Related: Tech ETF ‘VGT’ Could Keep Soaring if Microsoft, Apple Deliver on Earnings

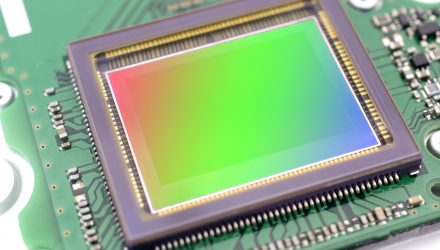

XKII offers a fresh view on infrastructure investing. While many legacy infrastructure funds are heavily allocated to sectors such as energy and utilities, XKII features exposure to over a dozen industry groups, many of which dwell in the industrial and technology sectors. The ETF holds nearly 50 stocks. For example, XKII allocates nearly 15% of its weight to semiconductor makers, a trait not often seen among traditional infrastructure investments.

“Without being constrained to traditional GICS sector classifications, the Kensho Intelligent Infrastructure Index attempts to harness the potential increase in infrastructure spending in an age of increasing technological advancements that touch every facet of our life,” said SSgA. “It goes beyond well-known traditional industrial firms by including companies involved in intelligent and connected home technologies, smart power grid technology, road sensors, traffic management infrastructure and smart water meters from other GICS-related sectors.”

XKII is up 1.10% over the past month.

For more information on the tech segment, visit our technology category.