By Chris Konstantinos, CFA, RiverFront Investment Group

With the upcoming Italian parliamentary elections set for March 4, Italy’s fragile political system may create uncertainty about the country’s future and its place in the Eurozone. We think economic momentum in both Italy and across Europe means that the elections are not a major risk factor for the Eurozone… but this is not to say that March will lack for drama or complexity.

taly’s importance here has less to do with its size within European stock indices (which is suprisingly small at only ~4% of MSCI Europe*), but rather its position as the current weak link in the Euro area political chain. Investors should prepare themselves for increasing headlines surrounding the potential for anti-Euro parties to gain a majority in Italy as we move towards March. The anti-establishment Five Star Movement (M5S) is now the country’s most popular party according to recent polls. While we find it unlikely that M5S could govern as a majority given Italy’s complex parliamentary system (more on this later), it’s possible they could offer their support to other Euroskeptic parties such as the anti-immigration Northern League and the center-right Forza Italia, headed by once-disgraced former prime minister Silvio Berlusconi (did we mention Italy’s politics are bewildering?). This event could, as the theory goes, result in a Brexit-like referendum in Italy on Eurozone membership.

We note that despite similar uncertainty associated with UK, Spanish, German and French politics over the past 18 months, European stocks and the Euro currency have been able to break out to the upside, as both the economy and corporate earnings have continued to positively surprise. Will Italy be the political straw that breaks the Eurozone’s proverbial back in 2018? We think not, for a number of reasons.

![]()

First, most Italian voters want to remain in the Euro: according to the November Eurobarometer poll, over 65% of Italian voters support the Euro (excluding undecided votes). We suspect that issues surrounding immigration and taxation are actually more crucial for Italian voters than Euro area membership. Politicians have implicitly acknowledged this in recent months, with key members of both M5S and Forza Italia backing down from threats to subject Italy to a referendum on Euro membership.

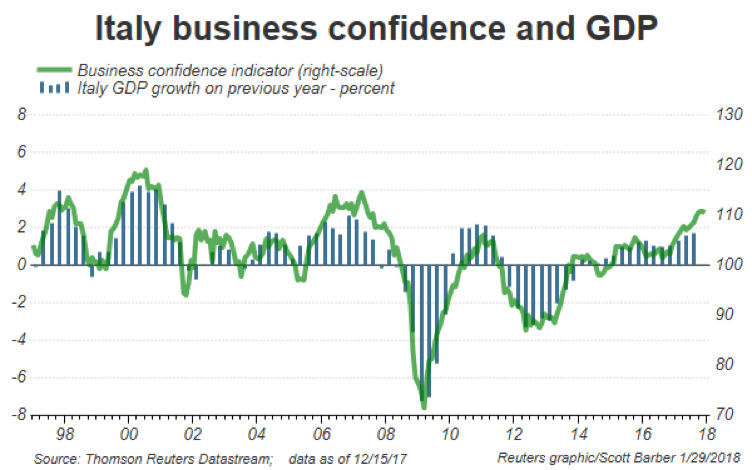

We also believe that, as Italy’s economy continues to rebound, the appeal of an anti-establishment party like M5S will begin to wane. Despite unemployment above 11%, job creation is starting to get back on track in Italy. Indicators of Italian business and consumer confidence, manufacturing output and non-performing loans in the banking system are all improving significantly, contributing to the rebound in Italian GDP (see chart, right). We think all of this dampens the appeal of a vote to leave the Euro, which would immediately plunge the country back into the type of deep economic uncertainty that they have just now started to emerge from after the devastating double-digit recession from 2009-2015.

Lastly, it’s important to note that, pragmatically, it would be problematic to actually hold an Italian referendum on Euro area membership. The reason is simple; the Italian constitution doesn’t allow referendums on international treaties. The country instead would first have to hold a referendum on changing the Italian constitution. Lawmakers in Italy might look to the ongoing political legitimacy issues that UK Prime Minister Theresa May is experiencing with regards to Brexit, and think twice before subjecting Italy to a similarly polarizing and disruptive event.

