Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don’t have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

It’s been a mixed bag for the electric and self-driving vehicle businesses. Industry bellwether Tesla Inc. (NASDAQ: TSLA) recently, cutting prices on its electric vehicle (EV) models clearly signals falling demand. On the other hand, Chinese high-end EV manufacturer NIO Inc. (NYSE: NIO) and battery producer Contemporary Amperex Technology Co. Limited recently announced a five-year agreement to create a new battery supply system and team up on other initiatives.

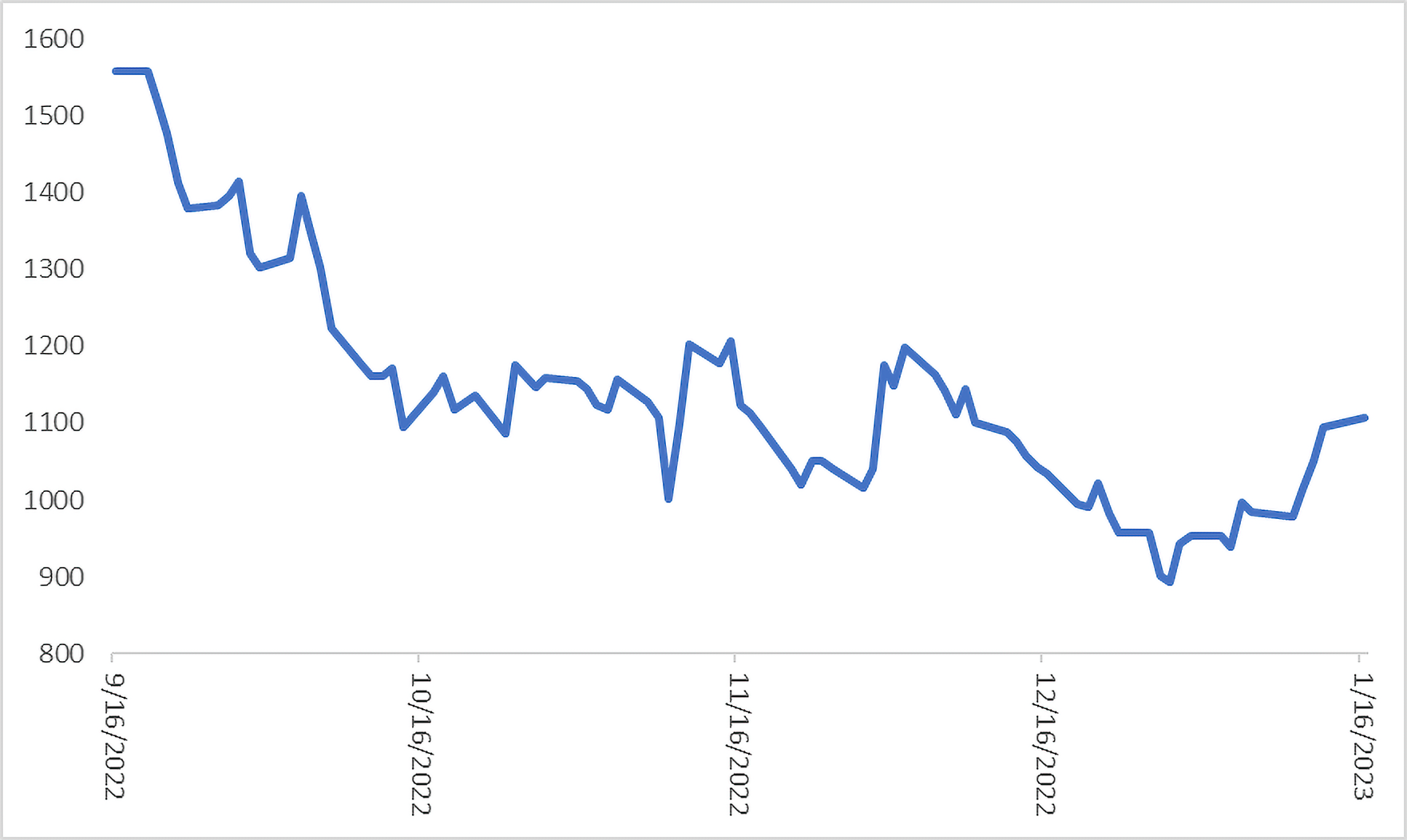

Upcoming earnings reports, however, from Tesla and other leaders in the innovative sector are what may really set the tone for early 2023. In recent months, the Indxx US Electric and Autonomous Vehicles Index* has been searching for direction after a decline, much like the overall market.

