Rising interest rates have been great for yield seekers in fixed income, but for bullish bond investors, it’s been the opposite. However, overseas investors are sensing opportunities with the current low prices, especially in Treasury notes.

In a recent MarketWatch article, global investment firm Morgan Stanley reaffirmed its bullish stance on Treasury bonds. Given that yields move conversely with prices, rising interest rates have been pushing yields higher, which may seem like bearish plays in notes should be the default play.

“We stand alone, with conviction, telling investors to buy government bonds, despite incessant selling and weak price action, driven by backward looking and — in our view — questionable narratives,” the firm said in the aforementioned MarketWatch article. However, it also noted that foreign investors have actually piled into U.S. government bonds amid the Federal Reserve’s monetary policy tightening.

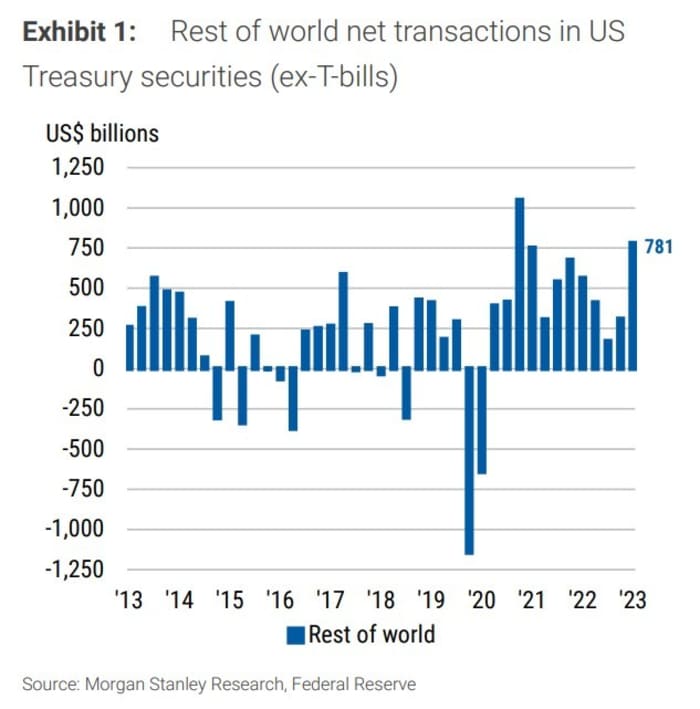

The chart below, included in the article, highlights how the rest of the world has been adding to their U.S. bond portfolio, while domestically the majority may be doing otherwise. According to the article, “the Fed’s financial accounts report showed that far from selling, overseas investors bought more Treasurys last quarter than in any quarter but one going back a decade.”

Treasury Notes at an Area of Value?

Eventually, the Fed will decrease the pace of its rate hikes, so it could simply be a case of foreign investors getting U.S. bonds at a value-oriented price. In the meantime, traders can take advantage of short-term moves when yields fall and bond prices tick higher via leveraged exchange traded funds from Direxion.

When long-term notes move higher, traders can consider the Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF), which seeks 300% of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. It’s an ideal play for traders looking at the long end of the yield curve, and has triple leverage for maximizing profits.

For upticks in bonds with shorter maturity dates (intermediate duration), traders can use the Direxion Daily 7-10 Year Treasury Bull 3X Shares (TYD). The fund seeks 300% of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index, which is a market-value-weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to 10 years.

For more news, information, and analysis, visit the Leveraged & Inverse Channel.