There was no shortage of economic data released last week. From inflation and consumer spending to housing starts and industrial production, with each release we gained more insight into the overall state of the U.S. economy. In this article, we have chosen three important data points from last week to spotlight – February’s consumer price index (CPI), February’s producer price index (PPI), and February’s retail sales. These indicators are closely watched by policymakers and advisors trying to understand the direction of interest rates because the data can have a significant impact on financial markets and business decisions.

Consumer Price Index (CPI)

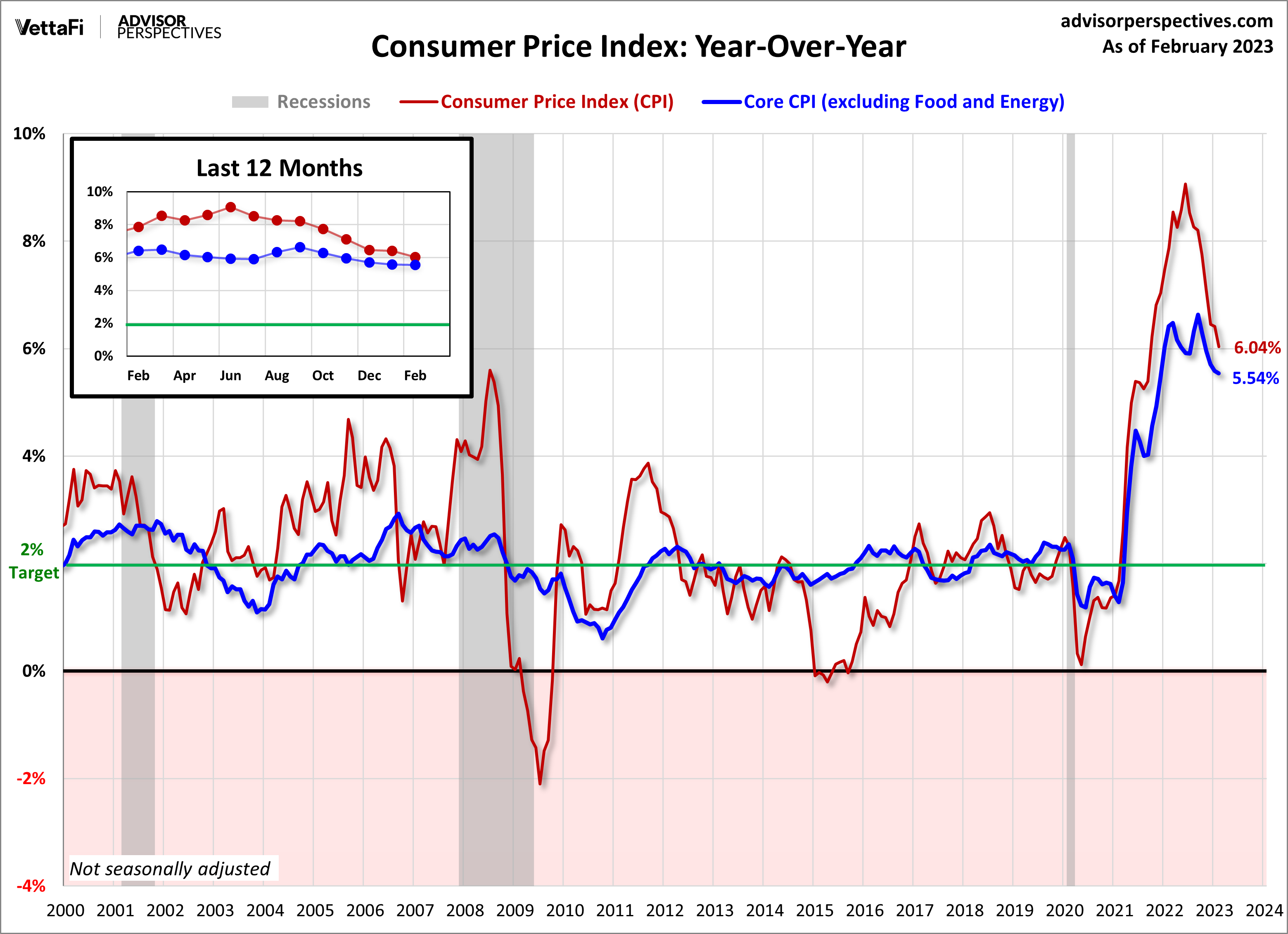

The consumer price index (CPI) came in as expected for February with a 6.0% increase in prices compared to a year ago, down from 6.4% in January. Inflation has fallen for eight consecutive months on an annual rate and is at its lowest level since September 2021. Core CPI (excluding food and energy) also came in as expected with a 5.5% year-over-year increase, down from 5.6% in January and at its lowest level since December 2021. While inflation looks to be cooling off, the latest numbers are still well above the Fed’s 2% target rate. Every month, prices were also in line with expectations as they rose 0.4% from last month, a cooldown from January’s 0.5% increase. Taking away food and energy, monthly prices increased by 0.5% from last month. This is slightly higher than expected (Investing.com forecast was 0.4%) and an increase from January’s reading of 0.4%, a reminder that inflation is still high.

Read more about the latest consumer price index report by clicking here.

