By Innovator ETFs

• Own the MSCI EAFE and MSCI Emerging Markets with built-in buffers

• Low-cost, flexible, liquid, and transparent

• No credit risk

• Reset annually and can be held indefinitely

What are the ETFs?

These are the only ETFs in the world to provide exposure to the benchmark MSCI EAFE Index and MSCI Emerging Markets Index with a built-in buffer of 15%. The ETFs can be held indefinitely, resetting at the end of each outcome period, approximately annually.

Why Invest in International Stocks?

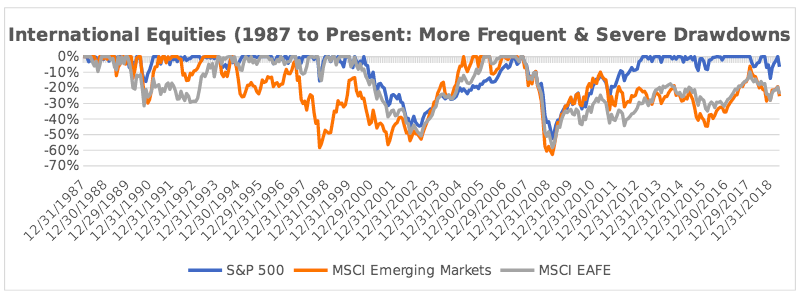

Investing in international markets offers investors the opportunity to diversify their equity portfolios, seeking growth opportunities outside of the U.S. Following a strong equity run in U.S. stocks investors are beginning to look across international borders, however, many are unable or unwilling to take on the increased risks present within these markets. Historically, international equities have offered investors the opportunity to diversify their portfolios as they experience different return cycles compared to U.S. equities. For example, rolling five year returns in the U.S. were around 8% in in the early 1990’s but were over 20% in Emerging Markets. Conversely when the rolling returns were 20% in the U.S. during the late 1990’s, returns in Emerging Markets were negative. As returns have been strong in the U.S. for the last decade, international markets may offer investors better prospects in the coming years.

Adding a Downside Buffer May Provide Needed Returns with a Smoother Ride

According to the CMG Capital Group, 75% of all wealth in the U.S. today is in the hands of pre-retirees or retirees. These investors no longer require full market upside or the heightened risk ofthis exposure. Many do not want the risk of experiencing large market drawdowns. Investing witha hedge is a practical approach for these individuals, particularly in consideration of the current markets cycle being closer to its end than beginning. The Innovator Defined Outcome ETFs built-in buffer can help investors weather drawdowns, lower volatility and capture market upside, to cap.

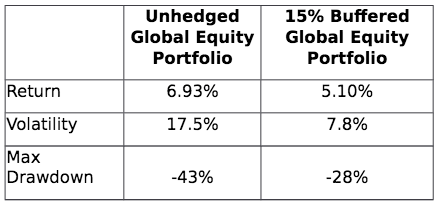

To illustrate the potential benefit, a hypothetical global portfolio was constructed with and without a built-in hedge. The hedged portfolio included an annual 15% buffer and 10% cap.

• 60% U.S. (S&P 500)

• 25% Developed International (MSCI EAFE)

•15% Emerging Markets (MSCI Emerging Markets)

The portfolios were tested from 1987 through 2018, and the results demonstrate the potential benefits that adding a buffer can provide. Over this 30-year time frame, the hedged portfolio experienced 55% lower annual volatility than an unhedged portfolio and had higher risk-adjusted returns with nearly identical returns. For investors looking to maintain equity exposure late in the business cycle, looking to avoid full market risk Moving forward, investors looking to maintain equity exposure, with less risk, may want to consider utilizing ETFs with built-in buffers.

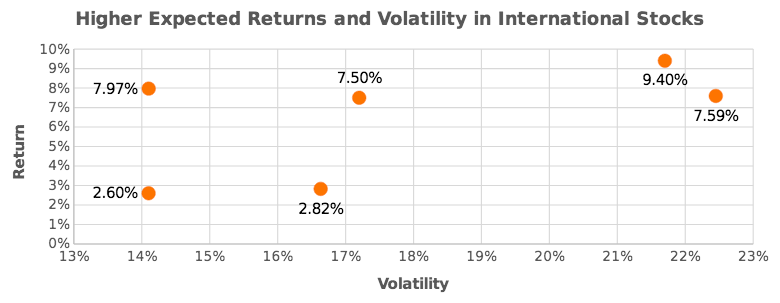

BLUE = Expected 10-year

ORANGE = From Dec. 1987 through May 2019

The Outlooks for Equity Markets

According to Research Affiliates (RAFI) the outlook for expected returns in U.S. equities over the next ten years is a meager 2.6% compared to 7.5% for international and 9.4% for emerging market equities. Higher returns, however, aren’t free. They involve more risk. The chart below highlights these expectations along with realized returns and volatility over the last 30 years. From 1987 through today, developed markets exhibited nearly 20% more volatility than the U.S. markets while emerging markets was 60% more volatile. Investors looking to access international markets will need to be able to weather the heightened volatility. Adding a downside buffer can dampen this volatility while providing the necessary returns.

Source: Research Affiliates as of May 31st, 2019.

For more information, visit www.innovatoretfs.com.