On the other side, DPST seeks daily investment results equal to 300% of the daily performance of the S&P Regional Banks Select Industry Index. DPST invests in securities comprising the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a modified equal-weighted index designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the GICS regional banks sub-industry.

“It’s a general trend that higher interest rates boost bank’s profitability by expanding net interest margins,” Brunton wrote. “However, in a rising interest rate scenario, a customer’s ability to afford a loan decreases, negatively impacting the demand for mortgage loans.”

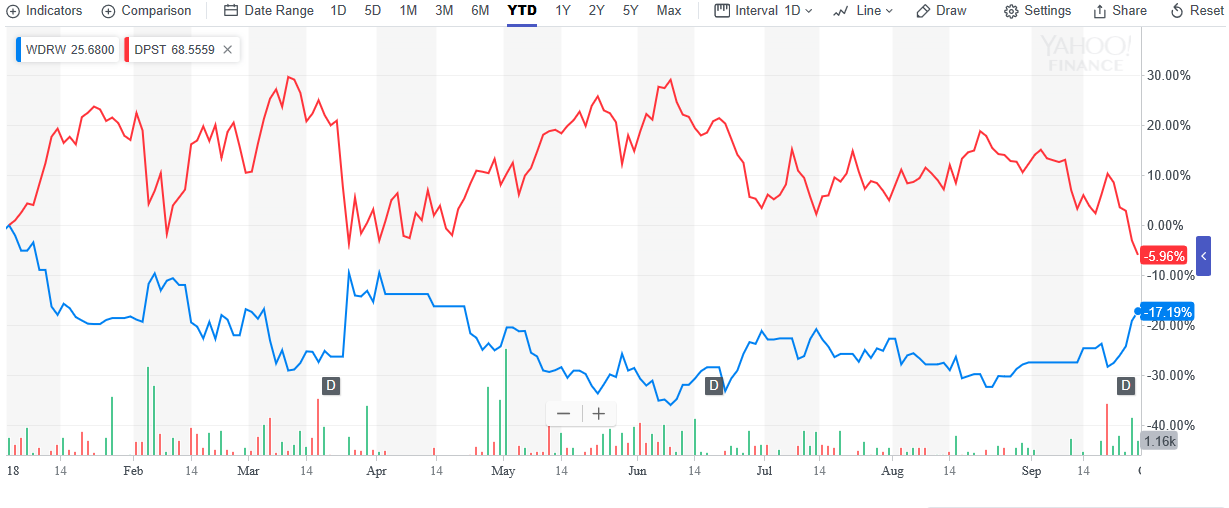

From a year-to-date perspective, DPST has been outlasting WDRW despite the two previous rate hikes the Fed incorporated to start the first half of 2018. Through the end of 2018, both ETFs may reach a convergence depending on how much these rate hikes actually do negatively impact the overall businesses of regional banks.

![]()

For more market trends, visit ETFTrends.com.

For more market trends, visit ETFTrends.com.