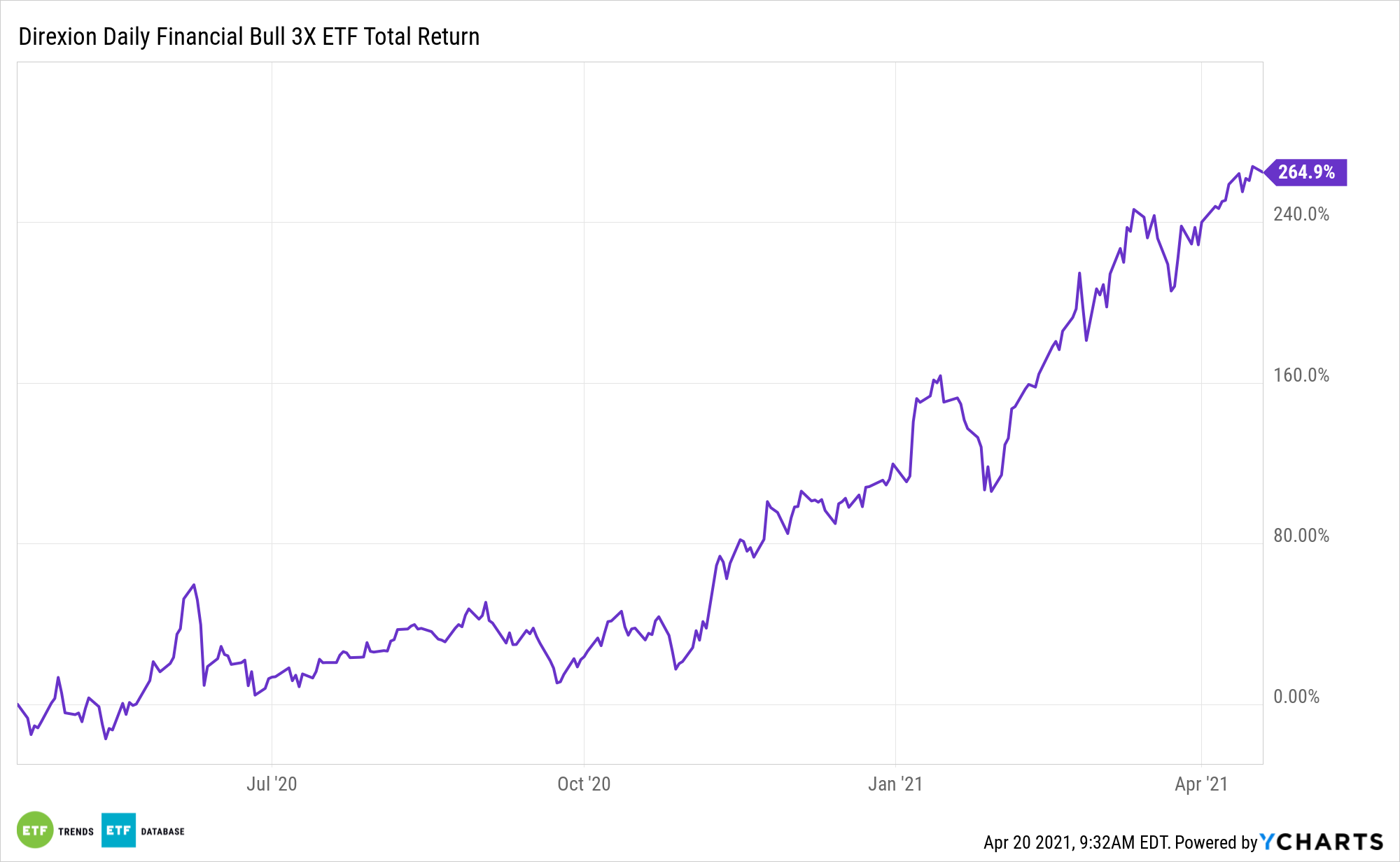

Up close to 70% for the year, the Direxion Daily Financial Bull 3X ETF (FAS) is heading higher thanks to a positive week of bank earnings.

Amongst the prominent holdings of FAS are JP Morgan and Bank of America. Both banks beat Wall Street’s expectations on earnings per share as well as revenue.

JP Morgan results (stock comprises 10% of FAS):

- Earnings: $4.59 per share vs. $3.10 per share expected by analysts.

- Revenue: $33.12 billion vs. $30.52 billion expected.

CNBC TV personality and “Mad Money” host Jim Cramer recently opined on the stock, saying that the JP Morgan stock “is a buying opportunity, plain and simple, and clearly somebody agrees because the stock started rebounding today.”

Bank of America results (stock comprises 6% of FAS):

- Earnings: 86 cents a share, vs. 66 cents a share expected by analysts.

- Revenue: $22.9 billion vs. $22.1 billion expected.

“There was nothing particularly surprising in the quarter itself. Do not despair. If we get a couple of rate hikes, this is the one to own, and we’re going to get them eventually,” Cramer said of BofA’s stock.

FAS seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index. The fund invests at least 80% of its net assets in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

Full Steam Ahead

As Cramer alluded to, one catalyst for earnings has been rising yields, which could help fuel consumer finance products like loans. While interest rates are still at historical lows, they have been creeping higher in the latter part of the first quarter.

While bank stocks aren’t rising meteorically, their short-term performance isn’t indicative of their long-term potential.

“We’ve got one less thing to worry about now that earnings season’s gotten rolling. The banks are doing pretty darned good, even if their stocks don’t necessarily reflect that fact,” added Cramer.

“I am still bullish on the financials, especially the investment banks like ‘Goldman Slacks’ and the turnaround plays like Wells Fargo,” Cramer continued. “After these numbers, the banks have gotten dirt cheap. Believe me, they will not stay that way.”

For more news and information, visit the Leveraged & Inverse Channel.