Earlier this month, Kevin O’Leary of O’Shares ETF Investments spearheaded the launch of his new ETF, the O’Shares Global Internet Giants ETF (OGIG).

According to O’Shares, OGIG is a “rules-based ETF designed to provide investors with the means to invest in some of the largest global companies that derive most of their revenue from the Internet and e-commerce sectors that exhibit quality and growth potential.” OGIG focuses on companies that exhibit revenue growth of 20- to 35- percent, “the majority of which you’ve never heard of,” O’Leary said, yet they are “blowing it away on the top line.”

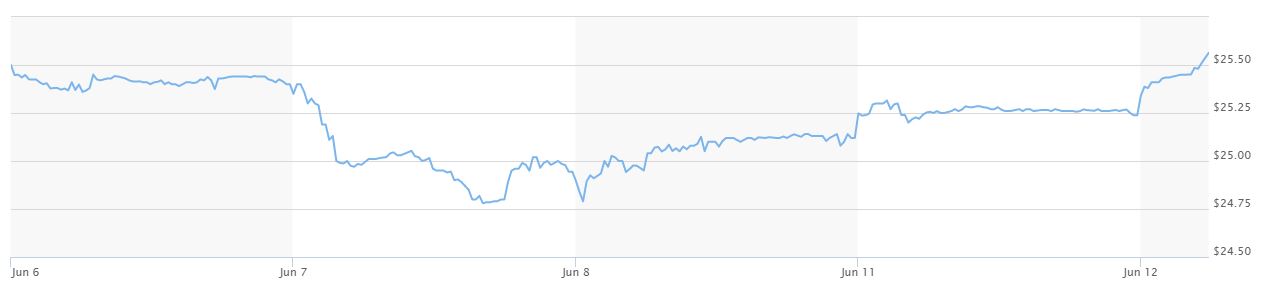

Although it is still far too early to analyze long-term performance of the ETF, its performance since launching has been fairly static. With an initial price (on 6/5/18) of $26.20, OGIG currently sits at $25.49, according to MarketWatch. OGIG has an expense ratio of 0.48%.

O’Shares Global Internet Giants (OGIG) ETF performance:

![]()

Source: MarketWatch

Source: MarketWatch

The Global Internet Giants index portfolio consists of 67 holdings, with some of its top portfolio holdings including companies such as Alibaba, Amazon, Facebook, and Alphabet, each of which represents 6- to 6.5- percent of the overall portfolio. Information Technology takes up about 75.39% of the index, while Consumer Discretionary comprises the rest. Regarding geographical exposure and country allocation, the United States leads the index at 54.79%, with China (31.35%) and the United Kingdom (5.20%) following. The remaining countries (Japan, Canada, Germany, and Argentina) all hold below 3% weight in the fund’s overall composition.

Related – Kevin O’Leary: Singapore Summit Is Woodstock Event

OGIG top 10 holdings:

Source: O’Shares ETF Investments