The third-quarter earnings-reporting season is now upon us, with banks kicking off the season as usual. Interest rates are much higher than they were a year ago, and some banks are seeing a nice boost. However, while most banks posted solid results or smashed analyst estimates entirely, activity in most bank exchange-traded funds over the five days ending October 18 remained somewhat muted.

Big Bank Earnings Smash Estimates

For the third quarter, Bank of America posted revenue and earnings that topped analyst expectations, partially driven by better-than-expected interest income. The bank reported 90 cents per share in earnings on $25.3 billion in revenue, compared to the analyst estimates of 82 cents per share and $25.1 billion. Bank of America’s interest income rose 4% to $14.4 billion, surpassing analyst expectations by about $300 million thanks to higher interest rates and loan growth.

Bank Stock Performance

Meanwhile, JPMorgan Chase, the biggest U.S. bank by assets, reported $4.33 per share in earnings on $40.7 billion in revenue, versus analyst estimates of $3.96 per share and $39.6 billion. However, JPMorgan’s per-share profit number included 17 cents per share in securities losses and 22 cents in legal expenses, and it wasn’t clear whether those items were included in the estimate. Again, JPMorgan’s net interest income came in better than expected, soaring 30% to $22.9 billion, which beat the analyst estimate by about $600 million.

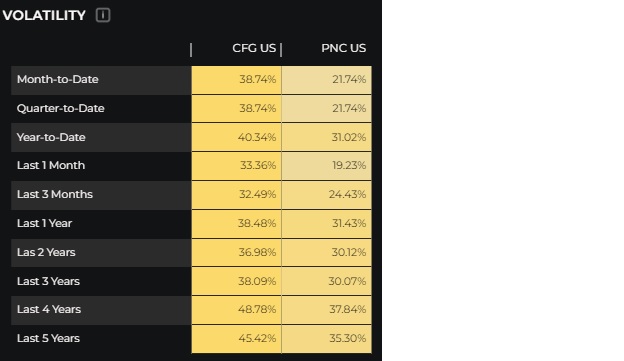

Bank Stock Volatility

Citigroup reported earnings of $1.63 per share or $1.52 per share excluding impacts from divestitures, versus expectations of $1.21 per share (although it’s unclear whether the estimate includes the divestiture-related impacts). The bank also reported $20.1 billion in revenue, surpassing expectations of $19.3 billion.

For its third quarter, Wells Fargo reported earnings of $1.48 per share on $20.9 billion, outperforming analyst expectations of $1.24 per share and $20.1 billion. Excluding discrete tax benefits, Wells Fargo reported $1.39 per share, although it was unclear whether the analyst estimate included that benefit or not. Wells Fargo reported an 8% year-over-year increase in net interest income.

Goldman Sachs also beat analyst estimates, reporting $5.47 per share in earnings on $11.8 billion in revenue, versus expectations of $5.31 per share on $11.2 billion in revenue.

Regional Bank Earnings Expected to Disappoint

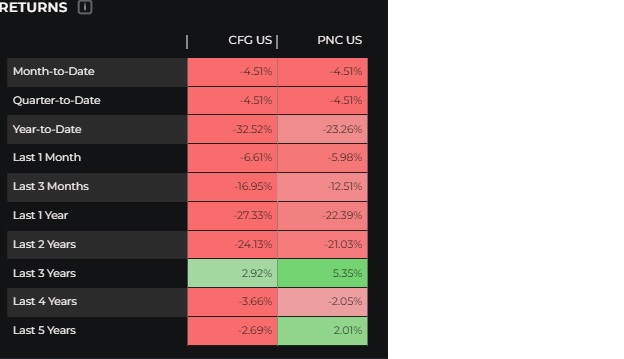

While the biggest U.S. banks by assets widely smashed earnings expectations on the back of stronger-than-expected interest income, regional banks were a different story. Citizens Financial (CFG) reported a 33% plunge in profits due to plummeting interest income.

The bank’s net interest income tumbled almost 9% year over year to $1.52 billion for the third quarter. However, Citizens did see a 2% quarter-over-quarter increase in average deposits, a key issue for regional banks since the banking crisis earlier this year.