Indxx US Electric and Autonomous Vehicles Index (9/16/22–1/16/23)

Source: Indxx Indices.

Key Earnings Reports to Watch: Tesla and NIO

Telsa is the largest stock in the Indxx US Electric and Autonomous Vehicles Index at about 10% of the benchmark as of Decemebr 31, 2022. It’s been a rough several months for the closely watched stock and the latest quarter’s deliveries came in lower than expected. There are lingering worries that CEO Elon Musk is distracted by also holding the reins at Twitter, Inc. (NASDAQ: TWTR), although there are expectations he could soon name a new Twitter CEO. That could be another potential catalyst for Tesla shares.

Tesla is expected to release quarterly earnings after the markets close on January 25. In particular, investors will be looking for any color on Tesla’s recent price cuts and what it means for EV demand amid signs the economy is slowing.

NIO, the second-largest stock in the Indxx US Electric and Autonomous Vehicles Index, is expected to release quarterly results in March. It’s been a long decline for shares of the Chinese luxury EV manufacturer. The stock peaked in early 2021 and is down more than 60% the past 12 months. The question is whether the bad news has already been priced in and if NIO and the broader EV sector are set for a rebound.

When NIO releases quarterly results, investors will be looking for potential improvement from easing Chinese COVID restrictions and supply chain disruptions. Investors will also be looking for details on the five-year comprehensive strategic cooperation agreement with Contemporary Amperex Technology the companies recently announced.

Trading the Bull Case for Electric and Self-Driving Vehicles

Traders looking to play potential upside in the high-growth sector with leverage can do it with Direxion’s Daily Electric and Autonomous Vehicles Bull 2X Shares (EVAV). The ETF is one way to play a recovery in the EV sector and its related industries if upcoming quarterly earnings reports top expectations. The stocks also tend to be highly cyclical, so any improvement in the economic picture could provide a tailwind.

EVAV seeks daily investment results of 200%, before fees and expenses, of the performance of the Indxx US Electric and Autonomous Vehicles Index.

Just Want to Trade Tesla?

Tesla bulls may consider opportunities in Direxion’s Daily TSLA Bull 1.5X Shares (Ticker: TSLL), which seeks to track 150%, before fees and eTesla bulls may consider opportunities in Direxion’s Daily TSLA Bull 1.5X Shares (Ticker: TSLL), which seeks to track 150%, before fees and expenses, of the daily performance of Tesla, Inc. common stock. For traders that are bearish on Tesla’s short-term prospects, Direxion offers a Daily TSLA Bear 1X Shares (Ticker: TSLS), which seeks to track 100% of the inverse (or opposite), before fees and expenses, of the daily performance of Tesla, Inc. common stock.

Originally published 24 January 2023.

For more news, information, and analysis, visit the Leveraged and Inverse Channel.

*Definitions

The Indxx US Electric and Autonomous Vehicles Index is designed to track the performance of companies that are likely to disrupt an existing transportation market and bring new and cleaner modes of transportation such as Electric and Autonomous vehicles.

One cannot directly invest in an index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment.

TSLA Trading Risk — The trading price of TSLA has been highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

Tesla Risk — The future growth and success of Tesla, Inc. are dependent upon consumers’ demand for electric vehicles, and specifically, its vehicles in an automotive industry that is generally competitive, cyclical and volatile. If the market for electric vehicles in general and Tesla, Inc. vehicles does not develop as Tesla, Inc. expects, develops more slowly than it expects, or if demand for its vehicles decreases in our markets or our vehicles compete with each other, the business, prospects, financial condition and operating results of Tesla, Inc. may be harmed. Tesla, Inc. may fail to meet its publicly announced guidelines or other expectations about its business, which could cause the price of TSLA to decline significantly.

Automotive Companies Risk: The automotive industry can be highly cyclical, and companies in the industry may suffer periodic operating losses. Automotive companies can be significantly affected by labor relations, fluctuating component prices and supplier disruptions. Please see the summary and full prospectuses for a more complete description of these and other risks of the Funds.

Direxion Shares ETF Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Derivatives Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investing in electric and autonomous vehicles companies, as well as the information technology, industrial, and consumer discretionary sectors. General risks of electric and autonomous companies include intense competition and rapid product obsolescence, intellectual property loss or impairment, supply chain disruption, regulatory changes, as well as cybersecurity attack risks. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Distributor: Foreside Fund Services, LLC.