While emerging markets have been roiled by ongoing trade wars this year, they’ve only been exacerbated by surging U.S. Treasury yields as of late with the benchmark yields rising beyond the 3% level, taking investor attention away from equities and bonds from abroad. One exchanged-traded fund (ETF) benefitting from this rise in U.S. government debt yields is the Direxion Daily MSCI EM Mkts Bear 3X ETF (NYSEArca: EDZ).

EDZ seeks daily investment results that equal 300% of the inverse of the daily performance of the MSCI Emerging Markets IndexSM. The fund invests in swap agreements, futures contracts, short positions or other financial instruments that provide inverse or short leveraged exposure to the index, which is a free float-adjusted market capitalization weighted index that is designed to represent the performance of large- and mid-capitalizations securities across the 24 emerging market countries.

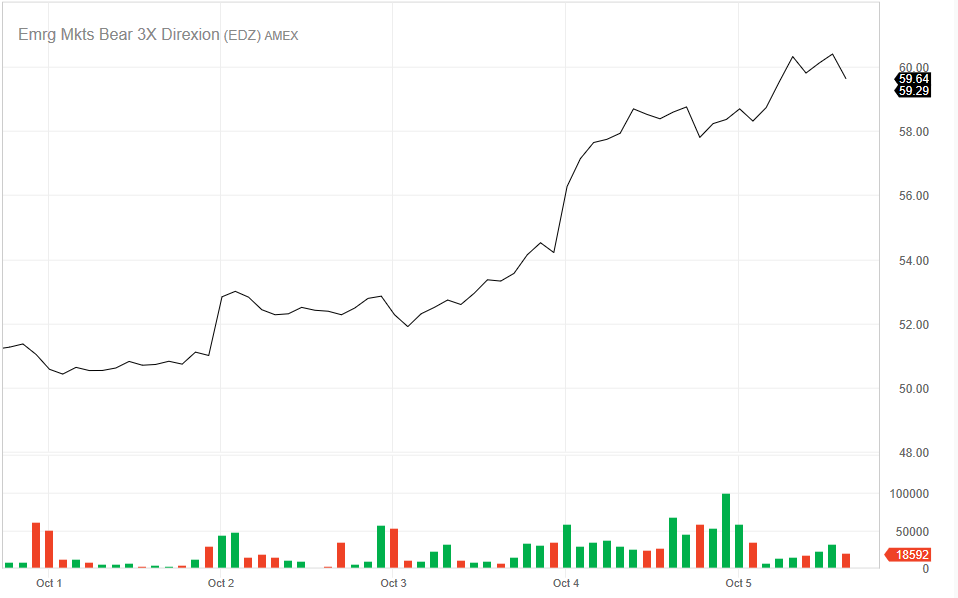

The rough year in emerging markets is evident in EM-focused ETFs, such as the Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO)–down 8.91% YTD, iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG)–down 8.24% YTD and iShares MSCI Emerging Markets ETF (NYSEArca: EEM)–down 8.31% YTD. However, EDZ has broken out with a 17% jump the last five days as the story of rising Treasury yields has been flooding the capital markets.

A rising U.S. dollar coupled with rising interest rates have also depressed opportunities in emerging markets thus far this year, helping to fuel EDZ’s year-to-date performance of 12.67%. Even with the Dow Jones Industrial Average falling by over 200 points today, EDZ is up 1.37% an hour before the markets close.

“A simple dynamic is playing out in the global economy right now – the U.S. is booming, while most of the rest of the world slows or even stagnates,” said HSBC economist Kevin Logan. “A Federal Reserve that is raising rates to prevent the U.S. economy from overheating is constraining the policy options of countries where financial conditions are tightening and trade tensions intensifying.”