As you can see, it handed out 234% in profits in less than a year!

Rokus’ management turned its business model upside down. Instead of manufacturing TV streaming boxes, it decided to put its software in TVs and license it.

The “Windows” of TV

I mentioned Windows earlier…

Back in 1985, Microsoft created Windows, the first (and still by far the most popular) operating system for computers. 77% of all desktop computers run on Windows today, according to Statista. It was a turning point for the company. Since Windows’ introduction, Microsoft has surged 144,000%.

Today, Microsoft is the world’s biggest public company! While licensing software may sound boring, as you can see, it’s a very lucrative business.

Now Roku is building an operating system for TVs and licensing it to TV manufacturers. This is the part of its business that’s EXPLODING and shows little sign of slowing down…

Roku is Already the #1 OS For TVs

There are five main TV operating systems: Android TV, webOS, Tizen, Roku TV and SmartCast. The biggest TV manufacturers like Sony, LG, and Samsung all use one of these five.

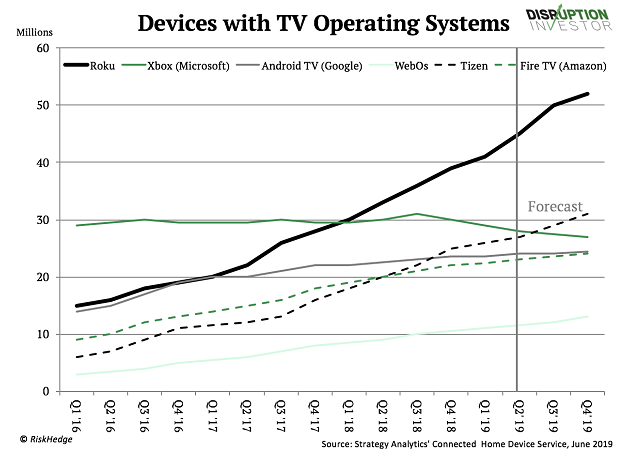

Roku is now leading the TV streaming market, leaving even tech giants Google, Amazon, and Microsoft in the dust:

Now 1 in 3 smart TVs sold in the US contains Roku technology. That makes it the best-selling TV operating system in the country.

But while licensing software to TV manufacturers is a lucrative business, it is not where Roku’s biggest money-making opportunity is…

Roku is in the Most Profitable Business

Do you know what some of the biggest tech companies on earth have in common? They are all in the business of advertising.

Google runs the #1 search engine on the planet. But it earns most of its money from selling ads. Facebook runs the #1 social network. But again, it earns most of its money from selling ads. Amazon runs the #1 e-commerce store… yet advertising is one of Amazon’s most lucrative businesses.

Roku is now in tens of millions of TVs, and that number is growing. And while its user base is one-fifth of Netflix’s, its daily average watch-time per user beats Netflix’s by 3X. Such an engaged audience is a dream come true to any advertiser.

Roku now set its sights on building a next-generation TV advertising platform. And it’s already paying off.

Roku’s advertising revenue is rocketing, as you can see below:

And last year, for the first time, the company made more money from advertising and licensing than its device sales.

How to Play Roku’s Roller Coaster

Getting in early on geyser-like stocks is alluring. But you have to be careful with Roku…

It has been on a wild run this year. As I mentioned, earlier this year, the stock leaped 450%. This month, however, it has taken a breather and slipped 35%.

Most of it is emotional selling, which is practically impossible to predict. Roku shows huge promise. In time, I could see it doubling or even tripling from here. But if you’re a buyer, know what you’re getting into. It’s still a small and very volatile stock.

The upside is big… but along the way, Roku will likely continue to dole out big, quick drops. My suggestion: consider taking a small position today… but keep it small enough so that a 30% to 40% drop won’t hurt too much.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money”

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.