WHAT WILL HAPPEN IN MARCH? HUNG PARLIAMENT THE MOST LIKELY RESULT, IN OUR VIEW

The complicated nature of Italy’s new electoral law – known as ‘Rosatellum bis’, a combination of a majoritarian and proportional representation – would make it very difficult for any one party to gain majority. While this certainly doesn’t preclude any number of Eurosceptic parties from forming a coalition government, the hostility of M5S toward other parties probably makes a coalition with M5S less likely, in our opinion. At the time of this writing, support still appears pretty evenly split between a more centrist partly like the Democratic Party (PD), M5S, and some sort of center-right coalition of Forza Italia, National League and possibly others. At this point, the highest probability outcome in March still seems to us to be a ‘hung parliament’ – no obvious majority – followed by months of coalition talks and political posturing. What will be the eventual outcome of all this? Our best guess at this point is most likely a fragile coalition between the center-left and center-right parties.

WHAT WILL HAPPEN IN MARCH? HUNG PARLIAMENT THE MOST LIKELY RESULT, IN OUR VIEW

The complicated nature of Italy’s new electoral law – known as ‘Rosatellum bis’, a combination of a majoritarian and proportional representation – would make it very difficult for any one party to gain majority. While this certainly doesn’t preclude any number of Eurosceptic parties from forming a coalition government, the hostility of M5S toward other parties probably makes a coalition with M5S less likely, in our opinion. At the time of this writing, support still appears pretty evenly split between a more centrist partly like the Democratic Party (PD), M5S, and some sort of center-right coalition of Forza Italia, National League and possibly others. At this point, the highest probability outcome in March still seems to us to be a ‘hung parliament’ – no obvious majority – followed by months of coalition talks and political posturing. What will be the eventual outcome of all this? Our best guess at this point is most likely a fragile coalition between the center-left and center-right parties. While a hung parliament and subsequent political gridlock is hardly the best-case outcome for a country struggling to enact lasting reforms, this result does not mean economic disaster for either Italy nor, more importantly, does it mean the dissolution of the Eurozone. Recall that Italy is a country that has learned how to muddle along through chronic political instability – 65 governments in 71 years, by some counts.

RIVERFRONT RISK MANAGEMENT IN THE AGE OF POLITICAL RISK

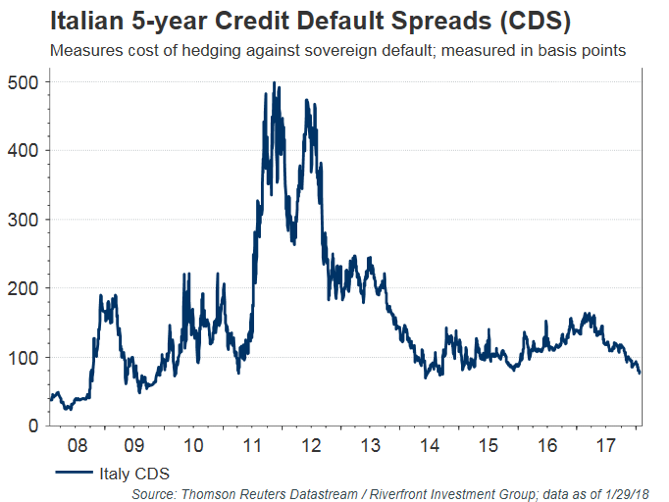

Interestingly enough, neither a major monitor of Italy sovereign risk – Italian credit default spreads (CDS) – nor one of a Eurozone breakup risk – like the EUR/USD currency cross – are indicating heightened risk at this time. In fact, we’d argue just the opposite: Italian CDS spreads are near multi-year lows (see chart below), suggesting the cost to hedge sovereign default is increasingly cheap, and the EUR/USD cross just broke out to a new multi-year high on Thursday at around 1.25. While both are encouraging, we also acknowledge it may suggest some level of complacency around European risks. We will continue to monitor fundamental and technical risk indicators closely and will consider action if our process suggests it.