The decision on Wednesday by the Federal Reserve to raise interest rates 25 basis points, effectively raising the federal funds rate from 1.75% to 2%, did not bode well for homebuilder ETFs after the news.

Within 30 minutes following the announcement, iShares US Home Construction ETF (BATS: ITB) was down 3.74%, SPDR S&P Homebuilders ETF (NYSEArca: XHB) was down 2.46%, Invesco Dynamic Building & Const ETF (NYSEArca: PKB) was down 1.6%, and Direxion Daily Hmbldrs & Supls Bull 3X ETF (NYSEArca: NAIL) was down big at 11.23%.

Mortgage Rates Increase

This did not come as a surprise since mortgage interest rates affect how the majority of homebuilders tailor their activity to the ebbs and flows of interest rates. The rate hike was widely anticipated by the markets and as such, mortgage application volume dropped 1.5 percent last week from the previous week–15.4 percent compared to a year ago based on data from the Mortgage Bankers Association’s seasonally adjusted report.

Prior to the announcement, mortgage rates were already sitting near seven-year highs. The average 30-year fixed mortgage rate already climbed from 4.15% to 4.54% since the beginning of the year.

Related: ETFs Slip as Federal Reserve Hikes Interest Rate

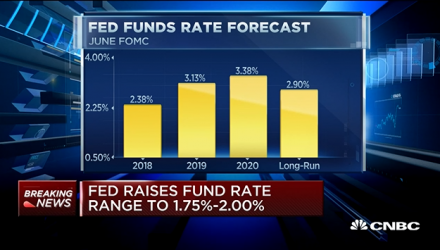

The homebuilder ETF woes could likely continue as the Federal Reserve hinted at more rate hikes to come if the economic climate warrants any further rate adjustments.

“In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective,” said The Fed. “This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

Click here for more alternative ETF news.