Investors can run with the rising rate narrative with exchange traded funds like the Direxion Daily Regional Banks Bull 3X Shares (DPST).

Regional banks offer many loan products that can certainly benefit from rising rates. More interest earned on loan products can translate to more revenue for regional banks. With the capital markets wondering whether the economic recovery is overheated, the prevailing sentiment is that the Federal Reserve will eventually have to back off of its dovish stance.

DPST seeks daily investment results equal to 300% of the daily performance of the S&P Regional Banks Select Industry Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

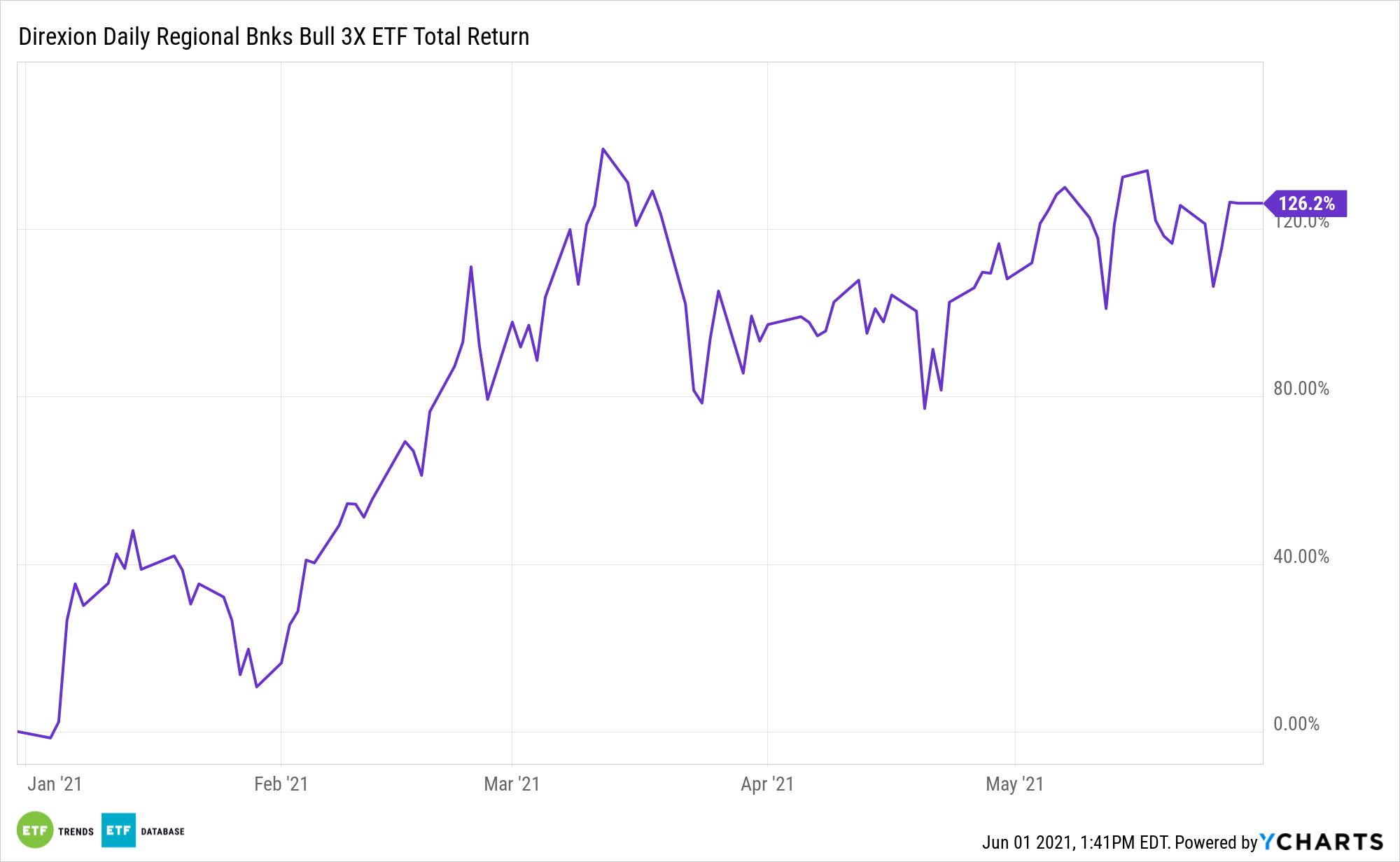

The index is a modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the GICS regional banks sub-industry. DPST is up 126% for the year.

Optimism Prevails Despite Rising Yields

The credit spreads between safe haven government debt and riskier debt are narrowing. As yields continue to rise and provoke inflation fears, equities have been particularly volatile as of late.

However, investors are brimming with optimism as the global economy continues the healing process in 2021. Savvy traders playing the re-opening can make inflation work for them with certain financial sector plays.

“Lenders also gave struggling borrowers a break on some of their monthly loan payments, especially early in the pandemic, which helped prevent widespread defaults,” a Wall Street Journal article noted. “Banks large and small are often viewed as a bellwether for the economy, and right now investors are feeling optimistic.”

And while the Fed hasn’t given a clear cut indication on raising interest rates, market experts are already predicting that the Fed will shift away from its dovish stance.

“While what we’ve heard from [Jerome] Powell remains pretty dovish, the interest rates are expected to continue to move higher,” said Steven Chubak, managing director at Wolfe Research, referring to the Federal Reserve chairman.

For more news and information, visit the Leveraged & Inverse Channel.