As interest rates and inflation climbed, the homebuilders sector was getting squeezed from both sides. Supply costs were increasing while high-interest mortgages began scaring buyers away from the market. Then, three of the largest bank failures in U.S. history all happened in the span of about two months this spring, spurring tighter lending restrictions that put even more strain on the mortgage market.

While all of that sounds like the makings of a bear market for homebuilders, the industry has stunned traders with double-digit growth while the rest of the market faltered. Now, bull traders are looking ahead for the potential of more bullish momentum to trade in what appears to be a gravity-defying homebuilder sector.

Earnings Surprises Boost Momentum for Builders

Defying the grim forecasts for the sector, homebuilder stocks have been on a bull run since October, even as the Fed continued to raise interest rates and housing demand slid. That surprise recovery has held strong through the start of the year, with stocks like Lennar Corporation (8.27%) and D.R. Horton, Inc. (9.81%) soaring. Lennar Corporation and D.R. Horton, Inc. are not alone, either. The Dow Jones U.S. Select Home Construction Index is up more than 30% since the start of the year (as of 6/15/23). That’s made for a phenomenal trading season for bull traders in what was expected to be a relatively flat period.

Despite that growth, the sector doesn’t seem to have topped out just yet. Lennar Corporation and D.R. Horton, Inc. are both trading above their 30-day moving averages* and have been for most of this year. The latter surprised analysts in April with stronger-than-expected earnings. That included $7.5 billion in revenue for the second quarter, beating analyst projections by about $1 billion.

Similar earnings surprises came from M.D.C. Holdings, Inc. (0.71%) and PulteGroup, Inc. (4.46%). Traders can still try to catch some of that potential earnings surprise price action in the next round of earnings releases expected in July, including NVR, Inc. (4.97%) and D.R. Horton Inc.’s Q3 results. All holdings are as of March 31, 2023 and are subject to risk and changes.

The Rate Hike Pause Could Boost Summer Housing Market

With the latest pause in rate hikes from the Federal Reserve, mortgage rates could finally level off. That could encourage more buyers to return to the housing market, driving up demand amid already tight supply.

Conditions like those could push prices up this summer, a season that already tends to see peak prices for real estate. Current forecasts see the number of home sales potentially climbing by about 5% over the summer. The growth may be modest, but given the better-than-expected earnings achieved during a period of declining demand, it could be enough for homebuilders to keep up some bullish momentum.

The Fed rate pause may indeed be enough to convince homebuyers to strike now.

Magnify Bullish Housing Trades with Direxion’s Daily Homebuilders & Supplies Bull ETF

Direxion’s Daily Homebuilders & Supplies Bull 3X Shares (NAIL) gives traders a way to seek to magnify exposure as this 3X Daily Leveraged ETF seeks daily investment results, before fees and expenses, of 300% of the performance of the Dow Jones U.S. Select Home Construction Index.

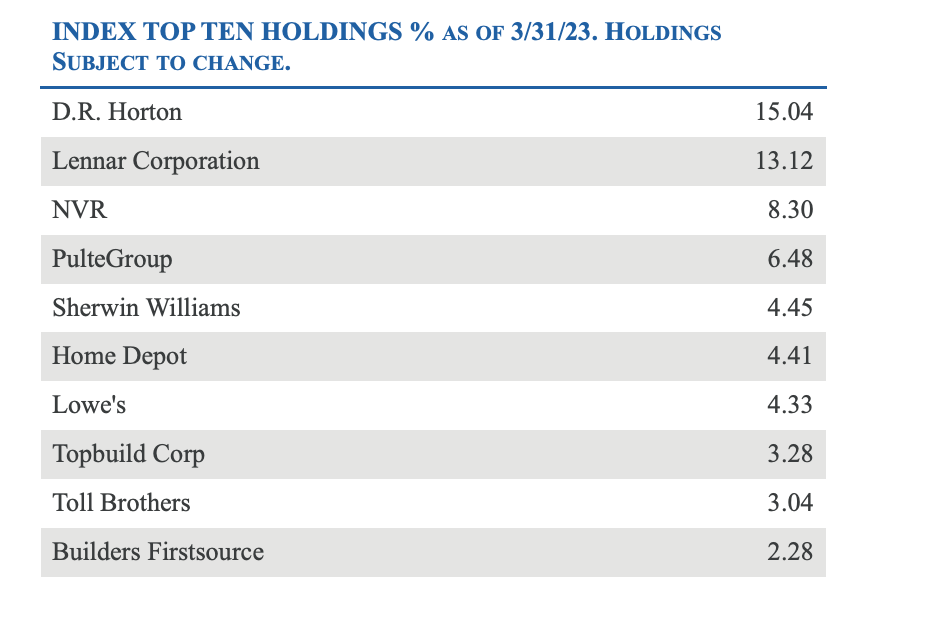

Composed of U.S. companies across the home construction market, the index is heavily weighted toward the homebuilding sector, which accounts for about 66% of its holdings. The index includes the following top 10 holdings:

This makes NAIL a potential tool for traders looking to supercharge their upcoming bullish trades this summer. That leverage means losses will be magnified as well as gains, but when used carefully as part of a short-term trading strategy, NAIL can help traders make the most of their bullish assumptions.

This makes NAIL a potential tool for traders looking to supercharge their upcoming bullish trades this summer. That leverage means losses will be magnified as well as gains, but when used carefully as part of a short-term trading strategy, NAIL can help traders make the most of their bullish assumptions.

*Definitions & Index Descriptions

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don’t have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

For more news, information, and analysis, visit the Leveraged & Inverse Channel.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The Dow Jones U.S. Select Home Construction Index (DJSHMBT) measures U.S companies in the home construction sector that provide a wide range of products and services related to homebuilding, including home construction and producers, sellers and suppliers of building materials, furnishings and fixtures and also home improvement retailers. The Index may include large-, mid- or small-capitalization companies. One cannot directly invest in an index.

The Dow Jones U.S. Select Home Construction Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Dow Jones U.S. Select Home Construction Index.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, Cash Transaction Risk, Tax Risk, and risks specific to the securities of the Homebuilding Industry and Industrials and Consumer Discretionary Sectors. The homebuilding industry includes home builders (including manufacturers of mobile and prefabricated homes), as well as producers, sellers and suppliers of building materials, furnishings and fixtures. Companies within the industry may be significantly affected by the national, regional and local real estate markets, changes in government spending, zoning laws, interest rates and commodity prices. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.