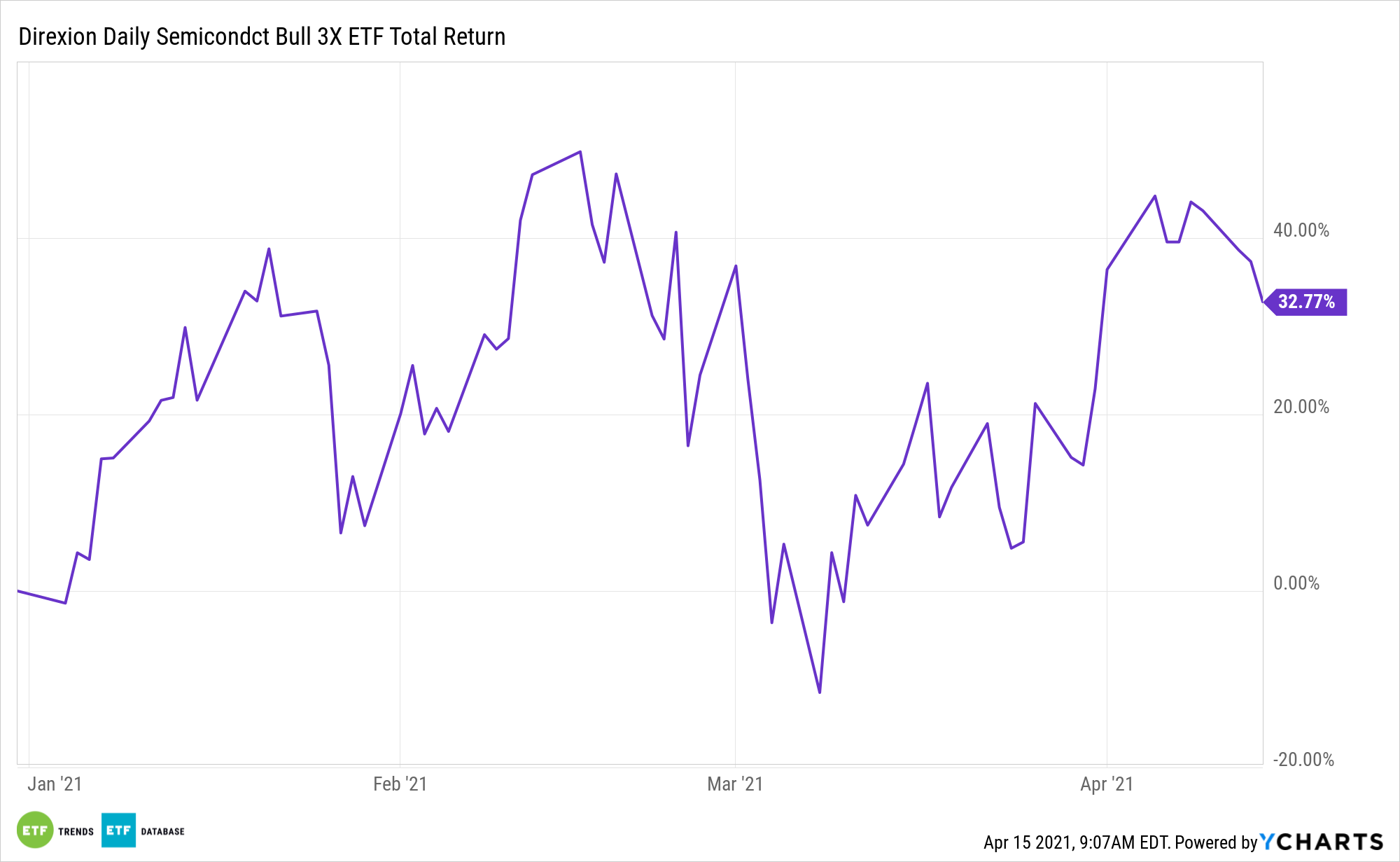

Not many goods are hotter than semiconductors at the moment, which is welcome news for the Direxion Daily Semiconductor Bull 3X ETF (SOXL).

SOXL seeks daily investment results equal to 300% of the daily performance of the PHLX Semiconductor Sector Index. The fund, under normal circumstances, invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

“A bipartisan group of more than 70 House and Senate lawmakers on Monday called on President Biden to support funds for semiconductor research and manufacturing as Biden hosted a meeting with technology leaders to discuss a critical shortage in chips,” an article in The Hill noted. “In a letter to Biden spearheaded by Sen. John Cornyn (R-Texas), the lawmakers asked that he work to fund initiatives for semiconductors created by the CHIPS for America Act, legislation included in the most recent National Defense Authorization Act, noting the need to compete with China.”

