Investors starved for yield since the great financial crisis can now have it merely by holding cash reserves. At least for now (as of November 8), the U.S. three-month Treasury Bill was yielding 5.4%, up from 0.50% at the end of 2021 and 4.4% at the end of last year. But they may not have it for long, with Los Angeles bond house DoubleLine casting doubt on the “T-Bill-and-chill” strategy.

Questioning ‘T-Bill and Chill’

Firm founder Jeffrey Gundlach has said in recent interviews that a recession, which he’s forecasting during 2024, could cause the Federal Reserve to drop rates enough to make the strategy of holding cash reserves or rolling three-month bills less attractive than locking up money in two-year or three-year instruments.

Gundlach posted on the platform X on November 3 that in discussing “T-bill and chill,” he did not recommend the strategy. Rather, he said he favored “mid-to-high quality 2-3 years credit (yields of 7-8%) combined with intermediate-to-long term Treasuries.”

ETF Trends caught up with DoubleLine’s Ken Shinoda, who confirmed the firm’s views, saying “the market seems to be agreeing with us either that the Fed sometime next year cuts either because it’s reached its goal or because there’s some type of recession or they just don’t need to be so restrictive.”

Shinoda continued, “Investors [may wind up saying]‘Oh I should have bought some of those 2-3 year bonds,’ [which are]the cheapest we’ve seen on an absolute yield basis in over a decade.”

Shinoda co-manages the firm’s flagship DoubleLine Total Return Bond Fund (DBLTX) with Gundlach and Andrew Hsu. He also manages DoubleLine’s more credit-aggressive DoubleLine Income Fund (DBLIX) with Hsu and Morris Chen, and the DoubleLine Mortgage ETF (DMBS) with Gundlach. (More on the ETF and mortgages later.)

Indeed, bonds have had a blistering run since November 1’s Fed meeting, with the yield on the U.S. 10-year Treasury retreating to 4.5% from 4.9%. For the five trading days since, and including, last Wednesday, the iShares 20+ Year Treasury Bond ETF (TLT), which many investors use to track the performance of the long end of the U.S. Treasury yield curve, has rallied more than 5.6%.

DoubleLine’s Gundlach on Curve Considerations

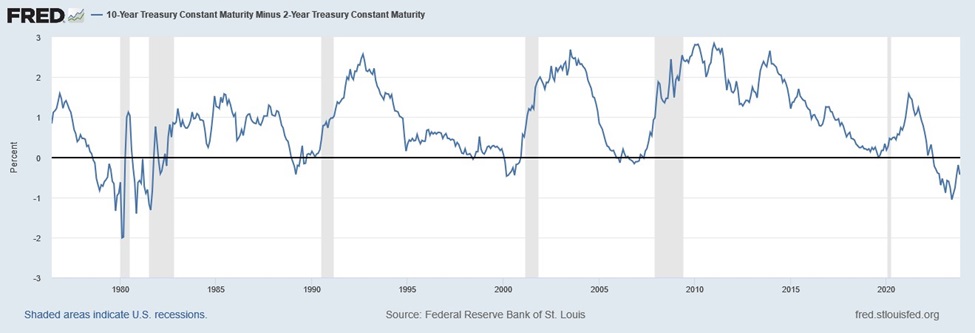

Another way in which the market potentially is agreeing with DoubleLine’s views is the de-inversion of the yield curve, which Gundlach has mentioned in recent webcasts and interviews.

An inverted yield curve (longer rates less than shorter rates) famously has forecast every recession since 1950. But, as Gundlach has emphasized, the recessions have come typically after an inverted curve begins to de-invert and rectify itself.

A look at the longer-term difference in yields between the U.S. 10-year and two-year Treasuries confirms Gundlach’s observations regarding inversion, de-inversion, and recession.

The most recent inversion began in early July 2022, and appears to have reached its most extreme points (two-year yielding more than 10-year) this past March and June.

Fund Options – Something for Everyone

Shinoda mentioned the DoubleLine Low Duration Bond Fund (DBLSX) as an example of a diversified fund with solid yield that won’t be as sensitive to falling rates as a T-bill.

The fund’s SEC 30-day yield is 5.54%, according to the firm’s website on November 8. It has 23.4% of its assets in government bonds, 16.4% in CLOs (securitizations of bank loans), 13.8% in nonagency commercial mortgage-backed securities (CMBS), and another 13% in nonagency residential mortgage-backed securities (RMBS).

The rest is in investment-grade corporates, emerging market bonds, and other asset-backed securities including agency CMBS and RMBS.

“There’s some risk” to these securities compared to U.S. Treasuries, Shinoda noted, though he thinks “the risk is limited.”

There are also tax issues since interest from U.S. Treasuries is tax-free at the state level.

Shinoda also understands the attractiveness of the “T-bill and chill” strategy. “I’m doing it; we’re all doing it – [holding some money in cash reserves]. But to the extent you have some [extra]liquidity, it’s a pretty good time [to allocate to somewhat longer-term bonds with some extra credit risk], and it probably won’t get better than this.”

For those who don’t want to take credit risk, “even 2-year Treasuries [are attractive]” to Shinoda. He didn’t mention products that compete with DoubleLine, but a possibility for investors who are averse to credit risk would be the iShares 1-3 Year Treasury Bond ETF (SHY).

“There’s something for everyone,” he said, though he prefers a diversified approach.

