Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don’t have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

Investing in the funds involves a high degree of risk. Unlike traditional ETFs, or even other leveraged and/or inverse ETFs, these leveraged and/or inverse single-stock ETFs track the price of a single stock rather than an index, eliminating the benefits of diversification. Leveraged and inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying stock’s performance over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments. The Funds will lose money if the underlying stock’s performance is flat, and it is possible that the Bull Fund will lose money even if the underlying stock’s performance increases, and the Bear Fund will lose money even if the underlying stock’s performance decreases, over a period longer than a single day. An investor could lose the full principal value of his or her investment in a single day. Investing in the Funds is not equivalent to investing directly in NVDA.

Among the “Magnificent Seven,” Nvidia Corporation (Ticker: NVDA) has been one of the most generous for investors and traders in recent years. Since the start of the year, the stock has appreciated over threefold, but has spent the last few months digesting its gains. The question now is whether this sideways price action could be construed as a dip-buying opportunity, or the early-stages of a correction back lower.

The AI Leader

It’s no secret that artificial intelligence (AI) has been the primary driver of growth in the tech space so far in 2023. Nvidia is one of the largest semiconductor manufacturers in the world, and continues to see some of the strongest revenue and earnings growth within the sector compared to its peers.

Nvidia’s niche has been on graphic processing units (GPUs). These were originally designed for computer graphics and image processing, but eventually, they became a keystone component for cryptocurrency mining and generative AI. Hence, the explosion in demand for Nvidia’s chips.

Traders that see sustained growth in these sectors of the economy may maintain a bullish outlook for Nvidia. In such a situation, Direxion’s Daily NVDA Bull 1.5X Shares (Ticker: NVDU) may be an interesting risk trade. NVDU seeks daily investment results, before fees and expenses, of 150% of the performance of the common shares of NVIDIA Corporation (NASDAQ: NVDA).

The next earnings report for Nvidia is set to be released on November 21. Analysts are currently looking at an earnings-per-share (EPS)* of $3.04. If the report comes in above estimates, and guidance remains strong, it could lead to another leg higher in NVDA.

