Invesco’s top-performing ETFs in 2023 represented some of the growthiest segments of the market, as stocks broadly showed strength last year.

The Invesco PHLXSemiconductor ETF (SOXQ) and the Invesco NASDAQ Internet ETF (PNQI) were among Invesco’s top-performing ETFs in 2023, trailing only the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

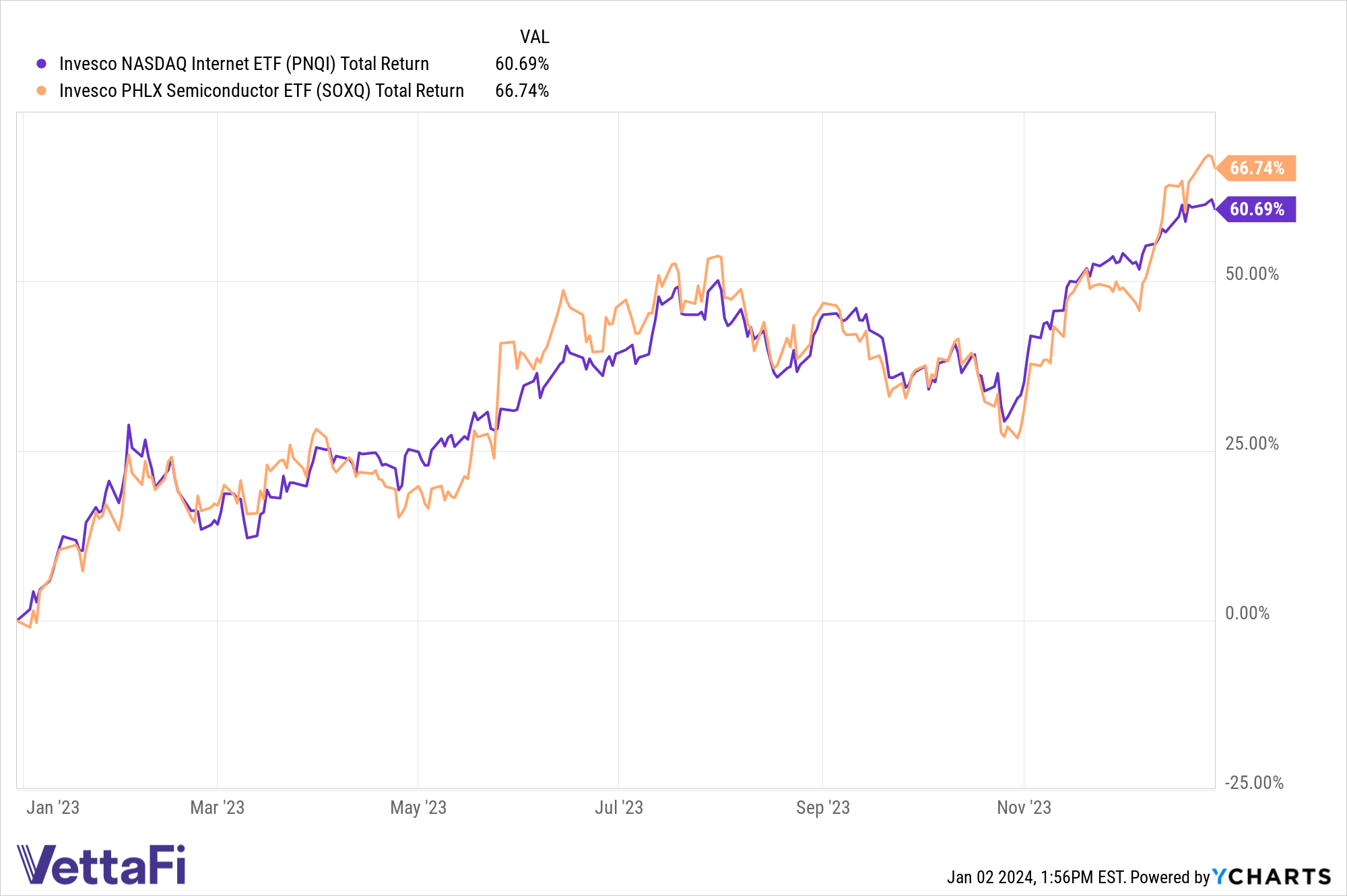

SOXQ notably gained 66.7% in 2023, while PNQI climbed 60.7% during the year. Both funds target high-growth segments of the market, a strategy that rewarded investors in 2023.

Invesco PHLX Semiconductor ETF (SOXQ)

SOXQ is based on the PHLX Semiconductor Sector Index. It measures the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business.

Semiconductors include products such as memory chips, microprocessors, integrated circuits, and related equipment that serve a wide variety of purposes in various types of electronics, including personal household products, automobiles, and computers, among others.

Top holdings in the fund include Advanced Micro Devices (AMD), Broadcom (AVGO), Intel Corporation (INTC), and QUALCOMM (QCOM).

SOXQ charges 19 basis points and has $184 million in assets under management.

Invesco NASDAQ Internet ETF (PNQI)

PNQI invests in internet-related businesses across the cap spectrum included in the NASDAQ CTA Internet index.

PNQI includes companies whose primary businesses include internet-related services including, but not limited to, internet software, internet search engines, web hosting, website design, or internet retail commerce as determined by the Consumer Technology Association (CTA). Top holdings in PNQI include Meta Platforms (META), Microsoft Corporation (MSFT), Alphabet Inc (GOOG), and Amazon.com Inc (AMZN).

PNQI is the pricier of the two ETFs, charging 60 basis points. The fund is also the larger of the two ETFs, with $700 million in assets under management.

For more news, information, and analysis, visit the Innovative ETFs Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for SATO, for which it receives an index licensing fee. However, SATO is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of SATO.