By Gargi Pai Chaudhuri

- We believe this latest Fed hike may be the last hike of the current cycle.

- A slowing economy, moderating inflation and stress in the banking system support a Fed pause. But we expect the Fed to keep rates at current levels for an extended period as inflation remains well above its 2% target.

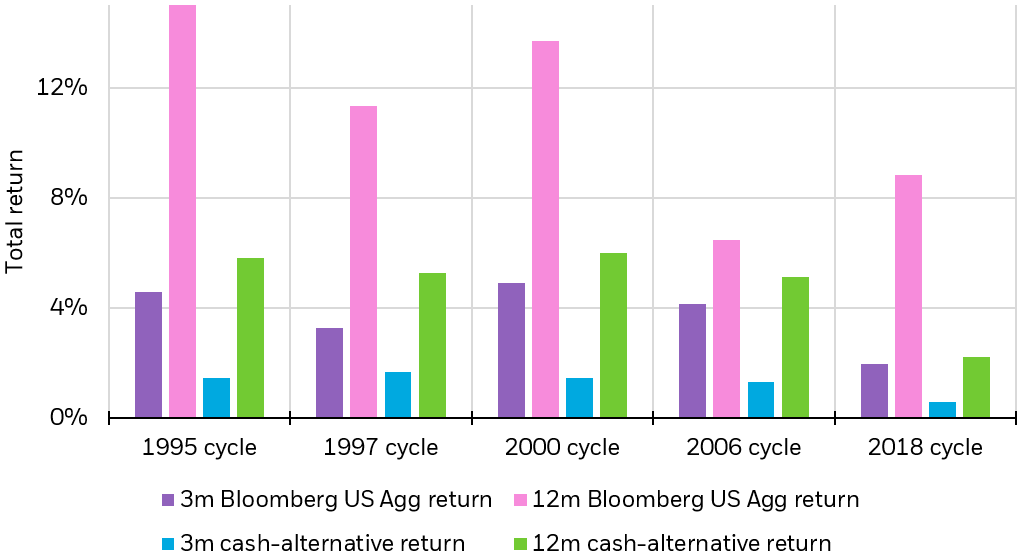

- History suggests investors may be rewarded when stepping out of cash and moving into investment grade fixed income and equity exposures when the fed stops raising rates.

As broadly expected, the Federal Reserve raised the policy rate by 25 basis points (0.25%) at its May 3 meeting. While the Fed did not commit to a pause, markets are overwhelmingly convinced — barring a dramatic change in the economic data or an exogenous shock – that this latest hike was the last hike of the cycle. From the statement, we now know the Committee no longer sees that “some additional policy firming” is needed. This is not the first time that the market has concluded that the Fed was set to ease and up until this point we have stubbornly argued the notion that the Fed had would keep hiking to counter high and persistent inflation. This time, however, we find ourselves broadly in agreement that the time for the pause has finally arrived.

3 REASONS THE FED IS LIKELY TO PAUSE

Here are three reasons we think this time is different, and the Fed will pause its tightening cycle:

- Recent data suggest growth has slowed and inflation has moderated. While price pressures have not eased enough to justify rate cuts, a pause at current levels no longer seems unreasonable;

- Policy rates have finally risen to levels consistent with Federal Reserve guidance. A 25 basis point hike at the May FOMC brings the policy rate range to 5.00–5.25%, squarely in line with the median 2023 “dot plot” in the FOMC’s latest Summary of Economic Projections; and

- Banking system stress has tightened financial conditions. Tighter bank lending standards can obviate the need for further policy rate hikes.

Importantly, a Fed Pause is not the same as a Fed Pivot.

A pause is a period where the Fed keeps rates “higher” and monitors the development of the economy and inflation. In the five previous hiking cycles since 1990, the Fed paused an average of 10 months between its last hike and its first cut (Figure 1). Even though this hiking cycle was incredibly fast relative to history, we expect the pause to be more in line with historic averages.

So policy is tight. And you see that in interest sensitive activities. And you also begin to see it more and more in other activities. And if you put the — you put the credit tightening on top of that and the QT that’s ongoing, I think you feel like, you know, we’re — we may not be far off. Possibly even at that level.

We’re trying to reach and then stay at a — for an extended period — a level of policy, a policy stance that sufficiently restrictive to bring inflation down 2% over time… And we thought that this rate hike along with the meaningful change in our policy statement was the right way to balance that.

— Federal Reserve Chair Jerome Powell