A handful of key economic data points were released last week that provided insight into the overall health of the U.S. economy. From the housing market to business conditions and spending, each report acts as a key piece to the broader economic puzzle. In this article, we have chosen three of the most significant economic releases from the past week to take a deeper look at – existing home sales, new home sales, and new orders for durable goods. These indicators are closely watched by policymakers and advisors trying to understand the direction of interest rates because the data can have a significant impact on financial markets and business decisions. The Federal Reserve raised rates by 25 basis points on March 22nd to 4.75% and 5%, but rate hikes could soon end.

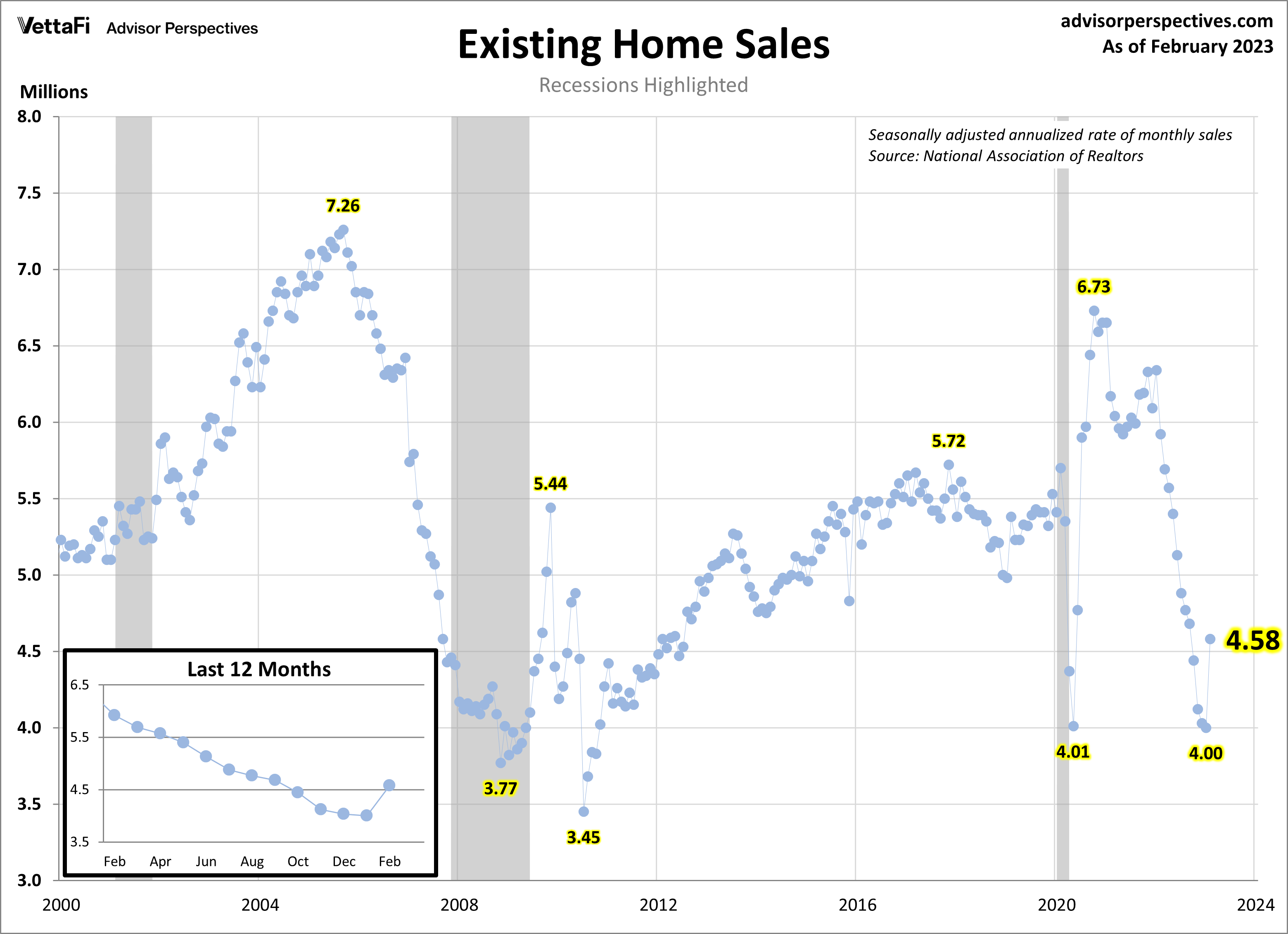

Existing Home Sales

Existing home sales in February surged by 14.5% from January to a seasonally adjusted annual rate of 4.58 million units, exceeding expectations of a 5% growth month-over-month. This is the first monthly increase in a year and the largest since July 2020. However, sales are down 22.6% compared to one year ago. Additionally, the median price for existing homes fell by 0.2% from February of last year to $363,000, marking the first yearly decline in over a decade. Home prices have been pushed down since last summer by high mortgage rates so when homebuyers saw a dip in mortgage rates in December and January, they took full advantage leading to this month’s sizeable uptick.

Read more about the latest existing home sales by clicking here.

