Municipal bonds have been a steady bet in 2021 despite all the volatility, with certain exchange traded funds (ETFs) high on momentum according to their relative strength index (RSI).

The RSI can be a helpful indicator to know if momentum is behind a certain ETF — the closer to a reading of 70, the higher the momentum. It can also indicate an oversold condition, so investors need to be aware of potential sell-offs. Likewise, it’s not an end-all-be-all when it comes to choosing a momentous fund, but rather a tool that investors can add to their toolboxes.

Fundamentally, municipal bonds have also been a strong bet in 2021. The trillion-dollar infrastructure package and the prospect of higher taxes are also propping up demand for municipal bonds.

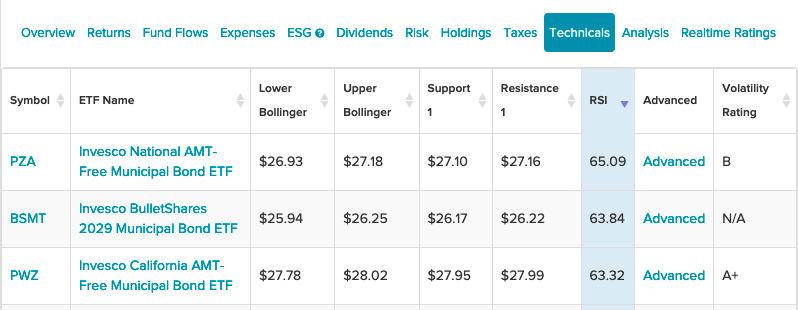

At the top of the RSI reading list is the Invesco National AMT-Free Municipal Bond ETF (PZA), which seeks to track the investment results of the ICE BofAML National Long-Term Core Plus Municipal Securities Index. The fund generally will invest at least 80% of its total assets in the components of the index.

The index is composed of U.S. dollar-denominated, tax-exempt municipal debt publicly issued by U.S. states and territories and their political subdivisions in the U.S. domestic market. PZA’s expense ratio comes in at 0.28%.

2 More Options to Consider

Another option worth considering is the Invesco BulletShares 2029 Municipal Bond ETF (BSMT), which is based on the Invesco BulletShares® USD Municipal Bond 2029 Index. The fund will invest at least 80% of its total assets in municipal bonds that comprise the index, which seeks to measure the performance of a portfolio of U.S. dollar-denominated bonds issued by U.S. states, state agencies, or local governments with effective maturities in 2029.

A more state-specific municipal bond ETF option is the Invesco California AMT-Free Municipal Bond ETF (PWZ), which is based on the ICE BofAML California Long-Term Core Plus Municipal Securities Index. The fund generally will invest at least 80% of its total assets in municipal securities that comprise the underlying index and that are also exempt from the federal alternative minimum tax.

The index is composed of U.S. dollar-denominated, investment-grade, tax-exempt debt publicly issued by California, any U.S. territory, or their political subdivisions, in the U.S. domestic market with a term of at least 15 years remaining to final maturity. The index is adjusted monthly, and its constituents are capitalization-weighted based on their current amount outstanding.