Gold faced downward pressure on Monday, but precious metals consultancy Metals Focus said in its latest Gold Focus 2019 report that a rally towards the end of 2019 could be ahead.

The Dow Jones Industrial Average gained over 300 points after strong manufacturing data from the Institute for Supply Management (ISM) re-instilled confidence back to the markets temporarily following fears of a global economic slowdown. This followed a flight from safe havens like gold, which saw its price fall below its March low of $1,280 per ounce.

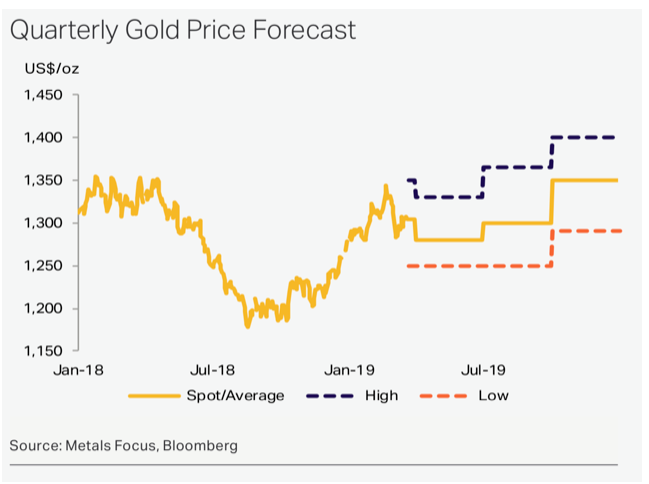

“Conditions are now becoming more supportive for a late-2019 rally,” said Metals Focus in its report. “For the next six months, (we) see gold trade in a relatively tight range around $1,300; on the upside…prices will probably be capped at last year’s peak of $1,365, while ventures to levels as low as $1,250 can also not be ruled out. A more meaningful rally is then forecast to take place later in the year, when we see prices testing the $1,400 mark.”

Amid the rise in the major stock market indexes, the SPDR Gold Shares (NYSEArca: GLD) fell 0.30 percent SPDR Gold MiniShares (NYSEArca: GLDM) ticked 0.35 percent lower 10 minutes before the close of Monday’s trading session.

The ISM index rose to 55.3 in March–up from a previous reading of 54.2 with three of five its main components increasing. this beat estimates from a Bloomberg survey that was expecting a rise to 54.5, staying above the 50 level–an indication of expansion.

In addition, the Caixin/Markit Manufacturing Purchasing Managers’ Index rose to 50.8 during, which was its highest level in eight months. A poll of economists by Refinitiv were expecting a 49.9 number.

“Comments from the panel reflect continued expanding business strength, supported by gains in new orders and employment,” said Timothy Fiore, chairman of the ISM business survey committee.

“The manufacturing sector continues to expand, demonstrated by improvements in the PMI three-month rolling average, which is consistent with overall manufacturing growth projections,” Fiore added.

Related: 12 ETFs to Stay Invested, Incorporate Downside Buffers

Upside Ahead for Gold

In move that was widely anticipated by most market experts, the Fed last week elected to keep rates unchanged, holding its policy rate in a range between 2.25 percent and 2.5 percent. In addition, the central bank alluded to no more rate hikes for the rest of 2019 after initially forecasting two.

The capital markets initially expected rates to remain steady after the central bank spoke in more dovish tones following the fourth and final rate hike for 2018 last December. Of course, less hikes and a rate cut would translate to dollar weakness–an open path for strength in gold.

“Recent comments from Fed officials, as well as FOMC members’ guidance on policy rates, all suggest that U.S. policy rates will remain unchanged for the foreseeable future. Fed fund rates futures are similarly pricing in no rate increases at least for 2019 … This in itself should be positive for gold, as it should encourage investor interest in safe-haven assets,” Metals Focus noted.

Traders were also quick to unload miners as the VanEck Vectors Gold Miners (NYSEArca: GDX) fell 2.23 percent. Leveraged bullish plays for gold also fell with the Direxion Daily Jr Gold Miners Bull 3X ETF (NYSEArca: JNUG) declining 10 percent and the Direxion Daily Gold Miners Bull 3X ETF (NYSEArca: NUGT) falling 6.62 percent.

For more market trends, visit ETF Trends.