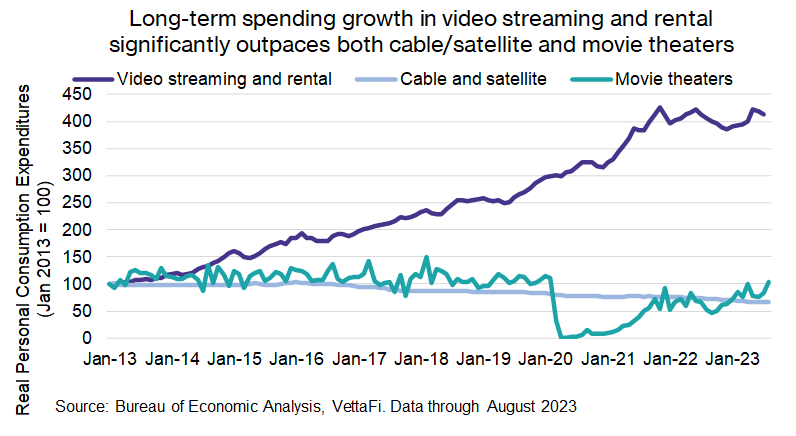

The communications sector has been one of the best-performing sectors of the year, benefiting from both the tech boost and in certain areas, from consumer spending on services versus goods. One of the highest growth industries within communications has been the media and streaming industry, which continues to see interest as consumers turn to instant, in-demand entertainment. Netflix (NFLX), the leader in the video streaming industry, reports its earnings on Wednesday, October 18, and there will be several key items to watch out for. These are a few things we can learn from its earnings that apply to the broader streaming industry.

Revenue Growth Isn’t Infinite

Revenue growth isn’t infinite, especially for companies that are already the market leader. In Netflix’s case, revenue is the number of subscribers multiplied by the membership price. At this point, penetration in developed countries — particularly America and Canada — is already deep. From here, member retention is important. But that also means revenue can’t grow without raising prices. The company raised its prices in January 2022 and plans to increase its fees again in a few months. Several other streaming subscribers have also recently increased their fees.

But fees can’t be increased infinitely without losing some members, so companies must look for other forms of revenue. Some of these forms have died out (DVD rental) or have been lackluster (video games). More successful ways have included membership tiers to attract those who want to pay for lower-priced plans Another way has been a password-sharing crackdown, which has stopped members from sharing accounts. Netflix also plans to open some brick-and-mortar locations in 2025, which could be an interesting revenue diversifier.

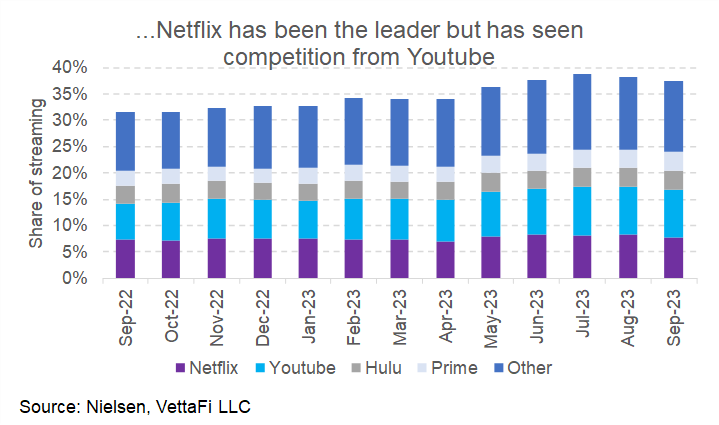

These revenue issues are most applicable to Netflix since it has the greatest market share. Yet these issues also apply to the broader streaming industry. This is because other companies try to maintain and grow their subscriber base while keeping prices profitable.

