In the early going of second quarter earnings, banks have posted strong earnings, which should give the Direxion Daily Financial Bull 3X ETF (FAS) a boost.

“Earnings season is off to a monster start, with companies from PepsiCo to UnitedHealthcare reflecting the ongoing economic reopening in their Q2 numbers,” a Cheddar News article mentioned. “But it was the banks that blew the cover off the ball, thanks to strong consumer spending and a busy dealmaking season on the Street.”

“JPMorgan Chase and Goldman Sachs were among the first to exceed profit expectations for the quarter (JPM more than doubled its profit from the same time a year ago.) Morgan Stanley beat expectations for all three of its investment banking, wealth management, and investment management divisions,” the article added. “Wells Fargo and Citigroup also beat — and yet, the sector traded sideways or lower for most of the week as investors questioned whether the momentum that took the big banks through the worst of the pandemic can last in a post-COVID world.”

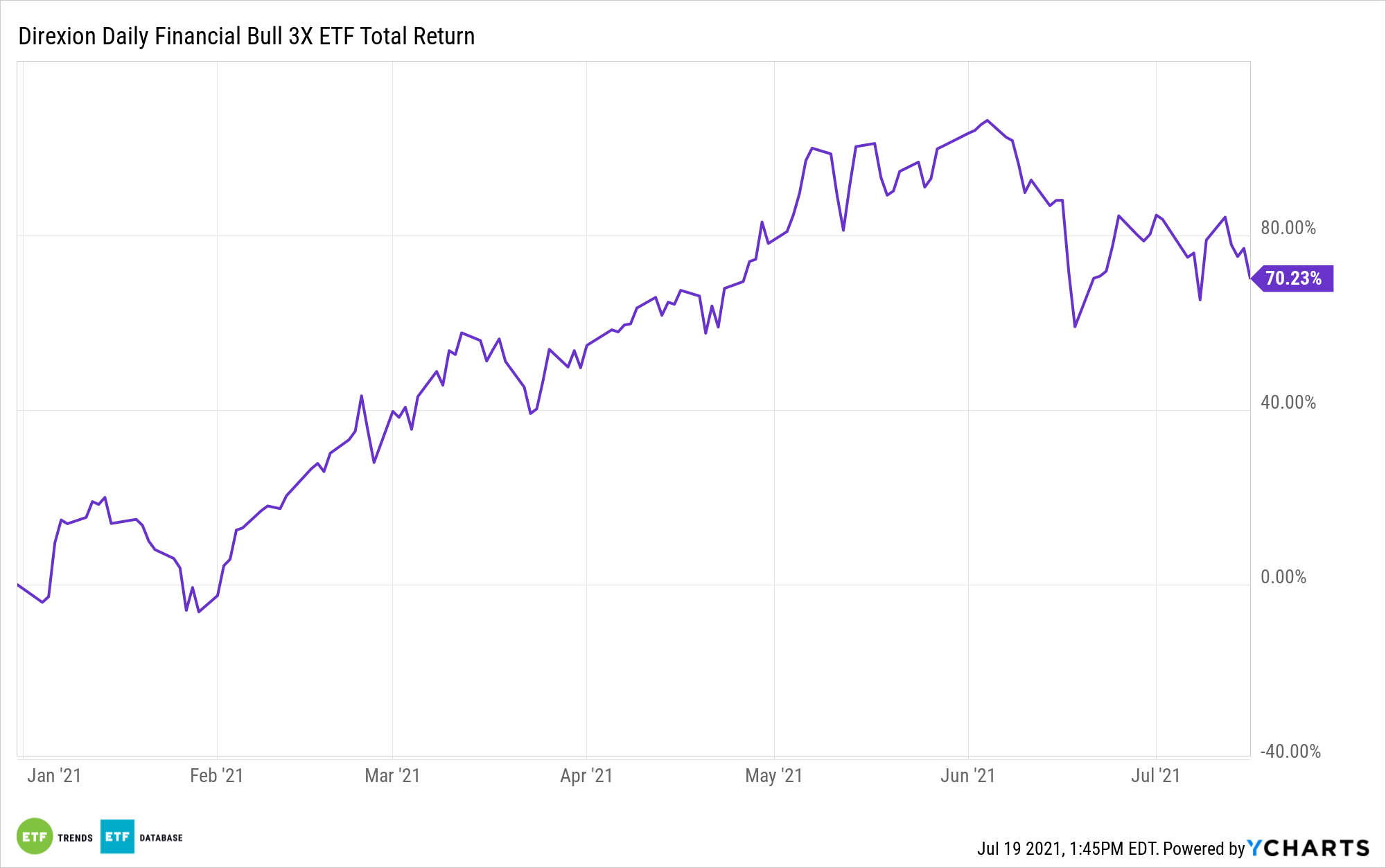

FAS seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index. The fund invests at least 80% of its net assets in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market. FAS is up 70% midway though 2021.

