The Invesco Golden Dragon China ETF (PGJ) is the top-performing equity ETF over the past week, propelled by the Chinese stocks’ rally.

The Chinese stocks rally this week came as Beijing pledged to increase initiatives to bolster China’s economy. Stocks surged on Tuesday, as global hedge funds bought Chinese stocks at the fastest pace since October 2022, Reuters reported.

“Efforts by the Chinese government to further boost its strong local economy, relative to much of the world, has supported investor sentiment,” Todd Rosenbluth, head of research at VettaFi, said. “While broader emerging market ETFs have exposure to China some advisors may want to augment it with dedicated country ETFs.”

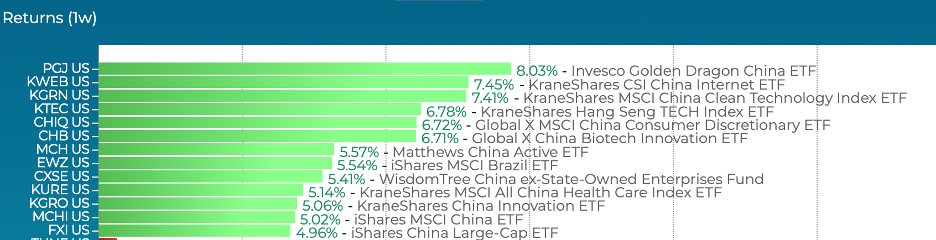

According to LOGICLY, the top 13 best-performing equity ETFs over one week are all funds that offer exposure to Chinese stocks – with one exception, an iShares ETF providing exposure to Brazil.

See more: “Where to Get Exposure to Alphabet, Microsoft Before Earnings Reports”

How to Use PGJ to Enhance Portfolios

PGJ is up over 8% over one week. The fund is up 14.7% over one month and is up 10.7% year to date.

As many U.S. investors have a home-country bias, PGJ could work as a possible diversification play in an equity portfolio.

Incepted in 2004, PGJ has a lengthy track record and $194 million in assets under management. The fund has seen $72 million in net outflows over one year, according to ETF Database.

See more: “Invesco’s Bank ETFs Rally on Upbeat Earnings”

PGJ is based on the NASDAQ Golden Dragon China Index. The index is composed of U.S. exchange-listed companies that are headquartered or incorporated in the People’s Republic of China.

The top industries represented in PGJ include: broadline retail; interactive media and services; automobiles; and hotels, restaurants, and leisure, according to Invesco.

PGJ charges a 70 basis point expense ratio.

For more news, information, and analysis, visit the Innovative ETFs Channel.