Highlighting Mortgages

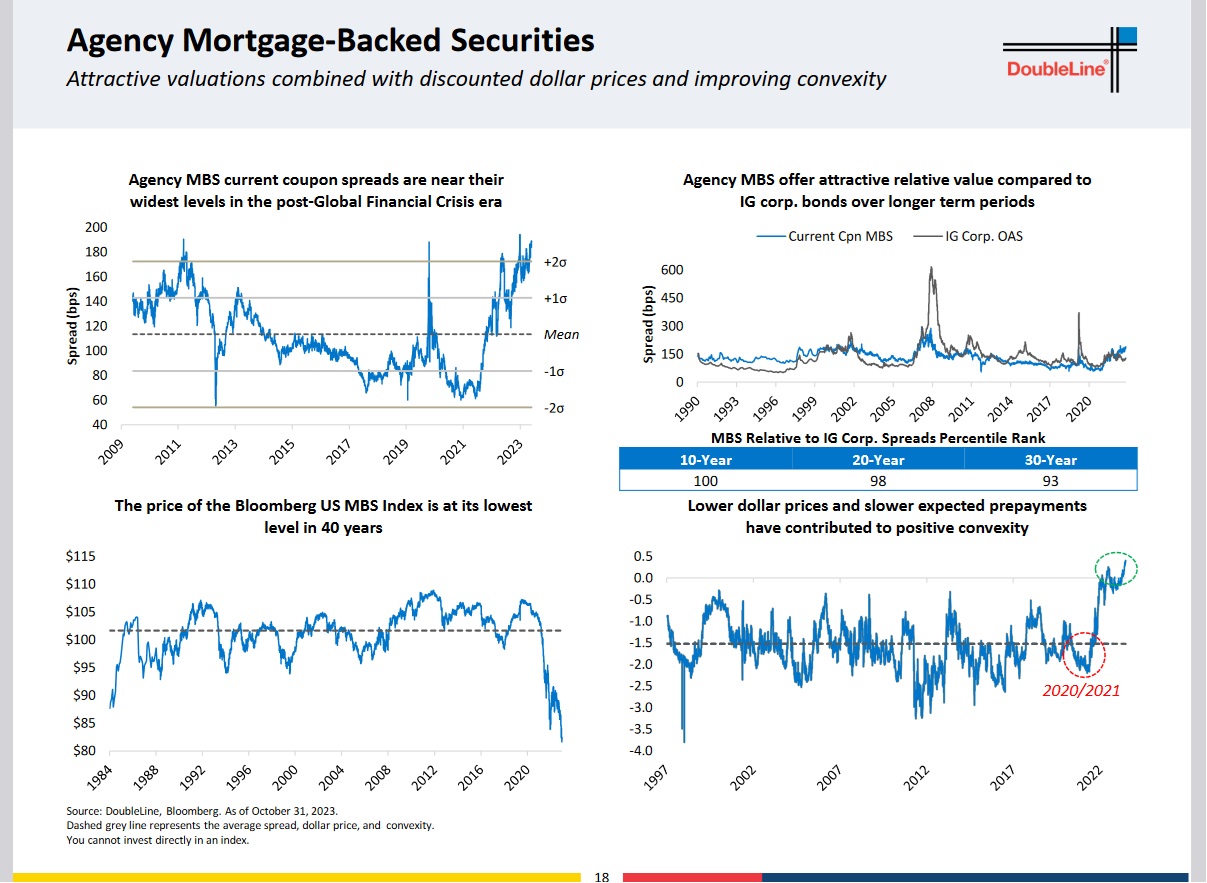

One reason for preferring that approach is that agency mortgage spreads are near their historic widest points. Shinoda puts that down to the Federal Reserve ending quantitative easing and struggling banks having exited the market as buyers.

“The bulk of the index is comprised of loans made in 2020-2021 at 3%-4% and packaged into 2%-3% coupon bonds. Those things have gotten crushed, getting down to around 73 cents on the dollar [at their worst],” said Shinoda.

An extra risk that mortgage-backed bonds typically carry is prepayment risk – the problem of borrowers refinancing their loans for lower rates. But that risk is minimal now with interest rates and mortgage rates having shot up since the start of 2022. “Rates could fall hundreds of basis points and much of the mortgage universe has zero refinance incentive,” said Shinoda.

Mortgage spreads can stay wide, he allowed, but mortgage-backed bonds typically hold up relatively well when stocks and corporate bonds are struggling. And DoubleLine views credit problems or a sluggish economy as the greater current threat to bonds than interest rate risk stemming from a strong economy.

DoubleLine’s Mortgage ETFs

Besides DoubleLine’s traditional mutual funds, including the Total Return fund with 75% of its assets in mortgages (agency and nonagency), the firm has two recently-issued ETFs dedicated to mortgages.

The DoubleLine Commercial Real Estate ETF (DCMB) is the riskier of the two from a credit standpoint, with nearly 79% of its assets in nonagency CMBS and almost all the rest in agency CMBS. Still, around 97% of the fund’s assets are rated AAA, and its interest rate risk is relatively low, with a duration of 0.94 years.

By contrast, DoubleLine’s DMBS has nearly 82% of its assets in agency RMBS and almost all of the rest in nonagency RMBS. This fund’s duration is longer than its sibling’s, at 5.7 years.

Cash may look great right now, but investors have to decide if holding copious amounts of it is skating to where the puck is instead of skating to where it will be.

For more news, information, and analysis, visit VettaFi | ETF Trends.