The Bearish Case

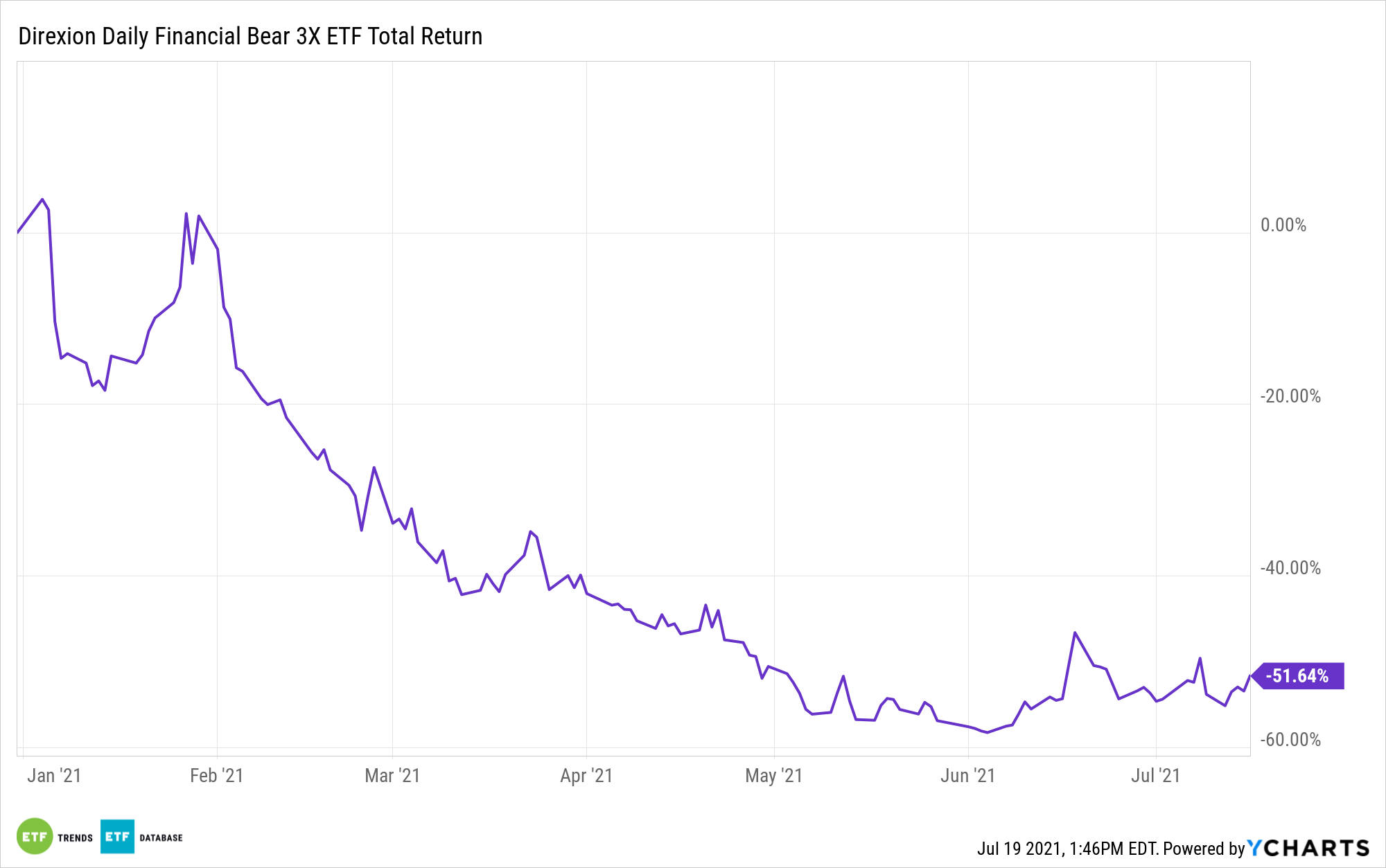

If the Federal Reserve keeps on standing pat on interest rates, this could hold back more revenue from banks that rely on loan products. As such, there’s a bearish case for the Direxion Daily Financial Bear 3X ETF (FAZ).

Taking the opposite side of FAS, FAZ seeks daily investment results that equate to 300% of the inverse (or opposite) of the daily performance of the Russell 1000® Financial Services Index. As mentioned, the index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

For more news and information, visit the Leveraged & Inverse Channel.