For the full report: Check out our February fixed income market update, brought to you by Elya Schwartzman, JoAnne Bianco, and the BondBloxx Investment Management team, HERE.

Overview

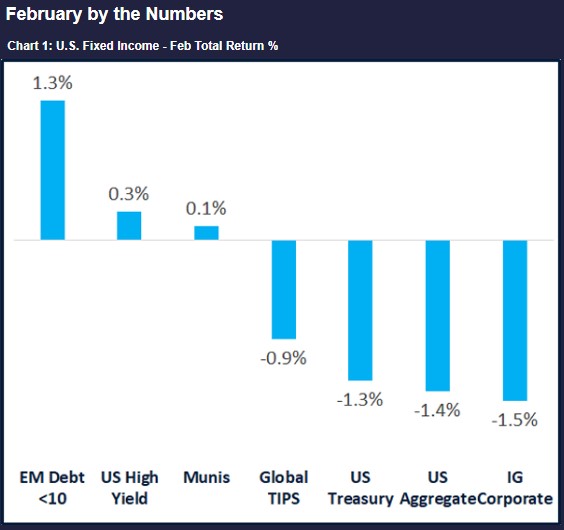

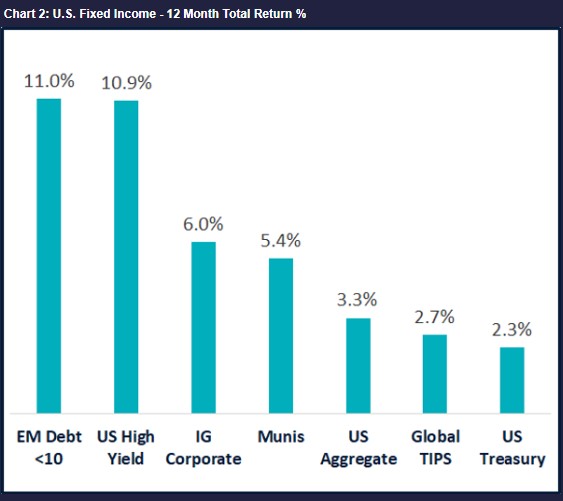

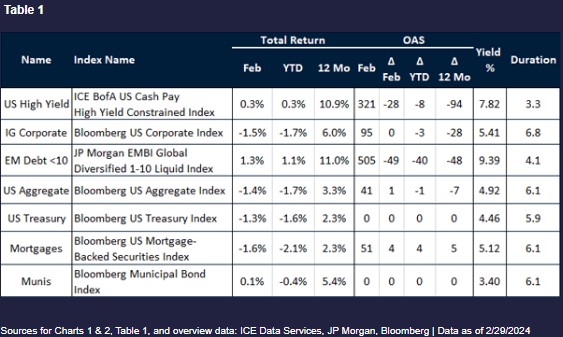

- Fixed income assets with higher yields staged a rally in February, as economic data reaffirmed the resilience of the U.S. economy, and earnings news confirmed the health of U.S. corporations. Equities rallied to record highs, helping boost the performance of risk-based assets. CCC-rated corporate debt was the top performing bond asset class (+2.1%), while long-duration treasuries declined the most (-2.3%).

- Most U.S. economic data surprised to the upside during February, including January payrolls (+353k), the unemployment rate (3.7%), January Consumer Price Index (+3.1%), and the Core Personal Consumption Expenditures deflator (+2.8%) (Bloomberg). This has led to strength in credit sectors such as U.S. high yield, while resulting in further volatility in long duration assets.

- Rate decreases are likely off the table for March and May, with market expectations for 2024 now at four rate cuts, approaching the Federal Reserve’s (“Fed”) guidance from December. Economists are discussing whether the Fed will need to recalibrate their stance on a 2.0% inflation goal, or even whether a rate hike might be required. Any change in “Fed-speak” at the next meeting will be closely watched.

Insights

- Given the strength of the U.S. corporations, we believe investors may benefit from increasing their allocation to credit, particularly BBB, single-B or CCC-rated U.S. corporates.

- We believe intermediate-duration exposure provides attractive potential returns in U.S. Treasuries and emerging markets.

For more news, information, and strategy, visit the Institutional Income Strategies Channel.

Glossary and Index Definitions

- Credit Spread: the difference in yield between a debt security and its benchmark measured in basis points

- The Bloomberg Global Inflation-Linked Total Return Index the performance of investment-grade, government inflation-linked debt from 12 different developed market countries.

- The Bloomberg Municipal Bond Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prefunded bonds.

- The Bloomberg U.S. Aggregate Index is a broad-based flagship benchmark that measures the investment grade, US-dollar-denominated, fixed-rate taxable bond market.

- The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

- The Bloomberg U.S. Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting.

- The Bloomberg US Mortgage-Backed Securities Index tracks fixed-rate agency mortgage-backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

- The ICE BofA US Cash Pay High Yield Constrained Index contains all securities in The ICE BofA US Cash Pay High Yield Index but caps issuer exposure at 2%.

- The J.P. Morgan 1-10 Year Emerging Markets Sovereign Index tracks liquid, U.S. dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIGDL 1-10 Index is based on the long-established J.P. Morgan EMBI Global Diversified Index and follows it methodology closely, but only includes securities with at least $1 billion in face amount outstanding and average life below 10 years.

- Option Adjusted Spread (OAS): For a bond, OAS is the measurement of the spread between the bond and the underlying government yield curve. For an Index, the average of its constituent security government option-adjusted spreads, weighted by full market value.

- Yield is the annual rate of return on a bond. It has a reverse relationship with price such that as bond prices rise, yields fall.

Disclosures

Index performance is not illustrative of fund performance. One cannot invest directly in an index. Please visit bondbloxxetf.com for fund performance.

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investment grade bonds have ratings of BBB- or above. High yield bonds have ratings of BB+ and below. BBB-rated bonds are typically subject to greater risk of downgrade than other investment grade bonds, especially during an economic downturn or substantial period of rising interest rates.

Any downgrade of such bonds would relegate such bonds from the investment grade universe to the high yield (or “junk” bond) universe, which could negatively affect their liquidity and their value. High yield bonds may be deemed speculative, may involve greater levels of risk than higher-rated securities of similar maturity and may be more likely to default. Investing in mortgage- and asset- backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on.

BondBloxx Investment Management Corporation (“BondBloxx”) is a registered investment adviser. The content of this presentation is intended for informational purposes only and is not intended to be investment advice.

Nothing contained in this presentation constitutes investment, legal, tax, accounting, regulatory, or other advice. Information contained in this presentation does not constitute an offer to sell or a solicitation of an offer to buy any shares of any BondBloxx ETFs. The investments and strategies discussed may not be suitable for all investors and are not obligations of BondBloxx.

Decisions based on information contained in this presentation are the sole responsibility of the intended recipient. You should obtain relevant and specific professional advice before making any investment decision. This information is subject to change without notice.

Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent ratings services, such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which are the highest grade, to ‘D’, which is the lowest grade.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by BondBloxx. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by BondBloxx or any other person. While such sources are believed to be reliable, BondBloxx does not assume any responsibility for the accuracy or completeness of such information. BondBloxx does not undertake any obligation to update the information contained herein as of any future date.

Distributor: Foreside Fund Services, LLC.