Producer Price Index (PPI)

The producer price index (PPI) for February revealed an unexpected fall in wholesale prices of 0.1% compared with a 0.3% gain the previous month. On an annual level, prices rose by 4.6%, the lowest 12-month increase since March 2021. Expectations were for PPI to rise 0.3% from last month and 5.4% over the year. Core PPI (excluding food and energy) was flat with a 0.0% monthly change and a 4.4% increase compared to the same time last year. Again, both monthly and annual rates came in lower than anticipated with month-over-month expectations at 0.4% and year-over-year expectations at 5.2%. PPI is thought to be a leading indicator of consumer inflation because producers pass along their price shifts to the consumer level.

Read more about the latest producer price index report by clicking here.

Retail Sales

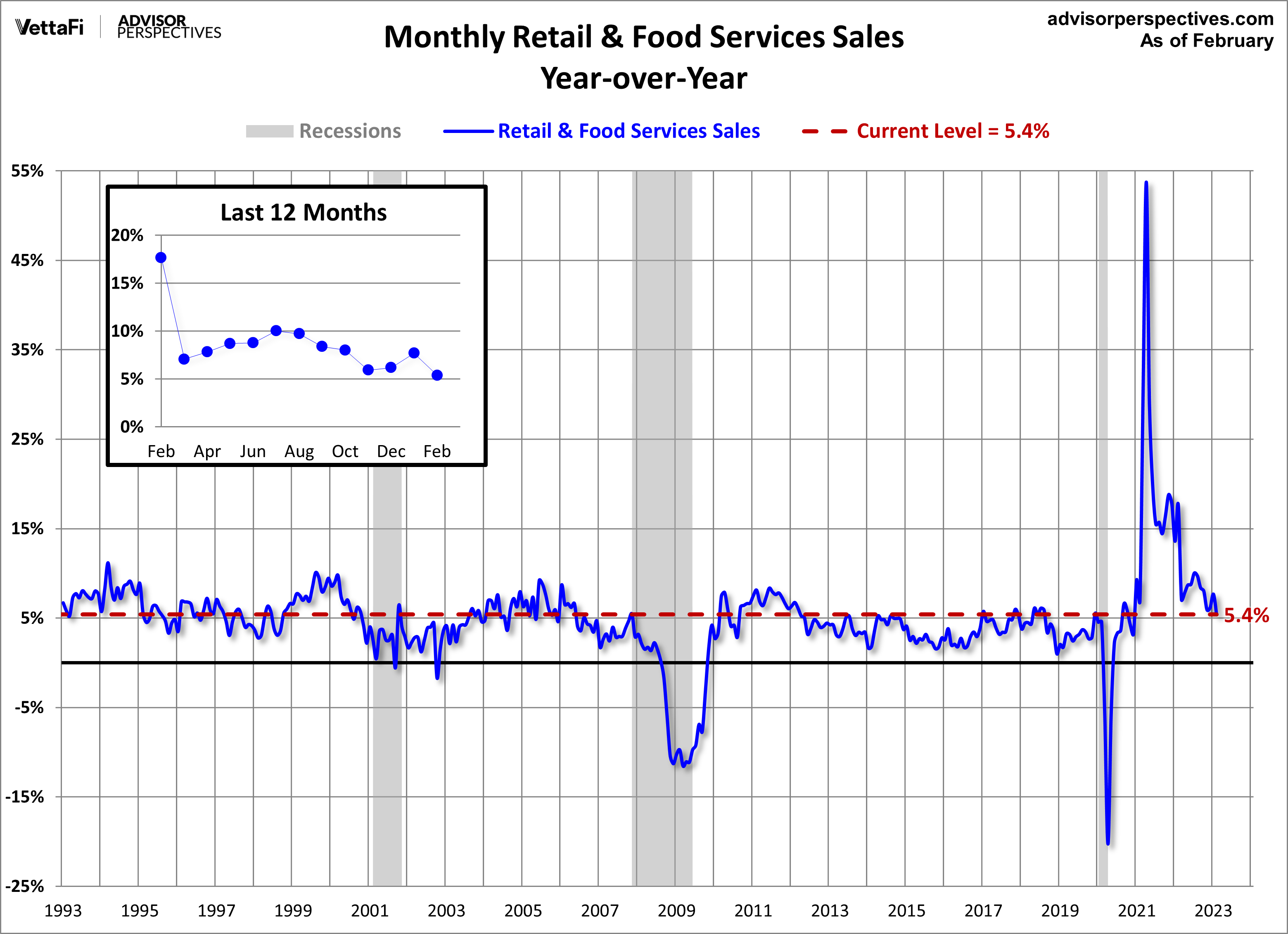

Consumer spending dipped by 0.4% in February after heavy spending in January. This marks the third monthly pullback in spending in the last four months, evidence that consumer spending is being challenged by high inflation. Spending was up 5.4% compared with February 2022, the smallest 12-month increase since December 2020. Core retail sales (excluding automobiles) were down 0.1% from last month, consistent with the forecast, however control purchases, thought to be an even more “core” view of retail sales, were up more than expected with a 0.5% increase from last month (Investing.com forecast was 0.3%).

Read more about the latest retail sales report by clicking here.

This week, keep an eye out for February data releases of existing home sales, new home sales, and new orders for durable goods. Such data will reveal more insight into housing market trends and whether businesses continue to cut back on spending for their big-ticket items. Existing home sales are expected to come in higher at 4.17 million, a 2% increase from January. New home sales are expected to come in lower at 650,000, a 3% decline from January. Residential home sales for both new and existing homes will impact interest in the iShares Residential and Multisector Real Estate ETF (REZ) and SPDR S&P Homebuilders ETF (XHB). New orders for durable goods are expected to inch up by 0.6% from January.

For more news, information, and analysis, visit VettaFi | ETF Trends.