Economic indicators provide insight into the overall health and performance of an economy. They serve as essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending on February 1st, the SPDR S&P 500 ETF Trust (SPY) rose 0.24% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 0.51 %. At their most recent meeting on January 31st, the Federal Reserve announced they would hold rates between 5.25% and 5.50% for a fourth straight meeting.

Some of the most closely watched economic indicators are those surrounding the labor market due to their significant impact on overall economic health. Last week featured a handful of employment updates including the BLS’s January Employment Report, December’s Job Openings and Labor Turnover (JOLTS) report, and January’s ADP Private Employment Report. These reports offer insights into different aspects of the U.S. labor market and contribute to the broader economic picture. This article will highlight the key data points from these three reports and explore their potential implications.

Employment Report

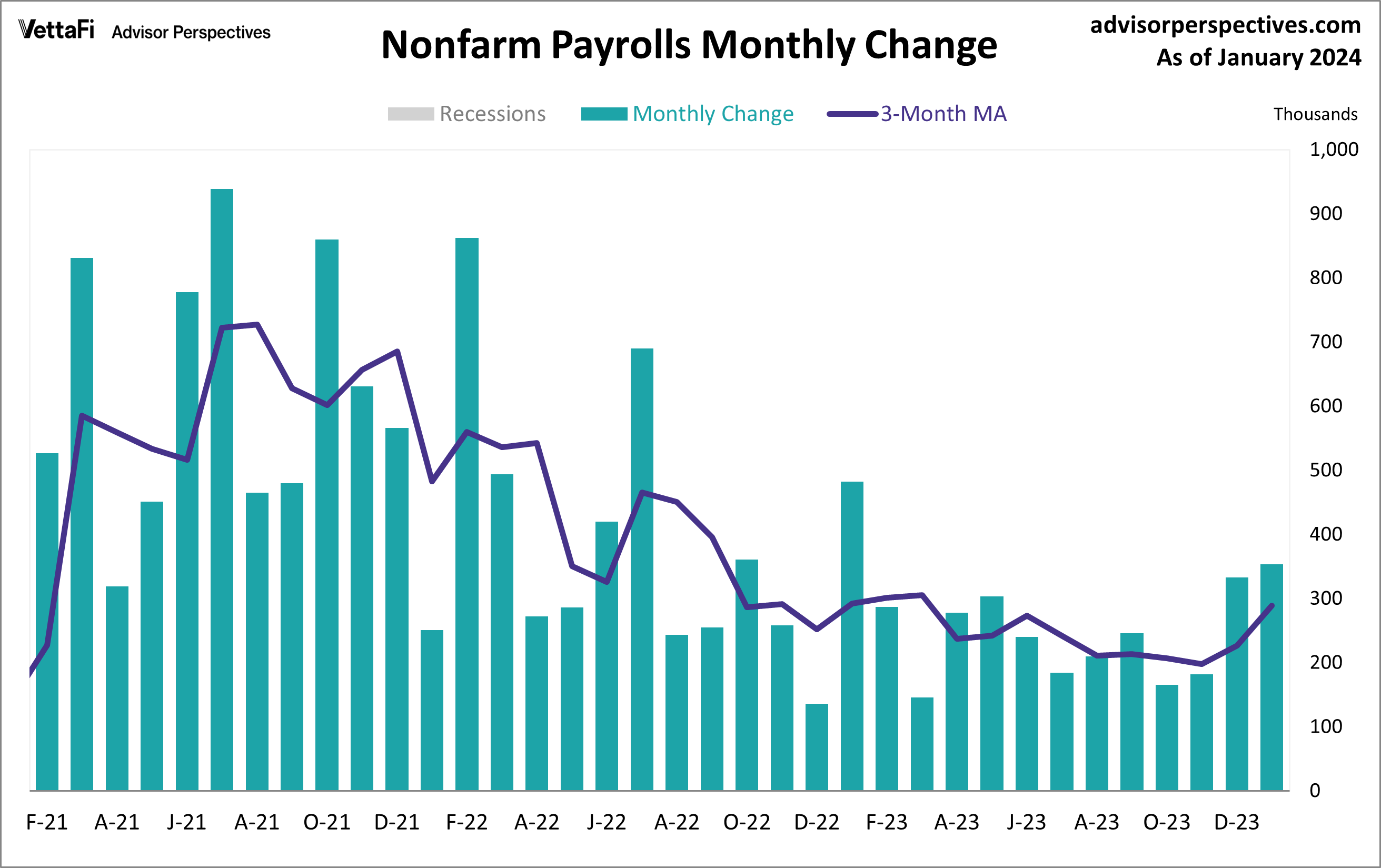

The U.S. labor market started off 2024 with a strong surprise. The January employment report revealed 353,000 jobs were added last month, almost doubling expectations of the 187,000 addition. January’s jobs numbers represented a slight pickup from December’s upwardly revised 333,000 addition and is the largest monthly gain since January 2023. Moreover, the report indicated that the unemployment rate remained at 3.7% while wage growth jumped to 4.5%. Overall, the jobs report showed unexpected resilience of U.S. labor market and economy. However, strong job growth coupled with accelerated wage gains could delay Fed rate cuts even further.

Job Openings and Labor Turnover (JOLTS)

