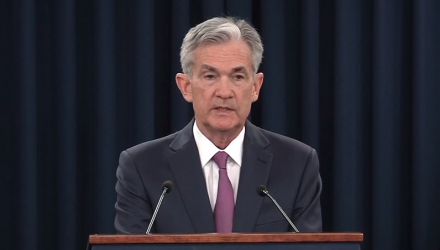

Stock and bond ETFs slipped on Wednesday as the Federal Reserve announced another moderate rate hike and stated its intent to raise rates two more times later this year.

Following the Fed’s announcement mid-Wednesday to raise interest rates 25 basis points, effectively raising the federal funds rate from 1.75% to 2%, the iShares 7-10 Year Treasury Bond ETF (NASDAQ: IEF) dipped 0.2% and the iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT) fell 0.3%, which wasn’t a surprise as older debt with lower yields become less attractive in a higher rate environment.

The Invesco DB U.S. Dollar Index Bullish Fund (NYSEArca: UUP), which tracks dollar movements against a basket of developed currencies, strengthened 0.2% in response to the tightening monetary policy.

Meanwhile, the U.S. equity market slipped into the red, with the SPDR S&P 500 ETF (NYSEArca: SPY) down 0.2%, on the prospects of slower growth with a higher rate environment ahead.

Four Rate Hikes for 2018

The Federal Reserve announced its second rate hike this year and upgraded their forecast to four total increases in 2018 as unemployment dips to 18-year lows and inflation rises above its target, reports Craig Torres for Bloomberg.