With the first quarter of 2021 in the books, financials are looking powerful. Savvy traders can use funds like the Direxion Daily Financial Bull 3X ETF (FAS) to play the short-term momentum.

One catalyst for earnings has been rising yields, which could help fuel consumer finance products like loans. While interest rates are still at historical lows, they have been creeping higher in the latter part of the first quarter.

FAS seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index. The fund invests at least 80% of its net assets in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

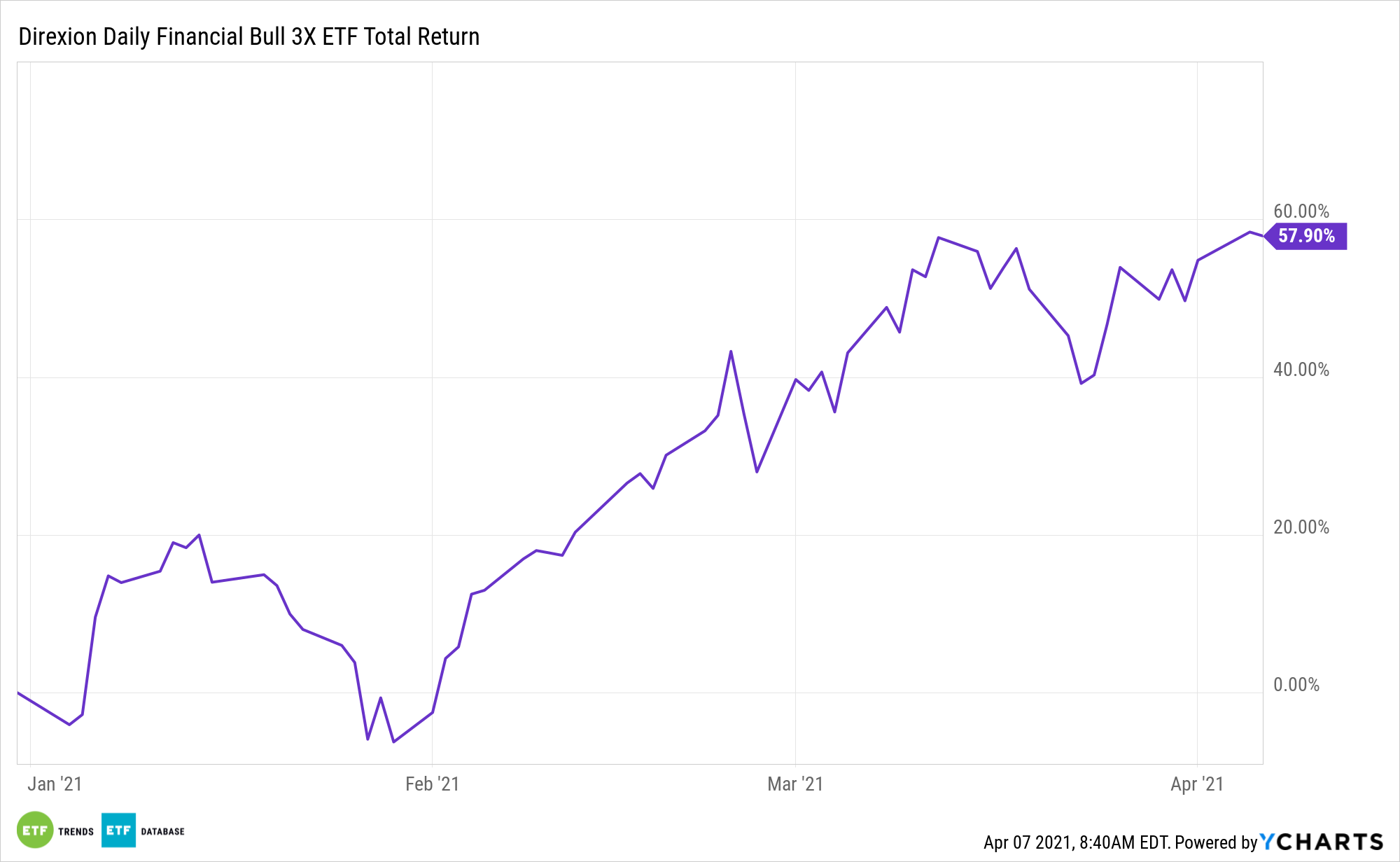

The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market. The fund is up almost 60% year-to-date.

Additionally, FAS is up over 300% the past year. Since November 24 of last year, the fund has risen over 70%.

The day before, November 23, actually marks when the 50-day moving average crossed up the 200-day moving average. Since then, FAS has been trending higher with the relative strength index (RSI) still below the overbought level.

Morgan Stanley Sees Strength in Consumer Finance

Global firm Morgan Stanley is forecasting that consumer finance could be a big winner when earnings results are revealed for the first quarter of 2021. As an FX Empire article published in Nasdaq noted, “consumer finance should be the star of the first-quarter earnings season, which will start hitting the wire the week after next, according to analysts at Morgan Stanley who expect that to light a fire under the stock.”

As a global vaccine continues to roll out, Morgan Stanley sees consumer finance names as a prime play for the reopening trade.

“1Q21 earnings will be full of good news. Our reopening trade stocks best positioned: Synchrony Financial (SYF), Capital One Financial (COF), Alliance Data Systems (ADS). Quarter should come with details on improving consumer spend, larger than expected reserve release and outlook for increasing buybacks. Value rotation a plus too for SEIC,” said Betsy L. Graseck, equity analyst at Morgan Stanley.

For more news and information, visit the Leveraged & Inverse Channel.