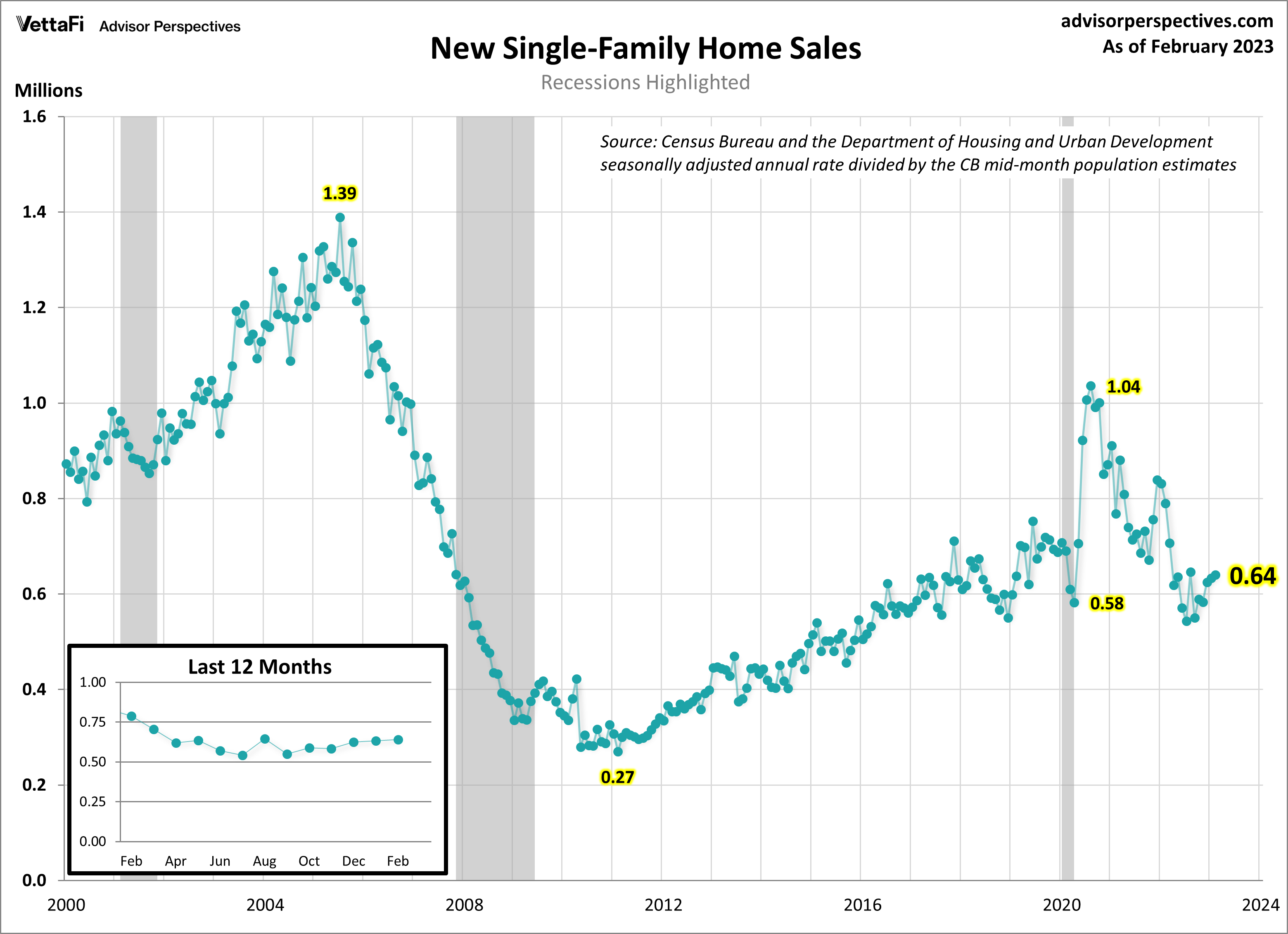

New Home Sales

New home sales in February inched up by 1.1% to a seasonally adjusted annual rate of 640,000 units (the Investing.com forecast was 650,000 units). The uptick in new home sales, despite being slightly below forecasted numbers, may be a sign that the housing market is beginning to stabilize. With mortgage rates still coming down from their highs of last year and low inventory available on existing homes, homebuyers are shifting more of their attention towards new construction. This is evidenced by new home sales growing each of the last three months and reaching their highest level in the last six months. With that being said, February’s sales are still 19.0% below what they were a year ago. The latest report also revealed that the median price for a new home rose to $438,200 in February, up 2.7% from last month and up 2.5% from February of last year.

Read more about the latest new home sales by clicking here.

Residential home sales for both new and existing homes will impact interest in the iShares Residential and Multisector Real Estate ETF (REZ) and SPDR S&P Homebuilders ETF (XHB).

