After hitting a record high earlier this year, gas prices are continuing to decline. According to AAA, the average national gas price was $3.94 per gallon as of August 17, down from more than $5 earlier this summer. Reuters reported on August 19 that Brent crude futures were down 13 cents, or 0.1%, at $96.46 per barrel, headed for a weekly loss of about 1.5%.

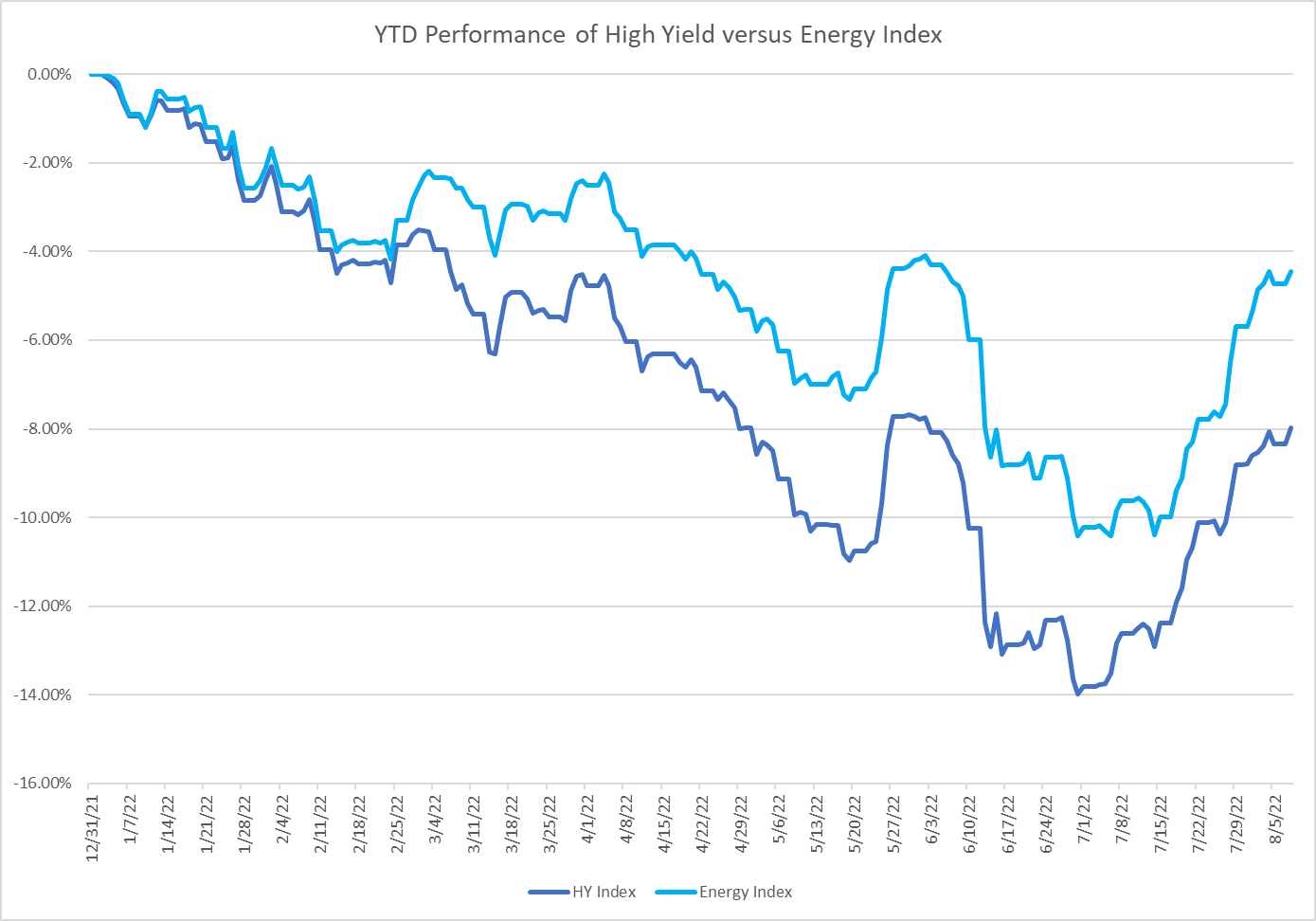

But despite recent declines in crude oil prices, energy remains an attractive sector in U.S. high yield. In fact, within high yield, energy is the best-performing sector year-to-date. This is due to industry fundamentals remaining strong, with high yield exploration & production companies still benefitting from oil prices well above their break-even levels. Plus, companies within the sector are generating healthy cash flows and focused on deleveraging.

Source: ICE Data Services (HY Index: ICE BofA US Cash Pay High Yield Constrained Index; Energy Index: ICE Diversified US Cash Pay High Yield Energy Index)

Another tailwind for the sector is that the industry is BB in average quality, which is higher than broad high yield indexes. Research suggests that the average net leverage ratios for the E&P sub-sector could improve to around 1.0x EBITDA by year-end 2022, from more than 3.0x during the recent peak of the 2020 COVID crisis.

Investors seeking high yield fixed income exposure to the sector may want to consider the BondBloxx US High Yield Energy Sector ETF (NYSE Arca: XHYE).

The U.S. high yield bond fund targets the energy sector, including the exploration & production, gas distribution, oil field equipment & services, and oil refining & marketing sub-sectors. XHYE has an annual expense ratio of 0.35%.

XHYE is one of seven U.S. high yield bond ETFs that BondBloxx Investment Management launched in February. The funds offer precise, index-based exposure to the high yield asset class and allow investors the opportunity to diversify and manage risk to the industry sector.

The funds are passively managed and track rules-based sub-indexes of the ICE BofA US Cash Pay High Yield Constrained Index.

BondBloxx was founded by ETF industry leaders Leland Clemons, Joanna Gallegos, Elya Schwartzman, Mark Miller, Brian O’Donnell, and Tony Kelly. The team has collectively built and launched over 350 ETFs at firms including BlackRock, JPMorgan, State Street, Northern Trust, and HSBC.

“Our conversations with investors have reinforced what we already knew – there is significant demand for more targeted fixed income products,” said BondBloxx co-founder Tony Kelly. “Our initial product suites aim to create a full toolkit for high yield investors looking to implement their specific views on the market, and we anticipate extending this approach to other fixed income asset classes.”

For more news, information, and strategy, visit the Institutional Income Strategies Channel.