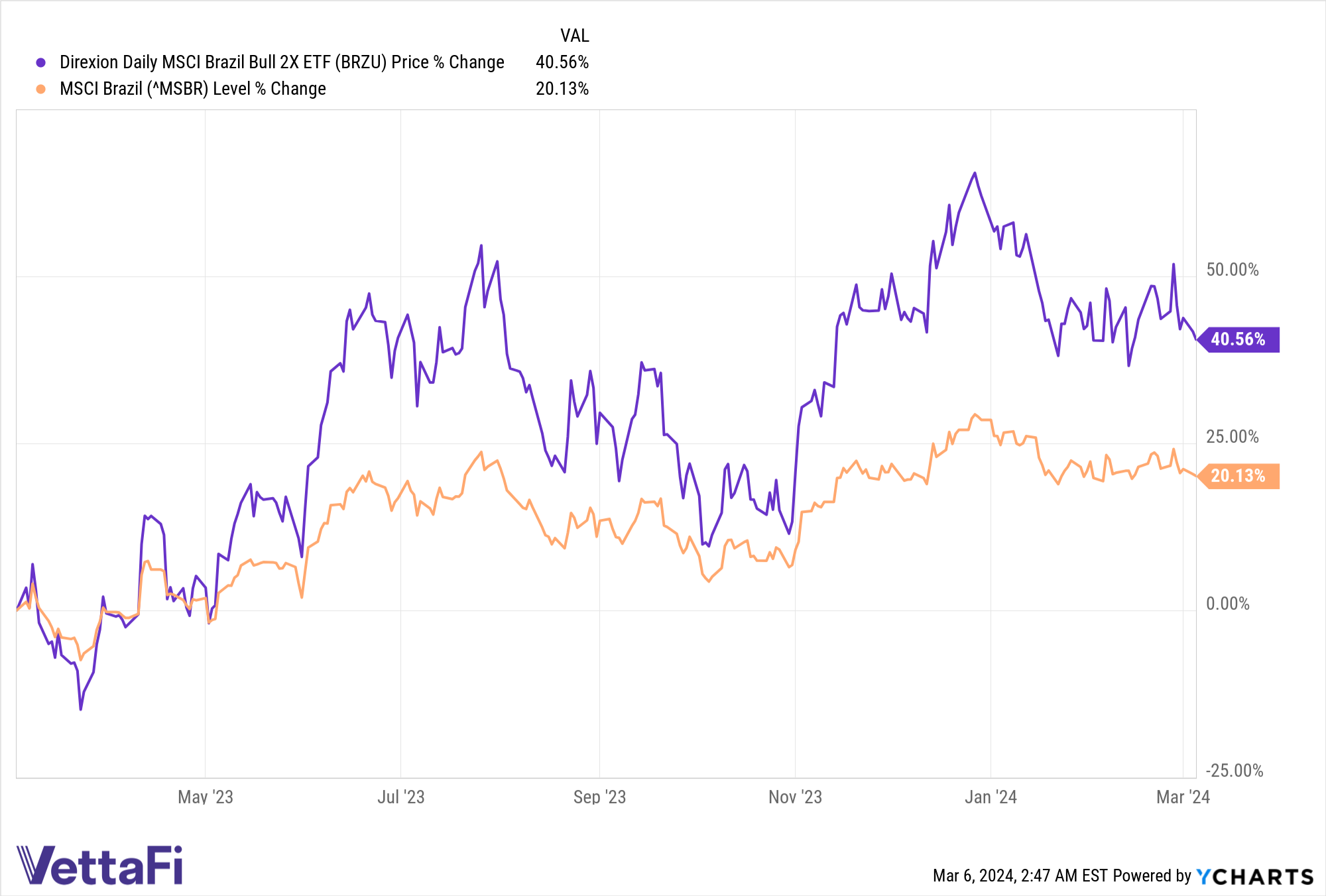

If Brazil can maintain its growth trajectory for the rest of the year, then traders who are bullish on its prospects may want to double up on Brazilian equities. This can be accomplished using the Direxion Daily MSCI Brazil Bull 2X ETF (BRZU).

Per its baseline fund description, BRZU essentially gives traders 200% exposure to the MSCI Brazil 25/50 Index. The benchmark tracks performance of the large- and mid-capitalization segments of the Brazilian equity market. Together, these two segments cover approximately 85% of the free float-adjusted market.

In the past year, BRZU has risen just a bit over 40%, largely following the MSCI Brazil index, but with the extra 200% leverage. That said, only experienced market players should consider using BRZU as part of their tools of the trade.

For more news, information, and analysis, visit the Leveraged & Inverse Channel.