By Eric M. Clark, Accuvest

At the end of each year, many people focus on things like wrapping up business and last minute holiday shopping. Shopping has never been my favorite thing, shopping in advance is even less interesting to me. Because of Amazon however, shopping is now fun, swift, and convenient.

Even if I don’t do all my shopping on Amazon, this amazing company has woken up virtually every other retailer so my options are only limited by the time I have to search & review potential items. What a wonderful development for those of us that do not enjoy shopping for hours at a time. As I was doing my research this year a thought occurred to me:

- What would an investment portfolio have yielded over 10 years if it were built to invest in the leading brands across important spending categories?

- Would that portfolio offer excess returns over the S&P 500?

- Most importantly, would the portfolio generate gains that could offset my spending on my favorite brands and their products/services?

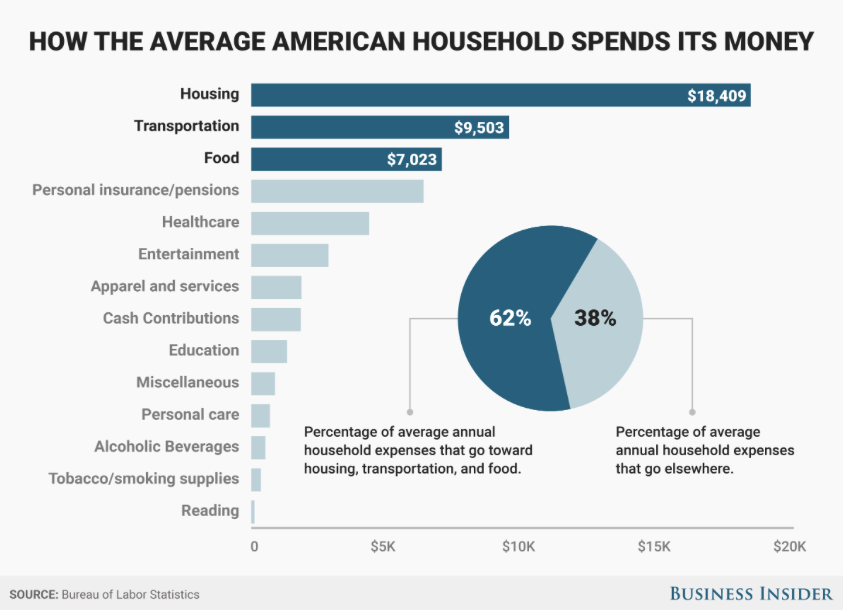

Given that I’m a Portfolio Manager of a global brands strategy, we all know the answers to these questions but I thought it would be fun to highlight a “hind-sight portfolio” as an illustration that a CONSUMER allocation to consumer-focused stocks can add value to a portfolio because 1. I like knowing what I own and why I own it and 2. because it literally can pay for your spending on your favorite brands by potentially adding capital gains, long-term. First, here’s a good guide on where the average person spends his/her money:![]()

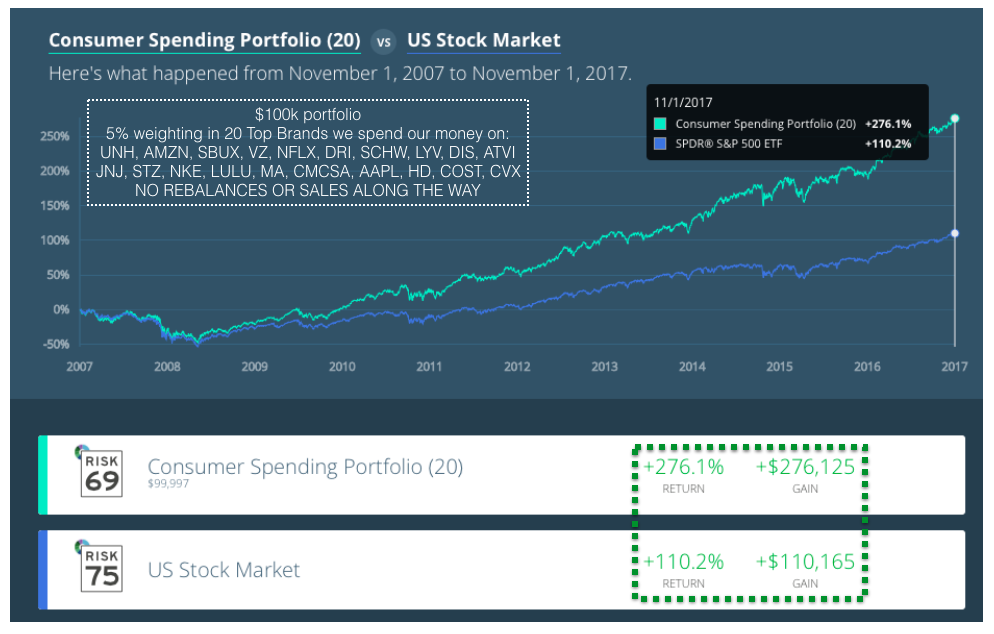

Here’s our illustrative, hind-sight portfolio. Let’s call it the Consumer Spending 20 Investment Portfolio. 20 stocks, equal-weighted, bought and held for 10 years, no trading, no reinvesting dividends, just buy and hold. We’ll start with a hypothetical $100,000 portfolio so 5% positions to start ($5k each). Here’s some important spending categories or industries and the leading brand chosen as the proxy investment for each category:

