With an economy coming closer to re-opening and benchmark Treasury yields still at lows, investors piled into the riskiest debt during the month of May. Many thanks go to the Federal Reserve, which decided to help backstop the bond market by purchasing high yield ETFs.

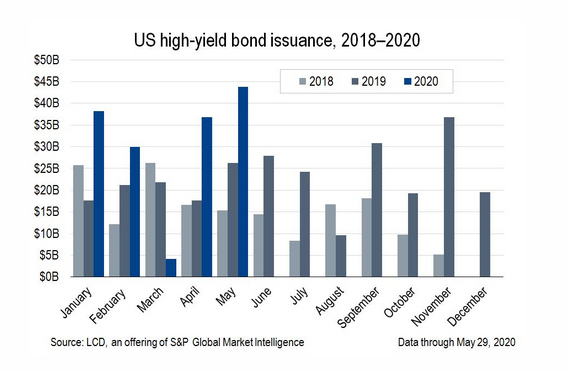

“Boosted by Federal Reserve initiatives to prop up the asset class, raging risk-on sentiment, and tightening yields and spreads, U.S. high-yield bond issuance closed out May with $43.8 billion in activity, the largest on record for that month, according to LCD. The figure edges out the previous $43.5 billion peak from May 2013,” a SP Global report said.

“The last month with more volume was September 2013, at $47.7 billion,” the report added. “Year-to-date volume through May is $152.9 billion, with 28% of that figure placed over the four full weeks of last month. The issuance tally for the current year marks a 48% increase from the first five months of 2019.”

Additionally, S&P Global also noted firmer market conditions have been feeding into high yield interest.

“Firming market conditions has also been a boon for speculative-grade credits,” the report said. “Last month, borrowing costs dipped to under 7% for the first time since early March, with the average yield to worst for bonds in the S&P U.S. Issued High Yield Corporate Bond Index at 6.87% on May 28. Additionally, the average option-adjusted spread for the index tightened to T+599, from levels indicative of distressed debt months earlier.”

High Yield ETF Options Today

If investors still want to quench their thirst for high yield debt, they can look to ETFs like The High Yield ETF (NYSEArca: HYLD). HYLD seeks high current income with a secondary goal of capital appreciation by selecting a focused portfolio of high-yield debt securities, which include senior and subordinated corporate debt obligations, such as loans, bonds, debentures, notes, and commercial paper.

Another option is the VanEck Vectors Fallen Angel High Yield Bond ETF (BATS: ANGL). ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

ANGL essentially focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status.

Lastly, investors can also look at the Goldman Sachs Access High Yield Corporate Bond ETF (GHYB). GHYB seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs High Yield Corporate Bond Index.

For more market trends, visit ETF Trends.