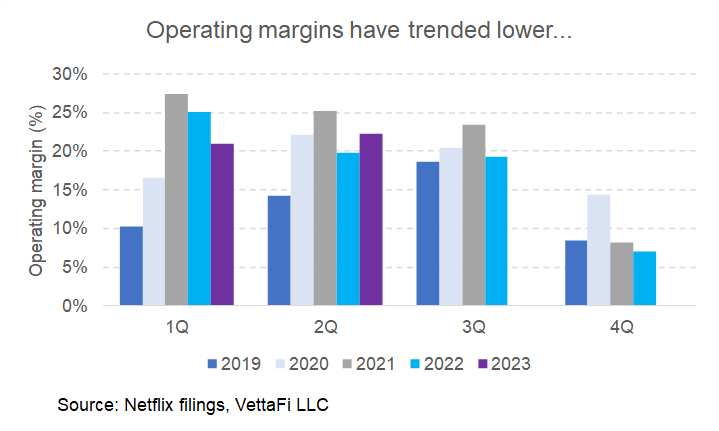

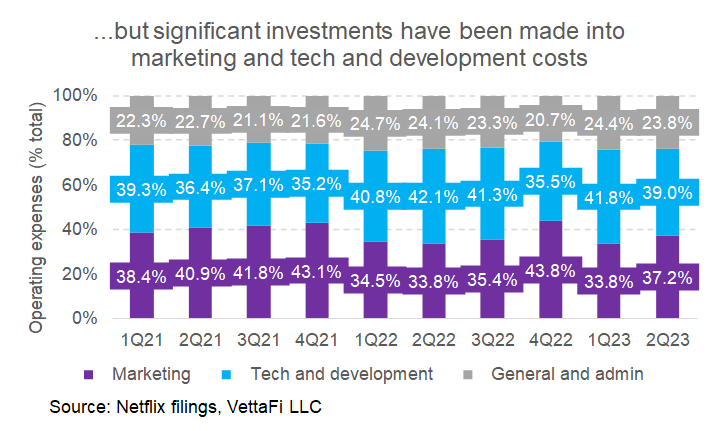

Analysts Focus on Company Profits

Analysts have traditionally had a focus on company profits. While demand trends have been overall easier to analyze, it’s more difficult to see how an industry will manage costs from unique factors like the Hollywood strike to marketing costs for original content. Higher expenses are not always bad though. Higher expenses are needed to increase revenue growth (e.g., higher advertising expenses can lead to an increase in membership). But the effects are not usually seen immediately. So it can sometimes be difficult to tell if a company is spending more on costs in an efficient manner. Netflix, for example, has seen its operating margins trend slightly lower over the past few years. However, the company has made significant investments into advertising expenses for its original content and technology and development. This could potentially lead to long-term revenue growth.

The struggle to cut costs to potentially boost earnings and therefore stock prices against the need to increase advertising expenses to differentiate streaming products will likely be a theme throughout the industry.

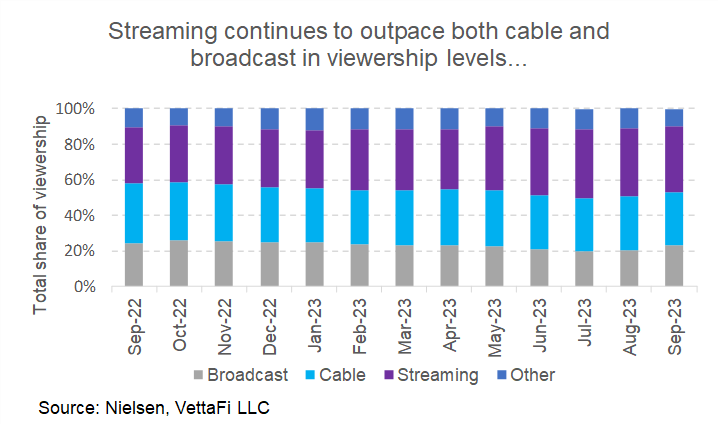

Consumer Culture Leans Toward Fast, On-Demand Consumption

Consumer culture leans toward fast, on-demand consumption. I have discussed this when referring to consumer retail trends like e-commerce, which has increasingly become about same-day, instant delivery. As with retail shopping, many people like consuming their media instantly through a broad online library — one that gives them many options on-demand without taking up physical capacity. (This is why streaming has become the next generation of media consumption for video, audio, and video gaming.) But with many competitors offering similar streaming libraries and with higher prices, consumers are likely to cut back on their subscriptions. The big differentiator will likely be original content.

Not surprisingly, Netflix has led the pack in streaming viewership (which can be partially attributed to its original content). But Netflix has also received the most competition from YouTube (owned by Alphabet). While YouTube has live streaming channels, much of its viewership is likely from viewing short-form videos, which have become popular among younger viewers (following that same trend of on-demand consumption).

Investment Takeaways: What ETFs Will Benefit From Long-Term Growth Trends in Streaming?

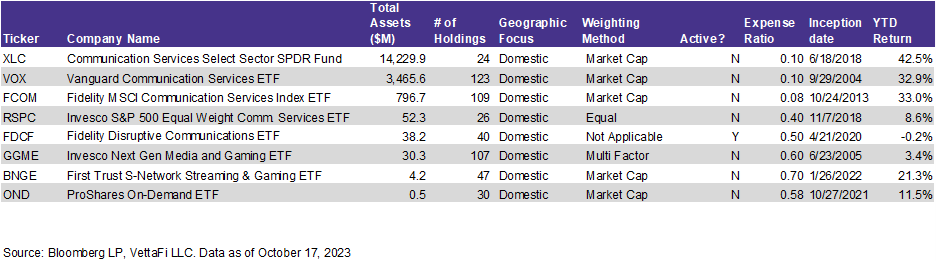

ETFs that benefit from performance growth in Netflix and other streaming companies include broader communication services sector ETFs in addition to next-generation media ETFs and internet ETFs. On a market-cap-weighted basis, the communications sector is currently the best-performing sector out of the Select Sector SPDR Funds (the Communication Services Select Sector SPDR Fund [XLC])mainly due to large allocations to internet stocks like Meta Platforms (META) and Alphabet Inc (GOOG/GOOGL). Streaming and media ETFs have had overall weaker performance, but certain ETFs like the First Trust S-Network Streaming & Gaming ETF (BNGE) have outperformed the broader S&P 500 market. While these smaller ETFs have underperformed most communications sector ETFs YTD, they may have a place in an investor portfolio as a tactical tilt toward disruptive technology.

For more news, information, and analysis, visit the Innovative ETFs Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for BNGE, for which it receives an index licensing fee. However, BNGE is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of BNGE.