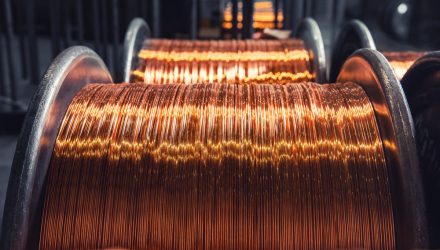

Copper prices are on the move. One of the prime catalysts for optimism is the potency for improving economic conditions in China. The second largest economy’s struggles has been well-documented. That’s because it continues to wrangle with the aftereffects of a property development crisis.

Recent economic data from the country showed manufacturing activity picking up. That could be an early signal of growth trending higher.

“The economic data is aiding market sentiment, signaling a recovery in manufacturing industry,” analysts at Galaxy Futures said.

With China being the largest consumer of copper globally, this bodes well for demand. And on the other side of that economic equation is supply constraints that may not be able to meet said demand. As a result, this should push up copper prices further. That would ETFs that have exposure to the industrial metal.

Copper is highly lauded for its electrical conductivity properties. The global push toward more electric vehicles (EVs) continues in order to reach respective emissions goals. So investors may want to capitalize on the growth prospects via the Invesco Electric Vehicle Metals Commodity Strategy No K-1 ETF (EVMT). Copper is currently the fund’s second largest holding, adding upside exposure to rising prices.

Flexibility and Diversification

One prime feature of EVMT is its active management component. Under the auspices of experienced portfolio managers, the fund seeks to achieve its investment objective by investing in commodity-linked futures and other financial instruments that provide exposure to a diverse group of metals commonly used for EV production.

EVMT seeks to provide long-term capital appreciation using an investment strategy designed to exceed the performance of the S&P GSCI Electric Vehicle Metals Index, which tracks commodities used in manufacturing of electric vehicles. In particular, the fund’s focus is on the upstream components of the EV global manufacturing process. That includes raw materials such as cobalt, aluminum, nickel, iron ore, and copper. Exposure to all these types of metals adds to the diversification of the fund.

Currently, the fund’s top holding consists of nickel, which could also face supply constraints in the future amid local geopolitical conflicts in Indonesia. In turn, this could drive its prices higher, adding to more potential upside to EVMT alongside copper.

“Corruption and land disputes are quickly becoming a major concern in Indonesia’s nickel sector, as local players grow increasingly aggressive with smelter projects and more international companies look to enter the country,” a Nikkei Asia report noted.

For more news, information, and strategy, visit the Innovative ETFs Channel.