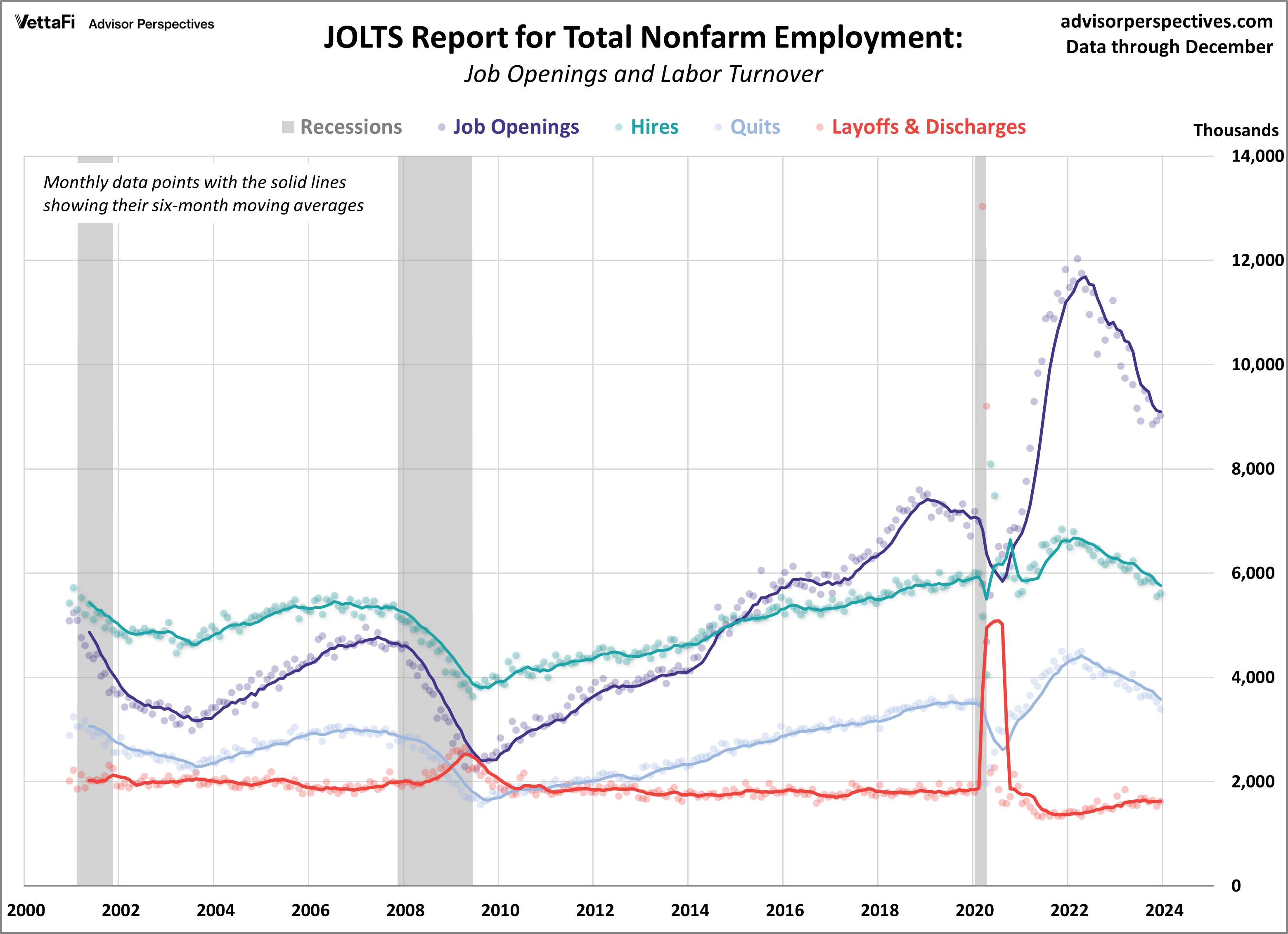

The December JOLTS report revealed a slightly stronger than expected labor market as job openings rose to their highest level in three months. In December, job openings increased by 101,000 from November to 9.026 million, surpassing the predicted 8.750 million vacancies. Other key data points from the report showed that the number of hires and layoffs inched up while the number of quits declined from the previous month. Overall, each data point was little changed as the quits rate remained at 2.2%, the layoffs rate remained at 1.0%, the job openings rate remained at 5.7%, and the hires rate ticked up slightly to 3.6%.

The JOLTS data serves as a barometer for assessing labor demand, and any disparity between workforce demand and supply could potentially exert upward pressure on inflation. Beginning in April of 2023, the gap between labor demand and supply has narrowed sharply. However, over the last three months, the gap has held steady with the ratio of the number of job openings per unemployed worker remaining at 1.4. While this ratio still sits above pre-pandemic levels, it is well below the 2022 peak of 2.0.

ADP Employment Report

Private sector hiring eased more than expected in January as the labor market slowdown from 2023 rolled over into 2024. The ADP employment report showed that 107,000 private jobs were added last month, less than the projected 145,000 addition. The pickup in January was most notable among companies with 50-249 employees, as they added 53,000 jobs, accounting for approximately 50% of January’s job growth. This marks the third slowdown in private sector job growth over the past four months.

The six-month moving average, a more stable indicator amid monthly volatility, is now at 125,000, the lowest since October 2020 during the peak of COVID-19 layoffs. The report also highlights a continued deceleration in annual pay growth, with pay gains for job-stayers dropping to 5.2%, the slowest since August 2021. The data suggests a continuation of the 2023 trend, where job and pay growth for the private sector experienced a notable slowdown.

Economic Indicators and the Week Ahead

The economic calendar will be light this week, however there are still a few important data points to keep an eye out for. The January readings for the S&P Global and ISM Services PMI will be released on Monday, followed by the Q4 Household Debt and Credit report on Tuesday, and then December’s Trade Balance data on Wednesday.

The S&P Global Services PMI is expected to increase for a 4th consecutive month to 52.3 while the ISM Services PMI is forecasted to rise to 52.0 from 50.6 in December. The trade deficit is expected to shrink to -$62.20 billion. Lastly, household debt and credit has increased every quarter since Q2 2020 and it is expected to have continued the trend in Q4 of last year.

For more news, information, and analysis, visit VettaFi | ETF Trends.