The ninth annual ETF Investor Study by Charles Schwab & Co., Inc. released today revealed the majority of ETF investors (61%) expect market volatility to increase in the next six months, and close to half (44%) say they will put more money into ETFs as a result.

The survey was completed by 1,500 investors who have bought or sold an ETF within the past two years.

Kari Droller, vice president of third-party mutual fund and ETF platforms at Schwab, told ETF Trends that the study showed real enthusiasm around the adoption of ETFs.

She said that after a decade of market gains, ETF investors now see clouds on the horizon and are planning to use ETFs to help them weather the storm.

“We really have seen that continued enthusiasm in embracing ETFs, particularly with the millennial generation; GenX are not far behind,” Droller told ETF Trends at the Morningstar Investment Conference in Chicago. “With millennials, it’s an investment vehicle they have grown up with and are very comfortable with. Today, the survey showed they have 42% of their portfolio in ETFs and millennials continue to add more.”

Droller attributed exposure as one of the key reasons ETF popularity was increasing.

“We see across all generations, being able to use ETFs for both the core of your portfolio and explore more niche environments – that combination makes the funds really attractive,” she said.

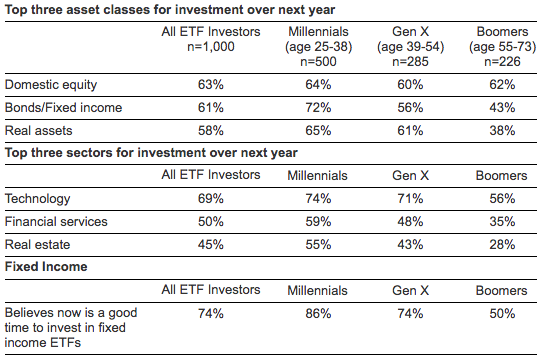

Given enthusiasm surrounding ETFs, Droller said the survey asked investors about ETF asset classes.

“Domestic equity was 63%, followed by fixed income and then real assets after that,” she said. “In looking at sectors, technology popped to the top – about 70% said they were interested – and that sentiment was even higher with millennials at almost 75%.

As investors look ahead at choppier markets, nearly three-quarters of those surveyed say now is a good time to invest in fixed income ETFs.

Volatility and ETFs

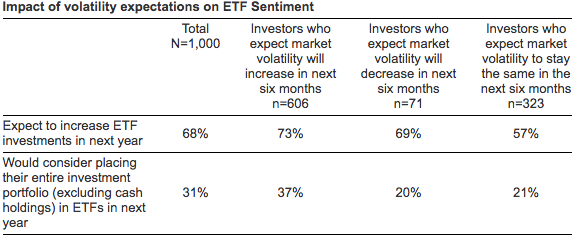

Already, 51 percent of respondents say they’ve increased their allocations to ETFs in the past six months after

increased market volatility, and expectations for volatility are also likely impacting their plans for the coming

year. Among the subset of investors who anticipate increased volatility, 73 percent expect to increase their ETF

investments in the next year and 37 percent would consider placing their entire investment portfolio, excluding

cash, into ETFs in the next year.

ETF enthusiasm continues to grow

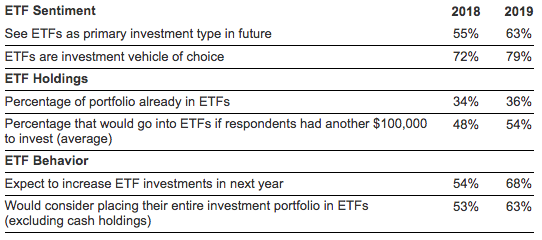

The market environment aside, ETF investors continue to look to ETFs to meet their investing goals. About two- thirds (68%) of all ETF investors surveyed plan to increase ETF investments in the next year, up from 54 percent in 2018. Sixty-three percent expect ETFs to be the primary investment type in their portfolios in the future, up from 55 percent in 2018.

A deeper look by generation: Millennials lead the pack, but don’t count out Gen X

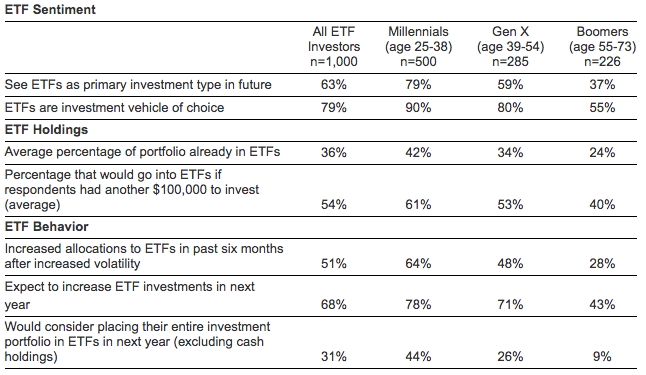

Millennials maintain their position as the most enthusiastic ETF investors by generation, but Gen X is not far behind. Forty-two percent of Millennial portfolios are currently in ETFs, on average, with Gen X portfolios at 34 percent.

Looking to the future, four in five Millennials and three in five Gen Xers expect ETFs to be the primary investment in their portfolios. Millennials are also the most likely to consider placing their entire portfolio in ETFs in the next year (44%), compared to 26 percent of Gen Xers and only 9 percent of Boomers.

A discerning eye: ETF investors care about cost, but that’s not all

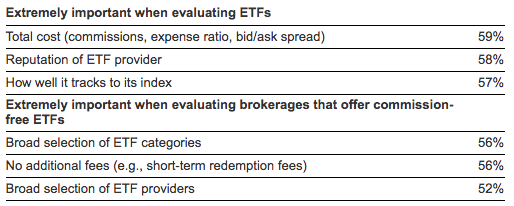

ETF investors say total cost, reputation of the ETF provider and how well an ETF tracks its index are the most important considerations when choosing an ETF. When evaluating brokerages that offer commission-free ETFs, investors look for a broad selection of ETF categories and no additional fees before anything else.

To review the full study, visit https://www.aboutschwab.com/etf-investor-study-2019.