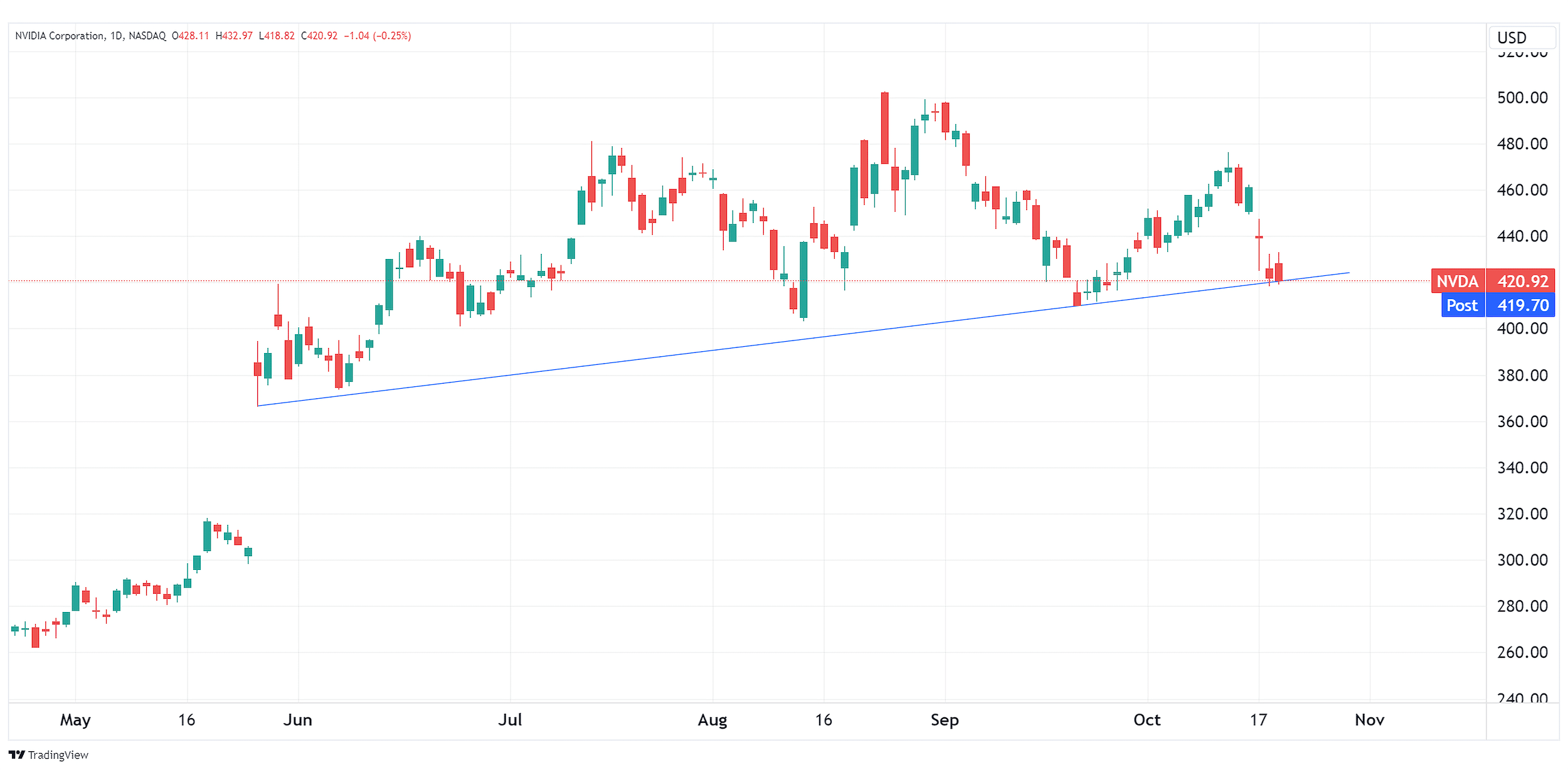

Below is a daily chart of NVDA as of October 19, 2023.

Source: TradingView.com

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results.

Did Regulators Break the Bull Trend?

Despite being a supplier to one of the fastest-growing economic sectors in the world, the Department of Commerce issued a ruling that prevents Nvidia from exporting AI chips to China. Some restrictions were already in effect, but this ruling is seen as more prohibitive.

Management doesn’t think that the new ruling will have a material impact on business results in the immediate term, but they couldn’t rule out whether this will impact future business results.

Traders that think this may be the start of tradable downside opportunities in NVDA can consider Direxion’s Daily NVDA Bear 1X Shares (Ticker: NVDD). The Direxion Daily NVDA Bear 1X Shares (NVDD) seek daily investment results, before fees and expenses, of 100% of the inverse (or opposite), of the performance of the common shares of NVIDIA Corporation (NASDAQ: NVDA).

*Definitions and Index Descriptions

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The Funds have derived all disclosures contained in this document regarding NVIDIA Corporation from publicly available documents. In connection with the offering of each Fund’s securities, neither the Funds, the Trust, nor the Adviser or any of its respective affiliates has participated in the preparation of such documents. Neither the Funds, the Trust nor the Adviser or any of its respective affiliates makes any representation that such publicly available documents or any other publicly available information regarding NVIDIA Corporation is accurate or complete. Furthermore, the Funds cannot give any assurance that all events occurring prior to the date hereof (including events that would affect the accuracy or completeness of the publicly available documents described above) that would affect the trading price of NVIDIA Corporation have been publicly disclosed. Subsequent disclosure of any such events or the disclosure of or failure to disclose material future events concerning NVIDIA Corporation could affect the value of a Fund’s investments with respect to NVIDIA Corporation and therefore the value of the Funds.

Semiconductor Industry Risk – Semiconductor companies may face intense competition, both domestically and internationally, and such competition may have an adverse effect on such companies’ profit margins. Semiconductor companies may have limited product lines, markets, financial resources or personnel. Companies in the semiconductor industry may have products that face obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for qualified personnel.

NVIDIA Corporation Investing Risk — NVIDIA Corporation faces risks associated with meeting the evolving needs of its large markets – gaming, data center, professional visualization and automotive – and identifying new products, services and technologies; competition in its current and target markets; changes in customer demand; supply chain issues; manufacturing delays; potential significant mismatches between supply and demand giving rise to product shortages or excessive inventory; the dependence on third-parties and their technology to manufacture, assemble, test, package or design its products which reduces control over product quantity and quality, manufacturing yields, development, enhancement and product delivery schedules; significant product defects; international operations, including adverse economic conditions; impacts from climate change, including water and energy availability; business investment and acquisitions; system security and data protection breaches, including cyberattacks; business disruptions; a limited number of customers; the ability to attract, retain and motivate executives and key employees; the proper function of its business processes and information systems; impacts from the COVID-19 pandemic; its intellectual property; and other regulatory, and legal issues.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with a Fund concentrating its investments in a particular security, industry, sector, or geographic region which can result in increased volatility. A Fund’s investments in derivatives such as futures contracts and swaps may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments, including imperfect correlations with underlying investments or the Fund’s other portfolio holdings, higher price volatility and lack of availability. As a result, the value of an investment in a Fund may change quickly and without warning. Risks of the Funds include Effects of Compounding and Market Volatility Risk, Leverage Risk, Derivatives Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Correlation Risk, NVIDIA Corporation Investing Risk, Market Risk, Industry Concentration Risk, Cash Transaction Risk, Tax Risk, Indirect Investment Risk, Trading Halt Risk, and risks specific to the technology sector and semiconductor industry. Additional risks include, for the Direxion Daily NVDA Bear 1X Shares, risks related to Shorting. Please see the summary and full prospectuses for a more complete description of these and other risks of the Funds.

Distributor: Foreside Fund Services, LLC.

Originally published 6 November 2023.

For more news, information, and analysis, visit the Leveraged & Inverse Channel.