- Managed healthcare – United Healthcare– Sadly, it’s an enormous part of the average person’s monthly disposable income these days

- Online retail and now organic grocery via Whole Foods – Amazon– It’s now the part of the year where we get an Amazon box literally every day

- Coffee & fast casual restaurants – Starbucks– The average person in America spends about $1100/year on coffee and most people think of coffee before anything else in the am

- Cell phone carrier – Verizon– Our phone and our cell phone bill is now a staple of life whether we like it or not

- Movies & entertainment – Netflix– Netflix now has more U.S. subscribers than all of the cable TV providers combined and it all started with a mail-in DVD

- Eating out – Darden Restaurants– So many choices but the Darden umbrella spans fast casual through fine dining at Capital Grille.

- Saving & investing – Schwab– Formerly a do-it-yourself online trading firm and now an investment powerhouse across DIY, Advisory, and investment products

- Live events & concerts – Live Nation– Millennial’s like the “experience” but everybody loves a good concert don’t they?

- Entertainment, vacations, media – Disney– The mouse-house is rumored to be buying most of 21st Century Fox assets to compete with Netflix. The ultimate compliment for NFLX

- Video gaming – Activision– I remember Asteroids on my tiny MAC, now we have video graphics that rival real life! E-sports is a huge business and early in its popularity

- Personal care products – Johnson & Johnson– What would we all do without our Neutrogena, Band-Aids, and Listerine?

- Spirits and wine – Constellation Brands– What a wonderful way to end the day right?

- Apparel – Athleisure – Nike & Lululemon– Two very popular clothing brands serving a healthy world

- Mobile payments & transition away from using cash – MasterCard– Visa & MasterCard are kind of interchangeable but MasterCard has the longer track record

- Cable & broadband – Comcast– Like ’em or hate ’em most of us like our entertainment and the pipe into our house is muy importante

- Tech hardware & entertainment – Apple– Our phones are now a staple of life. My daughter thinks I spend too much time on the phone, just wait until she has one, revenge is coming!

- Home improvement, home construction – Home Depot– It feels like I’m at Home Depot every week for something and I kind of like the experience

- Warehouse shopping – Costco– The original Prime membership, could there be a company with a bigger MOAT around it? People LOVE the experience & deals

- Energy as a proxy for our gasoline expenditure – Chevron– As a F-150 owner, it never feels good to fill up that tank but how would I get to the trails for a ride?

Not a bad looking hind-sight portfolio indeed. Its diversified yet not too diversified.

50% Consumer Discretionary, 10% Consumer Staples, 15% Technology, 10% Healthcare, 5% Telecom, 5% Financials and 5% Energy

Data source: Riskalyze.com

Well, I guess we have yet another wonderful looking back-test but it does highlight the potential to hedge your spending on your favorite brands by investing in those stocks for the long-term. This hypo portfolio doubled the S&P 500 return with a lower risk score based on Riskalyze’s methodology. For more information, go to Riskalyze.com, its a wonderful portfolio analysis tool.

I wanted to end this inaugural blog post by lasering in on a few of these brands to drive home the point:

Amazon

My family loves Amazon for a variety of things and we spend a decent amount of money every year on the site & for our Prime membership.

Prime is $99/year so 10 years of memberships has cost us $990

Let’s say we spend $2000/year on products so 10 years of spending is $20,000

I won’t add a Whole Foods analysis because it’s a recent purchase of AMZN but suffice to say we spent tens of thousands of dollars shopping at Whole Foods over the last decade.

Let’s sum our likely spending up: $990 + $20,000 = $20,990 in spending

WHAT WOULD MY GAIN LOOK LIKE IF I SPENT $25K ON AMAZON STOCK 10 YEARS AGO ENDING 11/1/17?

ABOUT A 10X GAIN VS THE S&P 500, I PAID FOR MY SPENDING HABITS IN GAINS AND LOTS AND LOTS OF MONEY LEFT OVER FOR RETIREMENT GOALS!

Source: Riskalyze

Starbucks

Are you one of those people that can’t start their day without your morning coffee?