“We would specifically request you consider joining us in support of funding levels that are at least the authorized amounts proposed in the original bill as you work with Congress on a package of policies to better compete with China and how best to strengthen our country’s economic competitiveness and resiliency as well as national security,” the lawmakers wrote.

A Bearish Point of View

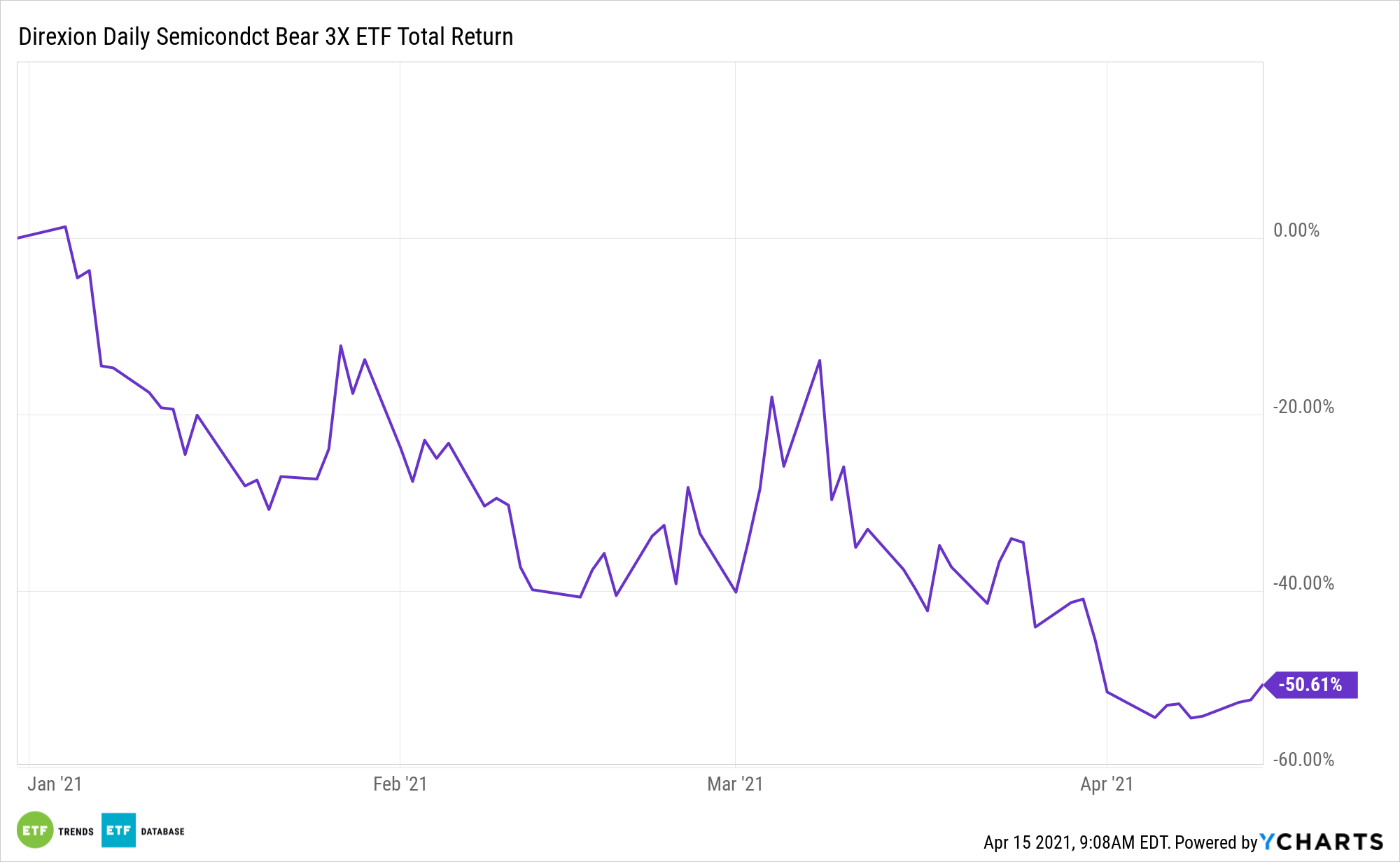

Yet will federal government assistance bring semiconductor prices back down? It’s a bet worth considering for the self-styled contrarian trader.

To take the opposing view, traders can use the Direxion Daily Semiconductor Bear 3X Shares (SOXS), which does the opposite of SOXL by seeking daily investment results equal to 300% of the inverse (or opposite) of the daily performance of the PHLX Semiconductor Sector Index.

The fund, under normal circumstances, invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse (opposite) or short leveraged exposure to the index equal to at least 80% of the fund’s net assets (plus borrowing for investment purposes). The index measures the performance of domestic companies engaged in the design, distribution, manufacture and sale of semiconductors.

For more news and information, visit the Leveraged & Inverse Channel.