Regional Bank Stock Volatility

Earnings results for regional banks are still coming in, but analysts generally expect most of them to report plummeting profits like Citizens did. However, there could be one or two positive surprises among the lot.

Regional Bank Stock Returns

For example, lower-than-expected expenses enabled PNC Financial (PNC) to report earnings of $3.60 per share, versus expectations of $3.18. Unfortunately, it wasn’t entirely blue skies for PNC in the third quarter, as the bank’s revenue tumbled 5.7% year over year to $5.2 billion, versus expectations of $5.3 billion. Net interest income fell 1.6% year over year to $3.4 billion.

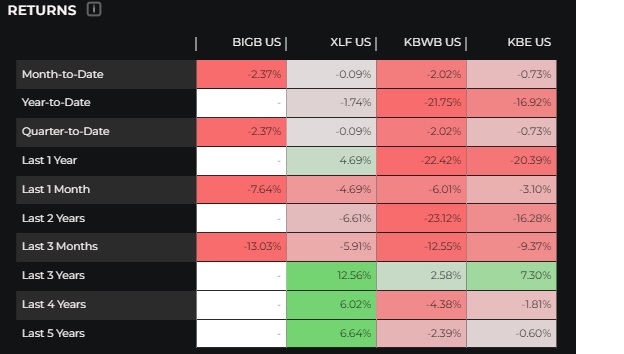

Bank-Focused ETFs Largely Unmoved by Earnings

For investors seeking exposure to a wide array of U.S. banks, there are plenty of ETFs to choose from. However, most bank ETFs have seen muted gains over the last five trading days.

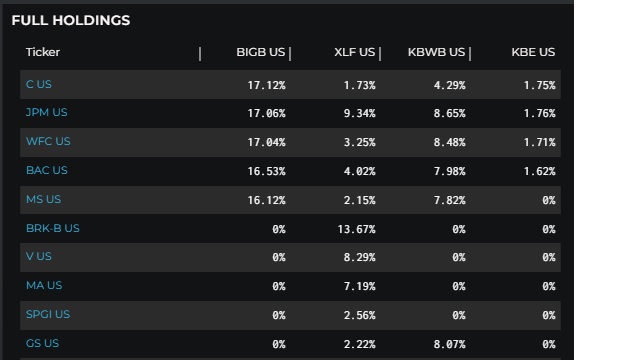

For example, the Roundhill Big Bank ETF (BIGB) is roughly flat over the last five days through October 18 — after plunging more than 1% toward midday. The ETF’s top holdings include mostly swaps, which are derivative contracts, for JPMorgan Chase, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley. BIGB also includes a few non-swap holdings in its top 10 positions: Wells Fargo, Bank of America, Citigroup, and Morgan Stanley.

Bank ETF Holdings

State Street’s SPDR S&P Bank ETF (KBE) plunged 2% on Oct. 18 through early midday, dragging its five-day performance down to roughly flat. The ETF’s top positions include a wider array of banks and financial firms, including some regional names. KBE’s top holdings are Corebridge Financial, Zions Bancorp, First Citizens, JPMorgan Chase, Wells Fargo, Coya Financial, M&T Bank, PNC Financial, Citigroup, and Cullen/ Frost Bankers.

The Invesco KBW Bank ETF (KBWB) also tumbled 2% by midday on October 18 to bring its five-day decline to about 1%. KBWB’s top holdings include Wells Fargo, JPMorgan Chase, Bank of America, Morgan Stanley, Goldman Sachs, Citigroup, M&T Bank, PNC Financial, State Street, and Truist Financial.

Taking an even broader view of the financial sector in general, State Street’s Financial Select Sector SPDR Fund (XLF) is also roughly flat over the last five trading days through Oct. 18. XLF’s top holdings include Berkshire Hathaway, JPMorgan Chase, Visa, Mastercard, Bank of America, Wells Fargo, S&P Global, Morgan Stanley, and Goldman Sachs.

Looking Ahead

As the third-quarter earnings season progresses, we should get a better picture of how regional banks are doing after the crisis shuttered Silicon Valley Bank, Signature Bank, and First Republic Bank earlier this year. While Wall Street doesn’t have high expectations for most regional names, any significant surprise could send shares soaring.

(All charts/tables are via LOGICLY)

For more news, information, and analysis, visit the Innovative ETFs Channel.