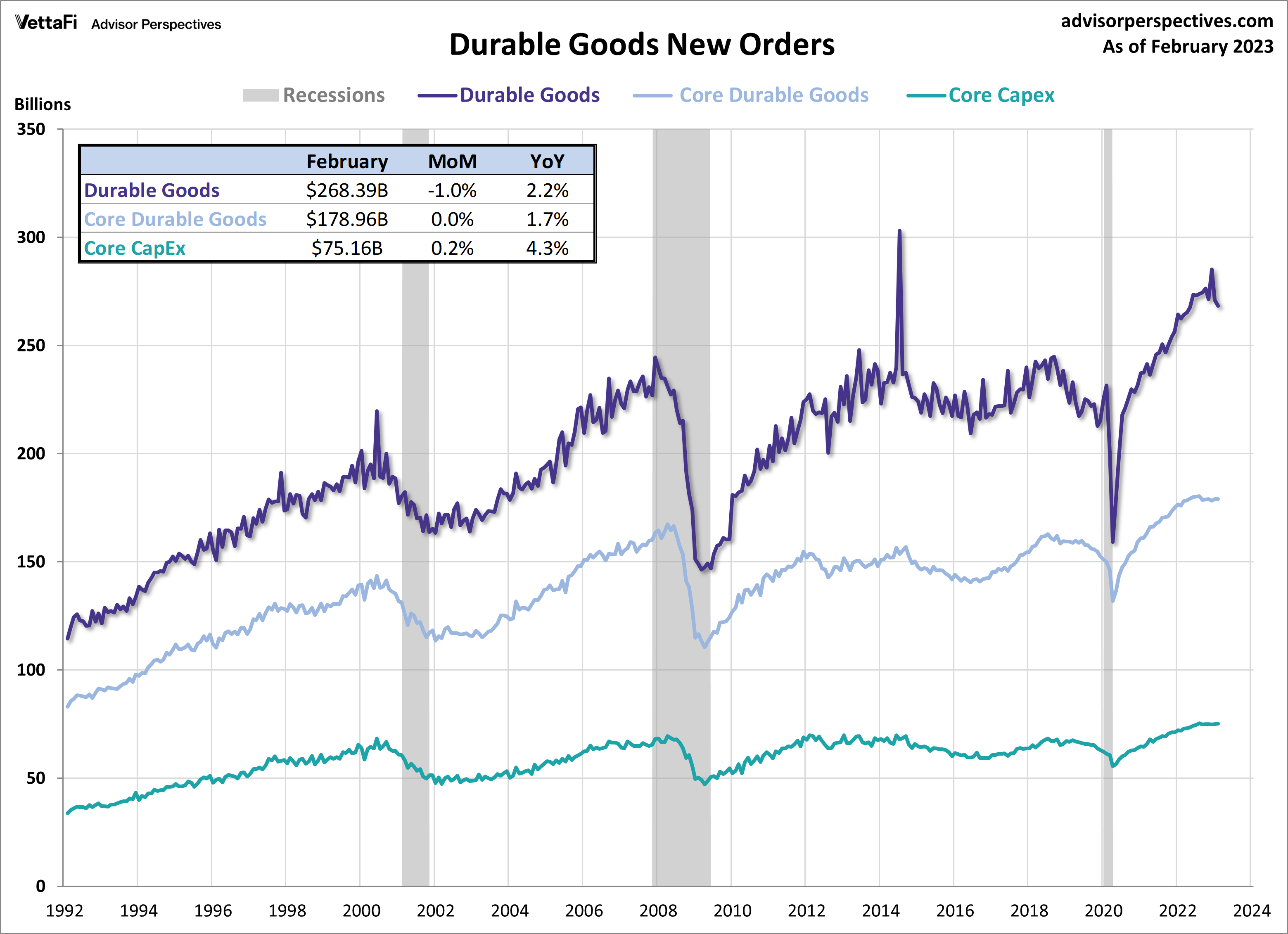

Durable Goods

New orders for durable goods unexpectedly declined in February, but core capital goods (capex) orders continued to show strength, a sign that the industrial side of the economy is still growing. In February, new orders for durable goods dropped by 1.0% to $268.4 billion, falling short of the Investing.com estimate for a 0.6% monthly increase. Although “core” durable goods were practically unchanged from last month, this was also below expectations of a 0.2% monthly increase. These broader figures measure the demand for longer-lasting products by both consumers and businesses, however new orders for core capital goods (capex) focus specifically on business investments. Despite the decline in durable goods, businesses continued to increase their spending on big-ticket items for the second straight month, as February saw a 0.2% increase in new orders for core capex.

Read more about the latest new orders on durable goods by clicking here.

This week, be on the lookout for the highly anticipated 2022 Q4 GDP third estimate, February’s data on the personal consumption expenditures (PCE) index, and March’s reading of the Conference Board’s Consumer Confidence Index®. Such data will reveal if the economy’s growth is continuing to slow down, whether consumer spending persisted from an unexpected spending spree in January, and how consumers are feeling towards the overall state of the economy. The 2022 Q4 third estimate is forecasted to come in at 2.7%, unchanged from the Q4 second estimate and down from the 2022 Q3 third estimate of 3.2%. The core PCE price index (excluding food and energy) is expected to come in at 4.7% year-over-year, unchanged from last month, and 0.4% month-over-month, slightly lower than last month’s 0.6% increase. The Conference Board’s Consumer Confidence Index® is predicted to decline for a third straight month in March to 100.5, down from 102.9 in February.

For more news, information, and analysis, visit VettaFi | ETF Trends.