April showers of capital inflows into passive equity funds grew their assets under management to $4.305 trillion by the end of the month, almost matching the $4.311 trillion in assets for active equity funds. Passive funds can thank an influx of $39 billion in inflows for this recent milestone, according to the latest Morningstar Direct Fund Flows Commentary.

Those April inflows could certainly spill over into May, which could put passive funds over active funds in terms of total assets compiled.

“Passive U.S. equity funds closed the gap with more than $39 billion in April inflows, versus more than $22 billion in outflows for their active counterparts,” the report highlighted “In market share terms (for open-end and exchange-traded fundscombined), active U.S. equity funds had 50.04% market share versus passive U.S. equity funds’ 49.96%. The May numbers will almost certainly show passive U.S. equity funds’ total assets eclipsing active funds.”

Given the recent shift from active to passive in recent years, this comes as no surprise.

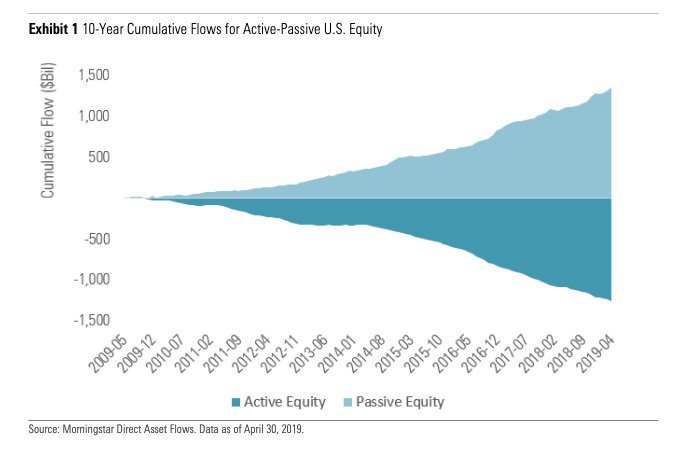

“This isn’t a surprise given the overwhelming outflows from active U.S. equity funds to passive options over the past 10 years,” the report noted further. “Still, 10 years ago, active U.S. equity funds had about 75% market share. And at that point we were just entering one of the longest bull markets in U.S. history. If you had known this, would you have guessed that active U.S. equity funds were on track to lose $1.26 trillion in outflows?”

Related: U.S. Stock ETFs Stumble as Trump Postpones Car Tariffs

Movement to Lower Cost Passive Funds

The move to passive could be due to a more cost-conscious investor. According to a J.P. Morgan report, exchange-traded fund (ETF) fees have fallen 40 percent over the last eight years, but its been passive funds leading the charge compared to their actively-managed fund peers in the space.

Based on the report’s findings, active ETFs recorded a smaller decline in fees versus passive ETFs as of late. The biggest reason is that investors comparing active funds focus more on cost and the strategies attached to these funds.

The report stated that active ETFs saw a 9 basis point decline in fees as passive funds since 2014, but just a 15 percent drop on average versus 32 percent for passive funds.

“This lower fee trend has been driven both by investor flows gravitating towards lower fee funds within each region and asset class and the move by ETF issuers to selectively cut the expense ratio on a number of funds,” wrote J.P. Morgan Global Quantitative and Derivatives Strategists, Marko Kolanovic and Bram Kaplan.

For more market trends, visit ETF Trends.